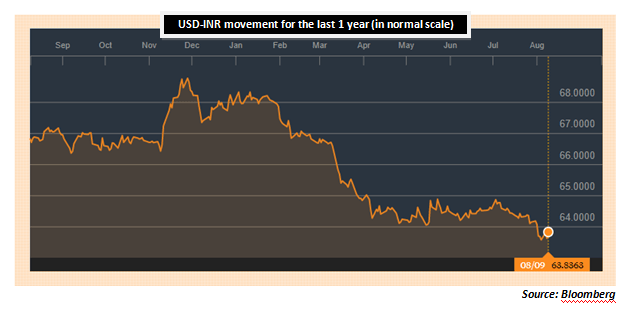

Back in December 2016, the USD-INR was quoting at Rs.68.5/$. The rupee had weakened sharply in the aftermath of the demonetization drive and was threatening to convincingly break the lows of August 2013. Most currency experts and analysts were of the view that in Real Effective Exchange Rate (REER) terms, the rupee was already overvalued and hence this was more of a fundamental mean reversion. The general consensus (well almost) in December 2016 was that the INR would eventually gravitate towards the Rs.72/$ mark where it would stabilize. Exactly 8 months later, these projections of the INR have gone absolutely awry as the INR has appreciated sharply to the level of Rs.63.84/$. Take a look at the chart below…

Why did most predictions of the INR go awry and why did the INR appreciate so sharply over the last 8 months? There are broadly 3 reasons for the same. Firstly, the Fed was expected to follow up on its rate hike moves in a hawkish manner, which was not the case. The Fed has already clarified that its rate hikes will be calibrated and that the equilibrium rate of interest will remain way below the pre-crisis levels. Secondly, the demonetization did not cause too much damage to the economy and the slowdown in GDP growth was very marginal. At the same time, demonetization enhanced the deposits with the banks by nearly Rs.7 trillion, giving big ammunition for growth. Lastly, the flows from the FPI and FDI route have continued to be robust in the last one year. Additionally, the government has committed itself to fiscal discipline notwithstanding the higher welfare outlays required. These 3 factors put together have helped the INR to strengthen substantially.

But the real question is whether there are any risks in this sudden strength of the rupee. Actually we see 3 distinct risks to a consistently strong rupee.

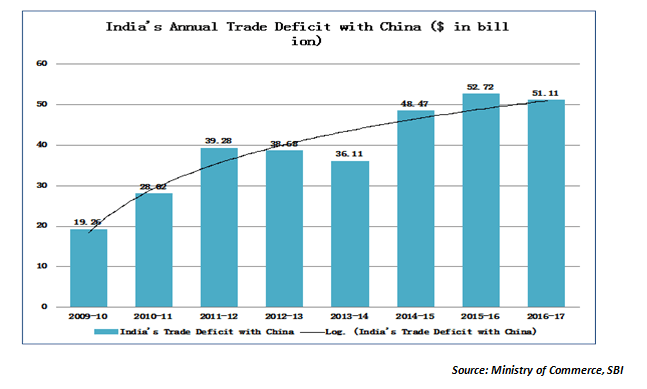

The big trade story in the last few months has been the rapid rise in the import bill. But that is a very short term perspective. At a slightly broader level, a strong rupee is actually encouraging imports. That is not too hard to fathom. Just as a weak rupee makes exports attractive, similarly a strong rupee makes imports attractive. Indian companies are realizing that due to the strong INR, it is making much more economic sense to import products rather than to produce them domestically. Today the world’s largest trading partner for most countries is China and therefore it will be instructive to look at how India’s trade balance with China is shaping up as depicted in the chart below…

As the chart above clearly underlines, there has been almost a 3-fold jump in India’s trade deficit with China since the financial crisis. During these years China has grown its GDP by exporting and running huge trade surpluses with countries like India and the United States. This is a clear outcome of a stronger than warranted INR. In fact, two instances come to mind. Over the last 5 years, Indian steel industry had to put up with huge NPAs as China continued to dump cheap steel in India. The strong rupee worked in favour of Indian steel importers. Secondly, Indian farmers are literally on the streets as they are earning non-remunerative prices on their pulses. The reason again is indiscriminate imports of pulses and that has been facilitated by a strong rupee.

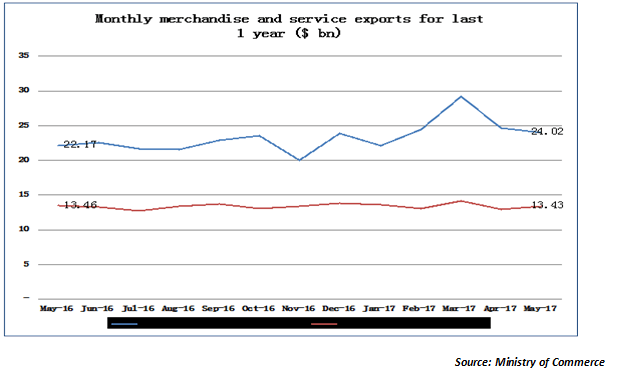

Exports tend to benefit from a weak rupee as it makes Indian products cheaper and more appealing to foreigners. We have seen the negative impact of a strong rupee on industries like Software and Pharma. Both these sectors are predominantly export oriented and have borne the brunt of the strong rupee. The big downside risk of a strong rupee is that it works against exports. In fact, when the trade data comes out each month, the exports data continues to disappoint. Here one needs to remember the lessons of the East Asian Miracle in the 1960s and 1970s and much later the China story since the 1990s. In both these cases, the sustained growth over a number of years was largely driven by a big push to exports. In fact, the strong rupee means that Indian exporters have been actually finding it hard to compete in the global markets.

As the export chart above clearly highlights, the exports of merchandise goods and services have suffered badly due to the strong rupee. As can be seen from the chart, the exports of goods and services have literally stagnated over the last one year, despite global trade showing clear signs of picking up. That is the second downside risk of a strong rupee.

This is the concomitant risk that follows when the INR sustains strength and therefore becomes a tad too predictable. Normally importers and foreign currency borrowers hedge their currency risk, which entails a cost. When the INR sustains strength for too long, then the importers and foreign currency borrowers tend to become smug and allow their exposures to remain un-hedged. This is a dangerous situation. When the INR shows weakness, we could see all of them rushing for cover, which could put immense pressure on the rupee. The time may have come for the RBI and the government to seriously consider a weaker rupee. Forget about boosting exports, it will definitely curb importers from binging on cheaper imports.

Enjoy Zero Brokerage on Equity Delivery

Join our 2 Cr+ happy customers

Enjoy Zero Brokerage on

Equity Delivery