Mirae Asset Nifty Midsmallcap400 Momentum Quality 100 ETF is an open-ended thematic Exchange Traded Fund (ETF) launched by Mirae Asset Mutual Fund on May 6, 2024. It tracks the Nifty MidSmallcap400 Momentum Quality 100 Total Return Index, aiming to deliver returns similar to the index performance (before expenses). The minimum investment is Rs 5000 and there is no entry load, but an exit load of 0.5% applies within the first 3 months of investment.

The Mirae Asset Nifty Midsmallcap400 Momentum Quality 100 ETF’s investment objective is to generate returns, before expenses, that are commensurate with the performance of the Nifty MidSmallcap400 Momentum Quality 100 Total Return Index, subject to tracking error. There is no assurance or guarantee that the investment objective of the scheme will be achieved.

his NFO of Mirae Asset Nifty Midsmallcap400 Momentum Quality 100 ETF is suitable for investors who are seeking returns that are commensurate with the performance of the Nifty MidSmallcap400 Momentum Quality 100 Total Return Index, subject to tracking error over the long term and Investments in equity securities covered by Nifty MidSmallcap400 Momentum Quality 100 Total Return Index.

| Types of Instruments | Risk Profile | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

| Securities included in the Nifty MidSmallcap400 Momentum Quality 100 Index | Very High | 95 | 100 |

| Money market instruments/debt securities, Instruments and/or units of debt/liquid schemes of domestic Mutual Funds. | Low to

Moderate |

0 | 5 |

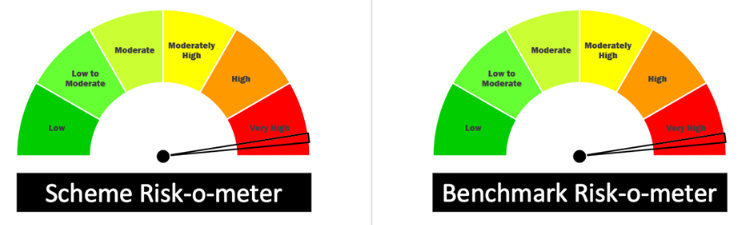

The performance of the Mirae Asset Nifty Midsmallcap400 Momentum Quality 100 ETF is benchmarked against the Nifty MidSmallcap400 Momentum Quality 100 Total Return Index.

The Mirae Asset Nifty Midsmallcap400 Momentum Quality 100 ETF fund managers are Ms. Ekta Gala and Mr. Vishal Singh.

Ms. Ekta Gala has over 6 years of experience as a dealer. Prior to this assignment, Ms. Ekta Gala was associated with ICICI Prudential Asset Management Company Ltd. Her qualifications include B.Com & Inter CA (IPCC).

Mr. Vishal Singh has over 5 years of experience in the field of financial services. Prior to this assignment, Mr. Singh was associated with NSE Indices Limited. His qualifications include C.A.; C.F.A; F.R.M; B.Com.

| Scheme Name | Launch Date | AUM (Crore) | Expense Ratio (%) | Returns as of – 03-05-2024 in % | |

| 2024 | 2023 | ||||

| Mirae Asset Nifty Smallcap 250 Momentum Quality 100 ETF | 29-02-2024 | 125.36 | 0.36 | – | – |

| Motilal Oswal Nifty 200 Momentum 30 ETF | 10-02-2022 | 42.47 | 0.36 | 21.6 | 41.19 |

| ABSL Nifty 200 Momentum 30 ETF | 12-08-2022 | 50.38 | 0.32 | 21.61 | 41.25 |

| HDFC NIFTY200 MOMENTUM 30 ETF | 11-10-2022 | 24.53 | 0.3 | 21.61 | 40.85 |

| ICICI Pru Nifty 200 Momentum 30 ETF | 05-08-2022 | 64.88 | 0.3 | 21.64 | 40.84 |

| ETFs | – | – | – | 7.87 | 24.46 |

Data as of May 03, 2024

Elevate your savings strategy with our easy-to-use Angel One SIP Calculator. See the impact of consistent investing. Your future self will thank you. Start planning today!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Start Your Mutual Fund Investments Journey Today

Join our 2 Cr+ happy customers

Enjoy Zero Brokerage on

Equity Delivery