Axis Mutual Fund launched a new open-ended index fund called Axis Nifty Bank Index Fund. This fund aims to track the total returns of the Nifty Bank TRI index, providing exposure to the leading Indian banks. The New Fund Offer (NFO) is open for subscription from May 3rd to May 17th, 2024. There is no entry load, but an exit load of 0.25% applies if redeemed or switched out within 7 days of investment. The minimum investment amount is Rs 500.

The investment objective of the Axis Nifty Bank Index Fund is to provide returns before expenses that correspond to the total returns of the Nifty Bank TRI subject to tracking errors. However, there is no assurance that the investment objective of the Scheme will be achieved.

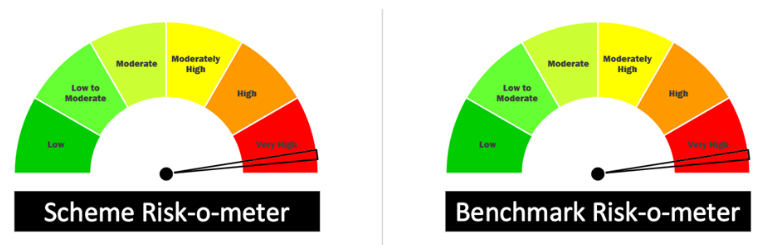

This NFO of Axis Nifty Bank Index Fund is suitable for investors who are seeking long-term wealth creation solution and to track returns by investing in a basket of Nifty Bank TRI stocks and aims to achieve returns of the stated index, subject to tracking error.

| Investments | Indicative Allocation | Risk Profile |

| Securities covered by Nifty Bank TRI | Minimum 95% – Maximum 100% | Very high |

| Debt & Money Market Instruments | Minimum 0% – Maximum 5% | Low to Moderate |

The performance of the Axis Nifty Bank Index Fund is benchmarked against the Nifty Bank TRI.

Mr. Karthik Kumar is a fund manager with 10 years of experience. He holds an impressive educational background including an M.B.A from the Krannert School of Management at Purdue University (USA), a C.F.A (USA) certification, and a B.E (Mechanical) degree from Sardar Patel College of Engineering, Mumbai University.

Mr. Ashish Naik is a fund manager with 10 years of experience. He is qualified with a B.E Computers degree from Mumbai University, a PGDBM from XLRI, and an FRM (GARP) certification.

| Scheme Name | Launch Date | AUM (Crore) | Expense Ratio (%) | Returns as on – 02-05-2024 in % | ||||

| 2024 | 2023 | 2022 | 2021 | 2020 | ||||

| Motilal Oswal Nifty Bank Index Reg | 05-09-2019 | 557.62 | 0.99 | 1.58 | 12.17 | 20.87 | 12.28 | -3.85 |

| Navi Nifty Bank Index Fund Reg Gr | 31-01-2022 | 507.16 | 0.79 | 1.61 | 11.97 | – | – | – |

| All Index Fund | – | – | – | 6.89 | 21.46 | 1.91 | 27.96 | 15.29 |

| Kotak Nifty Bank ETF | 04-12-2014 | 5047.80 | 0.16 | 1.87 | 13.05 | 21.76 | 13.6 | -4.37 |

| Nippon India ETF Nifty Bank BeES | 27-05-2004 | 6191.31 | 0.19 | 1.87 | 13.15 | 21.83 | 13.65 | -4.27 |

| SBI Nifty Bank ETF | 01-03-2015 | 4217.88 | 0.2 | 1.87 | 13.12 | 21.84 | 13.68 | -4.22 |

| ABSL Nifty Bank ETF | 20-10-2019 | 2630.04 | 0.17 | 1.87 | 13.15 | 21.85 | 13.71 | -3.27 |

| Axis NIFTY Bank ETF | 12-11-2020 | 192.06 | 0.18 | 1.87 | 13.07 | 21.78 | 14.09 | – |

| HDFC NIFTY Banking ETF Gr | 01-08-2020 | 2324.60 | 0.16 | 1.88 | 13.08 | 21.81 | 13.58 | – |

| ICICI Pru Nifty Bank ETF | 05-07-2019 | 3185.63 | 0.15 | 1.89 | 13.15 | 21.9 | 13.76 | -3.61 |

| UTI Nifty Bank ETF | 05-09-2020 | 3118.51 | 0.16 | 1.89 | 13.19 | 22.02 | 13.71 | – |

| All ETFs | – | – | – | 8.16 | 24.46 | 3.44 | 21.68 | 13.63 |

Data as of May 02, 2024.

“India’s economic rise is a compelling narrative driven by several factors. If addressed effectively, our growth story has the potential to propel the nation towards becoming a major global economic power. Against this backdrop, India’s banking sector continues to exhibit growth and resilience,” remarked B. Gopkumar, MD & CEO, Axis AMC. “Fuelled by robust regulatory frameworks and the rapid adoption of digital banking, the sector is well-positioned for sustained expansion. The Axis Nifty Bank Index Fund offers investors a strategic opportunity to tap into this growth opportunity. The sector benefits from strong emphasis on innovation and adherence to the highest governance standards, thereby capitalizing on the transformative trends reshaping India’s banking landscape.”

“This fund is an interesting opportunity for investors to gain exposure to the banking sector, which is expected to play a pivotal role in India’s economic expansion,” explained Mr. Ashish Gupta, Chief Investment Officer at Axis AMC. “With increasing financial inclusion and a shift towards more sophisticated banking services, the sector can offer the potential for significant returns”.

Ready to watch your savings grow? Try our SIP Calculator today and unlock the potential of disciplined investing. Perfect for planning your financial future. Start now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Start Your Mutual Fund Investments Journey Today

Join our 2 Cr+ happy customers

Enjoy Zero Brokerage on

Equity Delivery