1

For Private Circulation Only

Technical and Derivatives Review |August 18, 2023

Market continues to remain sluggish, eyes on global development

Sensex (64949) / Nifty (19310)

Source: Tradingview.com

Future Outlook

Trading for the week began with a downside gap on Monday and due to extended weakness in the financial space, Nifty went on to

test 19300 on the same day. Fortunately, a sharp tail end recovery rescued our markets from the crucial support zone. A similar

price action was replicated during the remainder of the week. However, with bears maintaining their dominance overall, we

concluded the truncated week tad above 19300 by shedding nearly a percent from the previous weekly close.

Although, the correction has not been severe, the Nifty has marked negative close in last four consecutive weeks. The global

headwinds and banking related concerns post the RBI policy are keeping our markets under pressure, whereas the inherent strength

in other spaces is providing some support at lower levels. To summarize, key indices are stuck in a range and till we do not find any

major trigger, the consolidation is likely to continue. If we take a meticulous glance at the hourly chart, we can see ‘Three-point

Positive divergence’ in RSI-Smoothened oscillator. This development did trigger some smart recovery around the midsession; but

due to lack of follow up, we saw few downticks towards the end. Nevertheless, the structure is still intact and hence, we will not be

surprised to see some buying emerging at lower levels (provided there is no major global aberration). The first sign of revival would

be confirmed once Nifty sustains above 19370 – 19400 levels, which may then push Nifty towards the next cluster of 19550 – 19650.

On the flipside, 19250 is to be seen as a critical support; because a drift below this would result in a sharp correction towards the

major support zone of 19100 – 19000 (which seems unlikely at this moment). Traders should refrain from complacent trades and

continue with one step at a time approach.

2

For Private Circulation Only

Technical and Derivatives Review |August 18, 2023

Sho

rt

Form

at

ion

Long Short Ratio slightly advanced to 42%

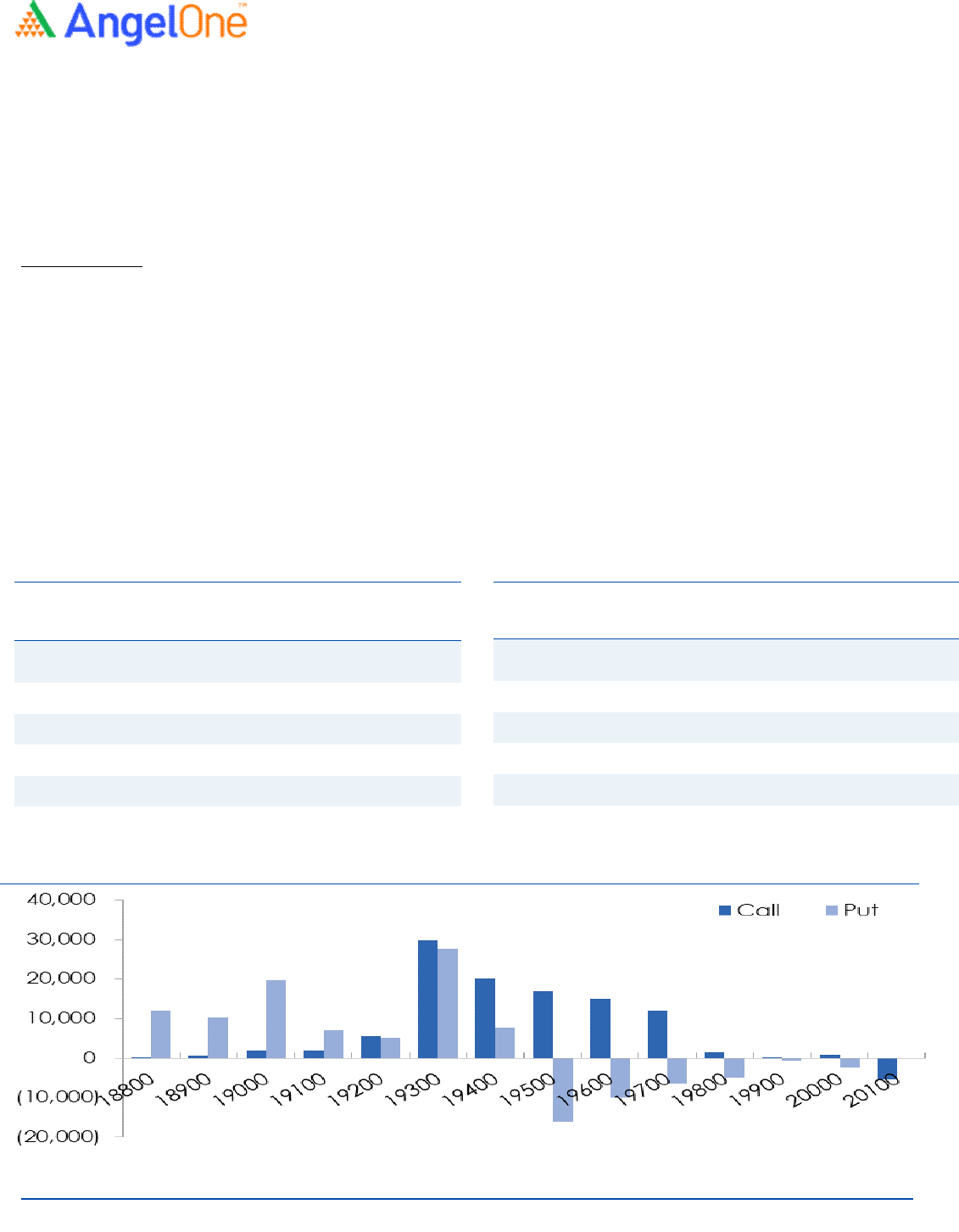

Nifty spot closed at 19310.15 this week, against a close of 19428.30 last week. The Put-Call Ratio has increased from 0.91 to 0.98 on

a weekly basis. The annualized Cost of Carry is positive at 3.10%. The Open Interest of Nifty Futures increased by 1.50%.

Derivatives View

Nifty current month’s future closed with a premium of 21.35 against a premium of 76.05 points to its spot in the previous week.

Next month’s future is trading at a premium of 128.55 points.

The Indian Equity market witnessed a dull trading week, wherein the benchmark index stayed in a slender range-bound stature and

eventually settled around 19300 with a cut of 0.61 percent. On the derivatives front, short formations were seen in key indices on a

weekly basis, suggesting a weakened undertone. On the options front, 19300-19200 put strikes have significant piling of open

interest, indicating a nearby support zone. While on the flip side, the scattered positioning of OI can be seen from 19300-19600 call

strikes, with the highest OI concentration at 19400 CE. The stronger hands added mixed bets in equities and with a strong short

covering in the last session, the ‘Long Short Ratio’ slightly advanced to 42% from 40% on a WoW basis. Considering the mentioned

data, our markets are likely to stay range bound and await some trigger to gain momentum.

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

MUTHOOTFIN 6732000 44.25 1237.40 (8.09)

HINDCOPPER 31932500 31.32 140.80 (11.17)

KOTAKBANK 32965200 15.09 1755.80 (2.52)

COFORGE 991200 13.31 4932.40 (5.33)

HDFCAMC 3231600 12.52 2469.55 (2.76)

Weekly change in OI

Long Formation

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

ESCORTS 1600225 44.07 2834.15 9.37

SYNGENE 3818000 17.37 804.20 0.73

NMDC 92011500 7.92 115.40 0.96

TRENT 4259200 5.14 1973.85 4.40

PVRINOX 3687420 2.36 1721.75 4.52

3

For Private Circulation Only

Technical and Derivatives Review |August 18, 2023

Sameet Chavan Head Research – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Analyst – Technical rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Hitesh Rathi Analyst – Technical & Derivatives hitesh.rathi@angelone.in

Research Team Tel: 022 - 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivative Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

We, Angel One Limited (hereinafter referred to as “Angel”) a company duly incorporated under the provisions of the Companies Act, 1956 with its

registered office at 601, 6th Floor, Ackruti Star, Central Road, MIDC, Andheri East, Mumbai – 400093, CIN: (L67120MH1996PLC101709) and duly

registered as a member of National Stock Exchange of India Limited, Bombay Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi

Commodity Exchange of India Ltd and National Commodity & Derivatives Exchange Ltd. Angel One limited is a company engaged in diversified

financial services business including securities broking, DP services, distribution of Mutual Fund products. It is also registered as a Depository

Participant with CDSL and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor.

Angel One Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164 and also registered with PFRDA as PoP ,Registration No.19092018. Angel Group does not have any joint ventures or

associates. Angel One Limited (formerly known as Angel Broking Limited) is the ultimate parent company of the Group. . Angel or its associates has

not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market.

AOL was merged with Angel Global Capital Private Limited and subsequently name of Angel Global Capital Private Limited was changed to Angel

Broking Private Limited (AOL) pursuant to scheme of Amalgamation sanctioned by the Hon'ble High Court of Judicature at Bombay by Orders

passed in Company Petition No 710 of 2011 and the approval granted by the Registrar of Companies. Further, name of Angel Broking Private

Limited again got changed to Angel Broking Limited (AOL) pursuant to fresh certificate of incorporation issued by Registrar of Companies (ROC)

dated June 28, 2018. Further name of Angel Broking name changed to Angel One Ltd pursuant to fresh certificate of incorporation issued by

Registrar of Companies (ROC) dated 23-09-21.

In case of any grievances please write to: support@angelone.in, Compliance Officer Details: Name : Hiren Thakkar, Tel No. –08657864228, Email id

- compliance@angelone.in

Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns

to investors.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations

as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document

(including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment.

4

For Private Circulation Only

Technical and Derivatives Review |August 18, 2023

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve

months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking or

merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business. Angel or its

associates did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with the

research report. Neither research entity nor research analyst has been engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. Investors

are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed

to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance

only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any

person from any inadvertent error in the information contained in this report. Angel One Limited does not warrant the accuracy, adequacy or

completeness of the service, information and materials and expressly disclaims liability for errors or omissions in the service, information and

materials. While Angel One Limited endeavours to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or

passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with

the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the subject company.

Research analyst has not served as an officer, director or employee of the subject company.

Investment in securities market are subject to market risks. Read all the related documents carefully before investing.

Any communication sent to clients on phone numbers or e-mail ids registered with the Trading Member is meant for client consumption and such

material should not be redistributed. Brokerage will not exceed SEBI prescribed limit. Any Information provided by us through any medium based

on our research or that of our affiliates or third parties or other external sources is subject to domestic and international market conditions and we

do not guarantee the availability or otherwise of any securities or other instruments and such Information is merely an estimation of certain

investments, and we have not and shall not be deemed to have assumed any responsibility for any such Information. You should seek independent

professional advice and/or tax advice regarding the suitability of any investment decision whether based on any Information provided by us

through the Site from inhouse research or third party reports or otherwise.

The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way,

transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written

consent.