Initiating coverage | Cement

December 22, 2014

Orient Cement

BUY

CMP

`148

Capacity expansion plan on track

Target Price

`183

Capacity expansion to drive volume growth: Orient Cement Ltd (Orient), a CK

Investment Period

12 Months

Birla group company having its plants in Telengana (capacity 3mtpa) and

Maharashtra (capacity 2mtpa), is expanding its cement capacity by 3mtpa (an

Stock Info

increase of 60%) to 8mtpa by 1QFY2016. The new plant is expected to be the

Sector

Cement

next growth driver as it would contribute significantly to volume growth. We expect

Market Cap (` cr)

3,032

Orient to report a healthy 14.1% volume CAGR during FY2014-16E, aided by

Net debt (` cr)

(327)

expected improvement in cement demand. The improvement in demand is

Beta

1.1

expected on the back of pick up in infrastructure activities with a stable

52 Week High / Low

158/34

government at the centre, resolution of Telengana-Seemandhara dispute, and

Avg. Daily Volume

86,767

progressive state governments in the company’s key markets (Telengana, Andhra

Face Value (`)

1

Pradesh and Maharashtra, which account for 89% of sales). Improvement in

BSE Sensex

27,372

cement demand is expected to take cement prices higher; we expect realizations

Nifty

8,225

for Orient to increase at a CAGR of 8.5% over FY2014-16E (in 1HFY15

Reuters Code

ORCE.BO

realizations grew by 7.2%).

Bloomberg Code

ORCMNT IN

A cost efficient player: Orient has been one of the most cost efficient companies in

the cement industry. The company’s plants are located in close vicinity of its raw

material reserves and the average lead distance of 300km shows that the product

Shareholding Pattern (%)

is sold in regions closer to the place of manufacture, thus translating into freight

Promoters

37.5

cost per tonne of `744 as on FY2014, which is among the lowest in the industry.

MF / Banks / Indian Fls

29.6

The Electricity cost per tonne of

`926 is also among the lowest in the industry

FII / NRIs / OCBs

18.5

with the company being well supported by a 50MW captive power plant. The new

Indian Public / Others

14.4

plant at Gulbarga will source coal from Singareni Collieries which is at a distance

of 450km from the plant. This will increase the landing cost of coal, but this

plant’s efficiency will still be higher compared to the existing plant. Thus we expect

Since

Abs. (%)

3m 1yr

the low cost structure of Orient to continue going forward.

Listing

Sensex

1.0

32.2

37.9

Valuation: At CMP of `148 the stock is trading at FY2016E EV/ton of $86 (on

Orient Cement

27.2

271.3

369.1

FY16E 8mtpa installed capacity), which is at a discount to its south based peers

(Ramco Cement trades at $120/tonne). The stock is trading at 8.8x and 8.9x its

*Orient Cement Listed on 16th July 2013

FY2015E and FY2016E EV/EBITDA, respectively. We initiate coverage on Orient

Cement with a Buy recommendation and target price of `183 based on 10.6x

FY2016E EV/EBIDTA and at EV/tonne of $95.

Key Financials

Y/E March (` cr)

FY13

FY14

FY15E

FY16E

Net Sales

1,502

1,438

1,622

2,185

% chg

0.0

(4.2)

12.8

34.7

Net Profit

162

101

163

160

% chg

0.0

(37.5)

61.2

(1.7)

EBITDA (%)

21.2

14.9

19.3

22.0

EPS (`)

8

5

8

8

P/E (x)

18.8

30.0

18.6

19.0

P/BV (x)

4.0

3.7

3.2

2.9

RoE (%)

12.7

18.4

16.0

RoCE (%)

13.8

13.5

14.0

Shrenik Gujrathi

EV/Sales (x)

2.0

2.1

1.7

2.0

022 39357800 Ext:6872

EV/EBITDA (x)

9.3

13.7

8.8

8.9

Source: Company, Angel Research; CMP as of December 19, 2014

Please refer to important disclosures at the end of this report

1

Orient Cement | Initiating coverage

Investment Arguments

Capacity expansion plan on track: Orient is setting up a 3mn tonne per annum

(mtpa) cement grinding unit (2mtpa clinker capacity) at Chittapur in Gulbarga

district, Karnataka. It also has a 45MW captive power plant along with a 7MW

waste heat recovery system, which will comprehensively fulfill the fuel requirement

of the plant. Towards this plant, the company will incur a capex of `1,700cr, of

which `1,200cr would be financed through debt and the rest `520cr through

internal accruals. The plant is expected to be commissioned by 1QFY2016 and is

expected to be the next growth driver as it would contribute significantly towards

volume growth. A stable government at the centre, resolution of the

Telengana-Seemandhra dispute and progressive state governments in key markets

of the company (Telengana, Andhra Pradesh and Maharashtra, which account for

89% of company’s sales) will provide a boost to infrastructure activities which will

drive demand going forward. Hence, we expect robust volume growth for the

company, ie at a CAGR of 14.1% during FY2014-16E. As demand improves we

expect cement prices to move higher. We expect realizations for Orient to grow at

a CAGR of 8.5% over FY2014-16E (in 1HFY15 realizations grew by 7.2%).

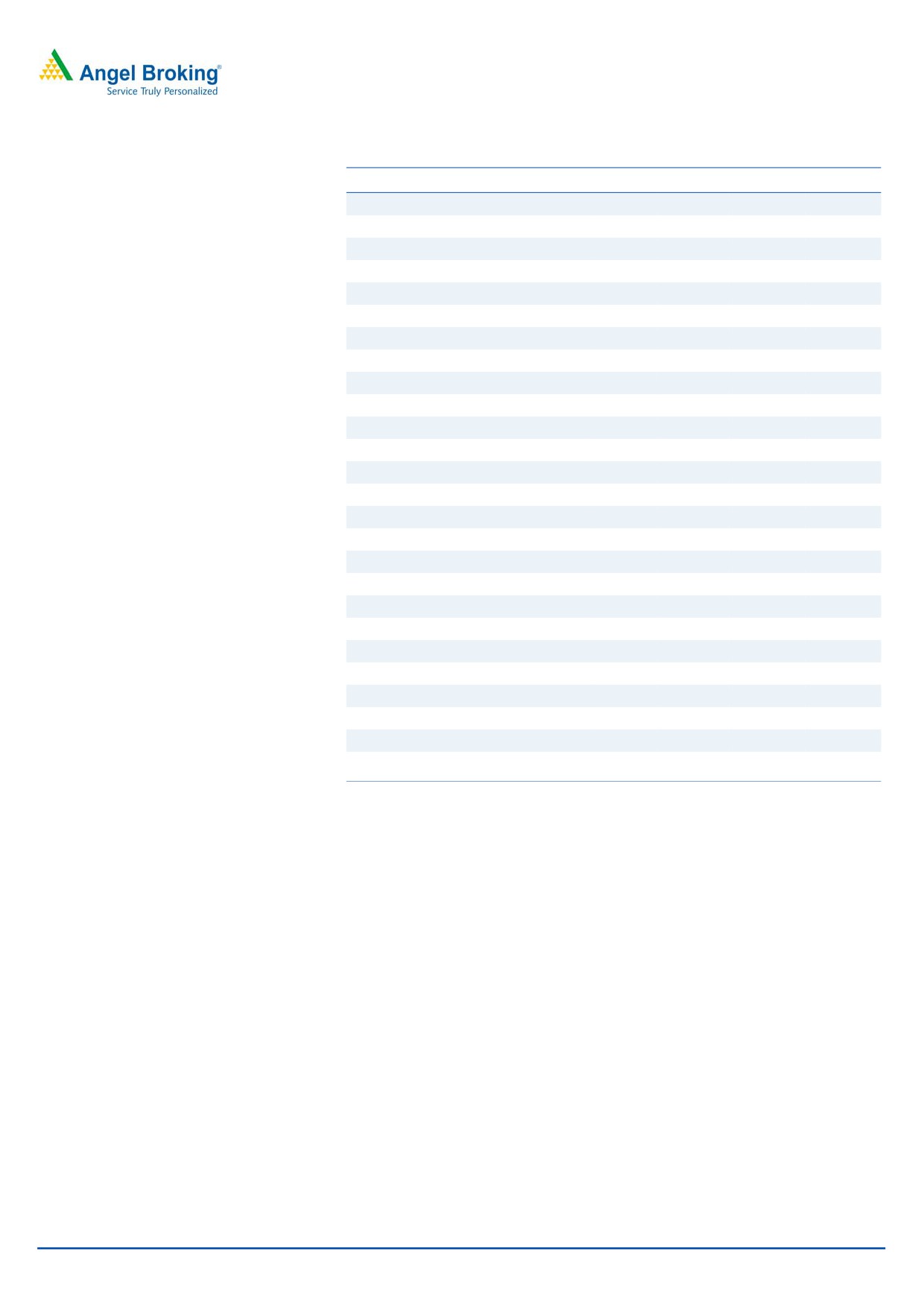

Exhibit 1: Cement Capacity and utilization levels

Exhibit 2: Volume Growth Trend

(mn tn)

(mn tn)

9

100.0

7.0

30.0

84.1

68.4

80.6

25.9

8

90.0

87.0

85.4

80.2

6.0

75.6

80.0

25.0

7

70.2

6.5

70.0

5.0

4.4

6

61.1

4.1

4.2

5.5

20.0

60.0

3.6

3.8

5

4.0

8

50.0

3.2

17.8

15.0

5

5

5

5

8

4

5

5

3.0

13.3

40.0

10.9

3

10.0

3.4

30.0

2.0

5.2

2

6.8

20.0

5.0

1.0

1

10.0

2.8

3.5

0.0

0.0

0

0.0

FY10

FY11

FY12

FY13

FY14

FY15E FY16E FY17E

FY09

FY10

FY11

FY12

FY13

FY14

FY15E FY16E FY17E

Capacity(mn tonnes)

Capacity utilization(%)

Sales Volume

yoy%

Source: Company, Angel Research

Source: Company, Angel Research

A cost efficient player: Orient has been one of the most cost efficient companies in

the cement industry. The company’s Devapur cement manufacturing plant is

located in a high-quality limestone reserve belt which is just 2km from the plant.

The company has linkage coal from Singareni Collieries which enables it in

maintaining coal costs at lower levels. Fly Ash is sourced from NTPC’s

Ramagundam Thermal Power Plant, located at a distance of around 40km from

the Devapur plant, while Fly Ash for the Jalgaon plant will be sourced from NTPC’s

Bhusawal Thermal Power Plant which is located at a distance of 20km from the

plant. This will help in keeping the fly ash cost lower due to low lead distance.

Orient’s average lead distance is of 300km, which indicates that the products are

sold in nearby areas to the place of manufacture. The low lead distance aided in

keeping freight cost per tonne lower at `744 for FY2014 which is the lowest in

industry. The Electricity cost per tonne at `926 is also one of the lowest in the

industry as the plant is well supported by a 50MW captive power plant. The new

plant at Gulbarga will also source coal from Singareni Collieries which is at a

distance of 450km from the plant. This will increase the landing cost of coal, but

this new plant’s efficiency will still be higher compared to the existing plant. Thus

we expect the low cost structure of Orient to continue going forward.

December 22, 2014

2

Orient Cement | Initiating coverage

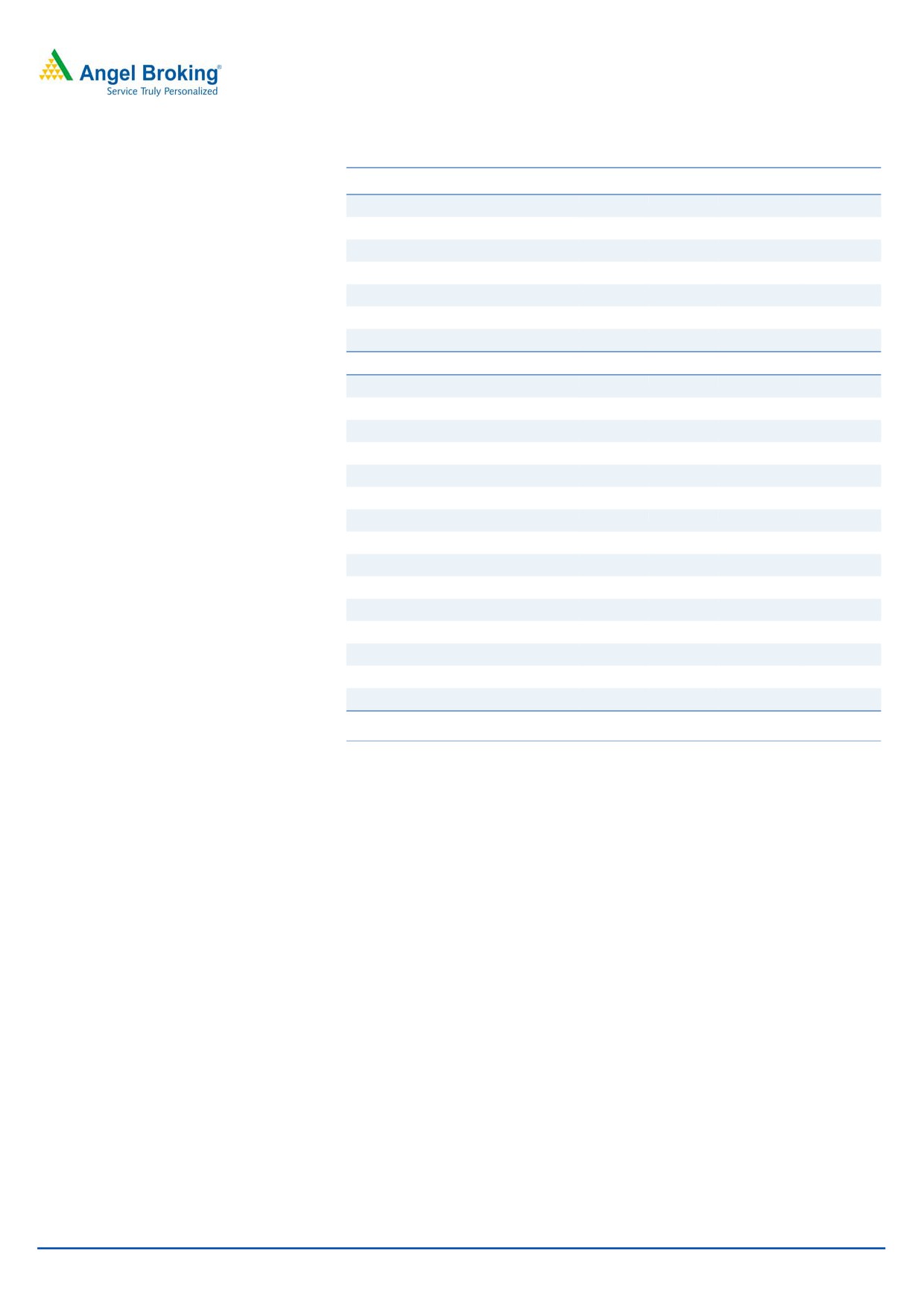

Exhibit 3: Power cost per tonne versus peers

Exhibit 4: Freight cost per tonne versus peers

Company

FY13

FY14

Company

FY13

FY14

ACC*

988

996

ACC*

926

968

Ultratech

1,071

1,014

Ultratech

1,053

1,116

Ramco Cement

956

969

Ramco Cement

920

961

India Cement

1,249

1,272

India Cement

954

1,006

JK Lakshmi Cement

766

750

JK Lakshmi Cement

795

812

Orient Cement

927

926

Orient Cement

759

744

Source: Company, Angel Researc; Note: *ACC has December year ending

Source: Company, Angel Research; Note: *ACC has December year ending

Exhibit 5: Total cost per tonne versus peers

Company

FY13

FY14

ACC*

3,797

3,987

Ultratech

3,862

4,036

Ramco Cement

3,379

3,602

India Cement

3,735

3,892

JK Lakshmi Cement

3,068

3,117

Orient Cement

2,892

2,911

Source: Company, Angel Research; Note: *ACC has December year ending

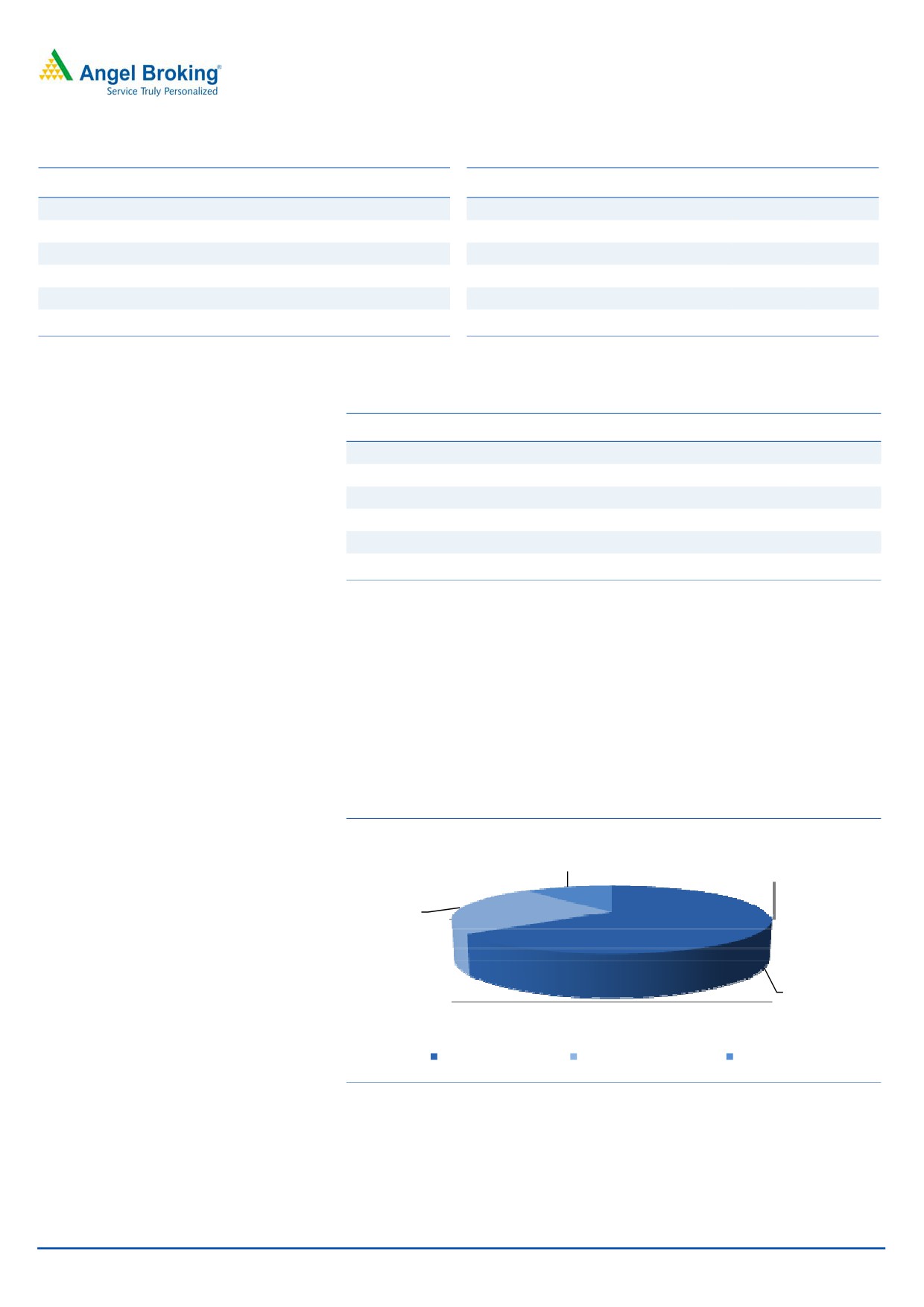

Strong market mix: Currently 60% of Orient’s capacity is located in the south.

Despite this, 65% of its sales are accrued from the Maharashtra region. Orient had

a utilization level of 84% in FY2014 which is much higher than any of its peers in

the south (which had utilization levels at 68-70%). The new capacity at Gulburga

can sell its products in relatively high realizations markets of Karnataka and south

Maharashtra. The existing plants at Devapur and Jalgaon would target to scale

newer markets of Madhya Pradesh and Chhattisgarh.

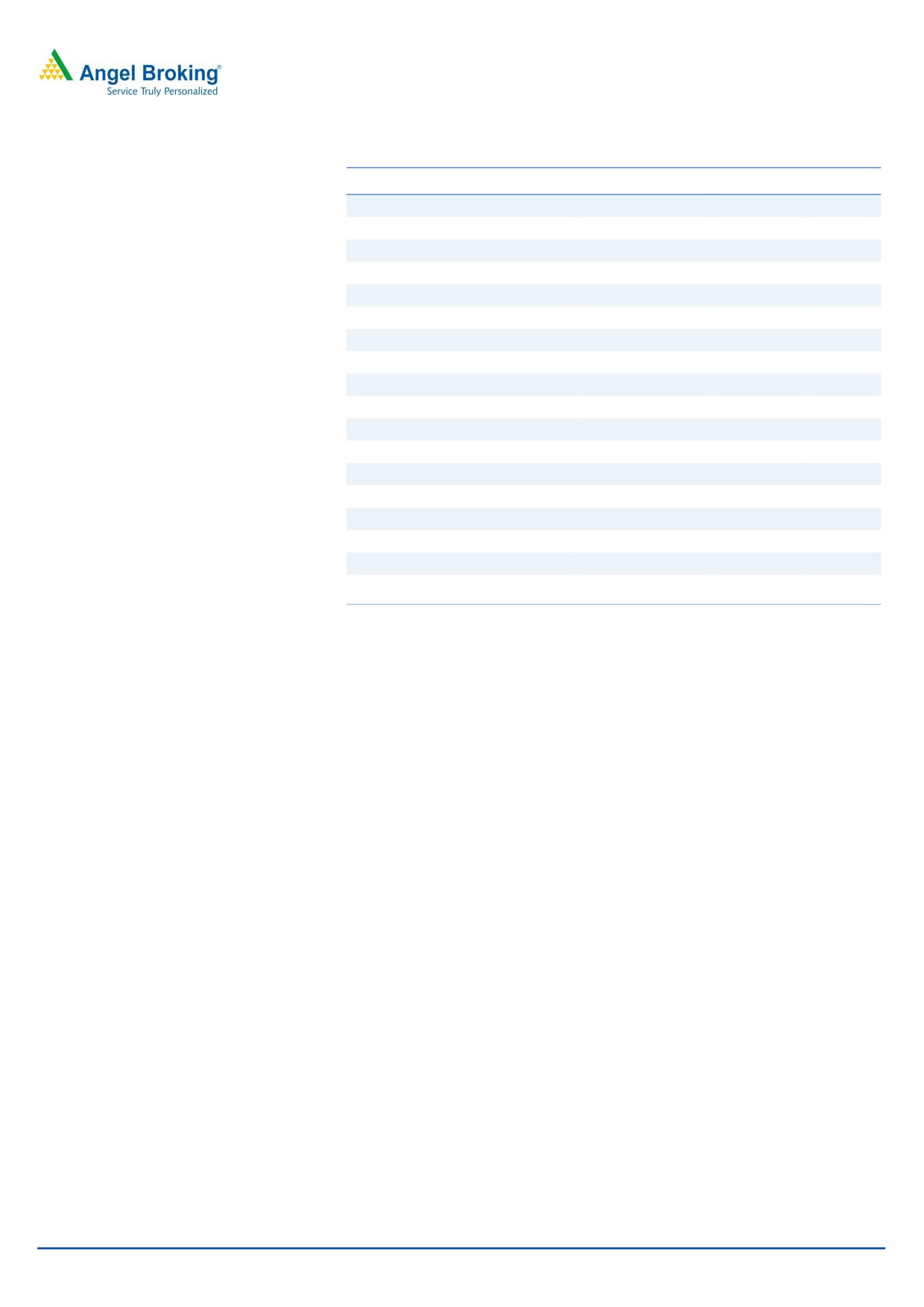

Exhibit 6: Orient Cement Market Mix

11

24

65

Maharashtra

Andhra Pradesh

Other States

Source: Company, Angel Research

December 22, 2014

3

Orient Cement | Initiating coverage

Financial outlook

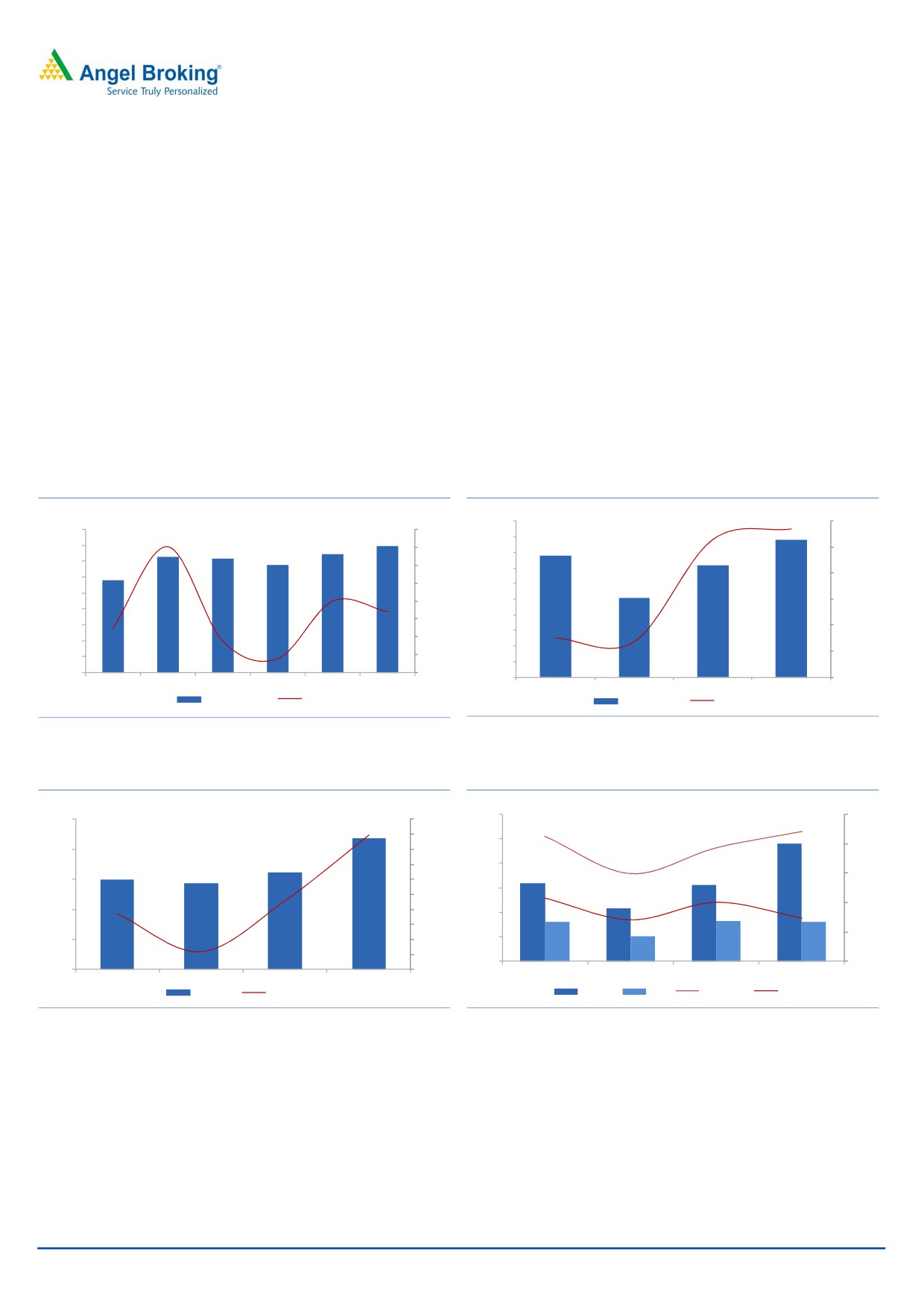

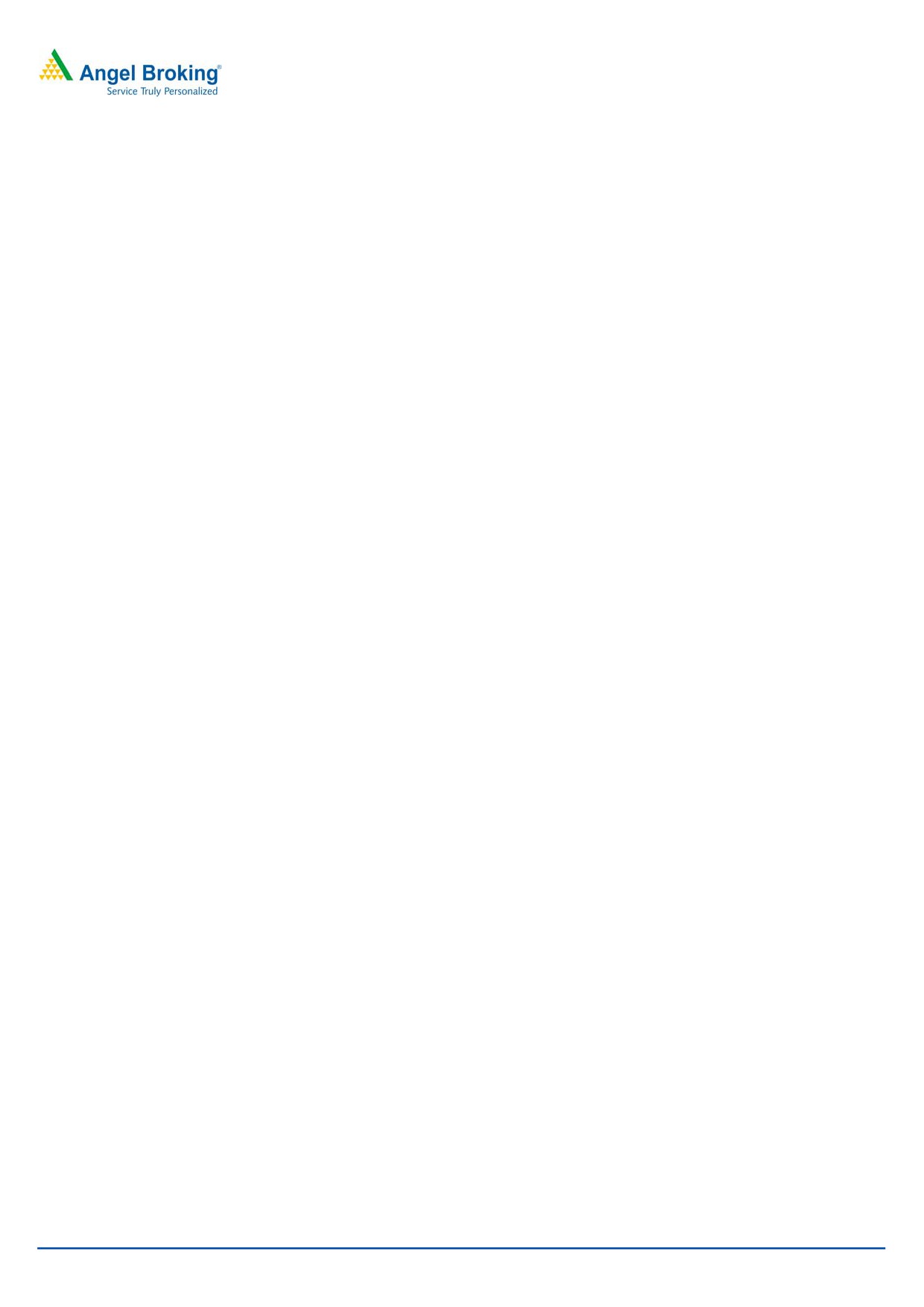

We expect Orient to report a healthy 23.2% revenue CAGR during FY2014-16E.

This should be on the back of strong volume growth as a new capacity will be

operational in 1QFY2016 and better cement demand outlook will lead to higher

realizations.

In FY2014, the company’s EBITDA declined sharply by 32.6% yoy to `215cr while

its EBITDA margin declined to

14.9% vs 21.2% in FY2013 due to fall in

realizations. Going forward we expect the EBITDA margin to improve due to higher

realizations and owing to the cost efficient structure of the company. The EBITDA

margin is expected to improve from 14.9% in FY2014 to 22% by FY2016E. Overall

we expect EBITDA to grow at a CAGR of 49.7% over FY2014-16E. With better

profitability, we expect Orient’s RoE to improve from current levels of 12.7% to

16% by FY2016E.

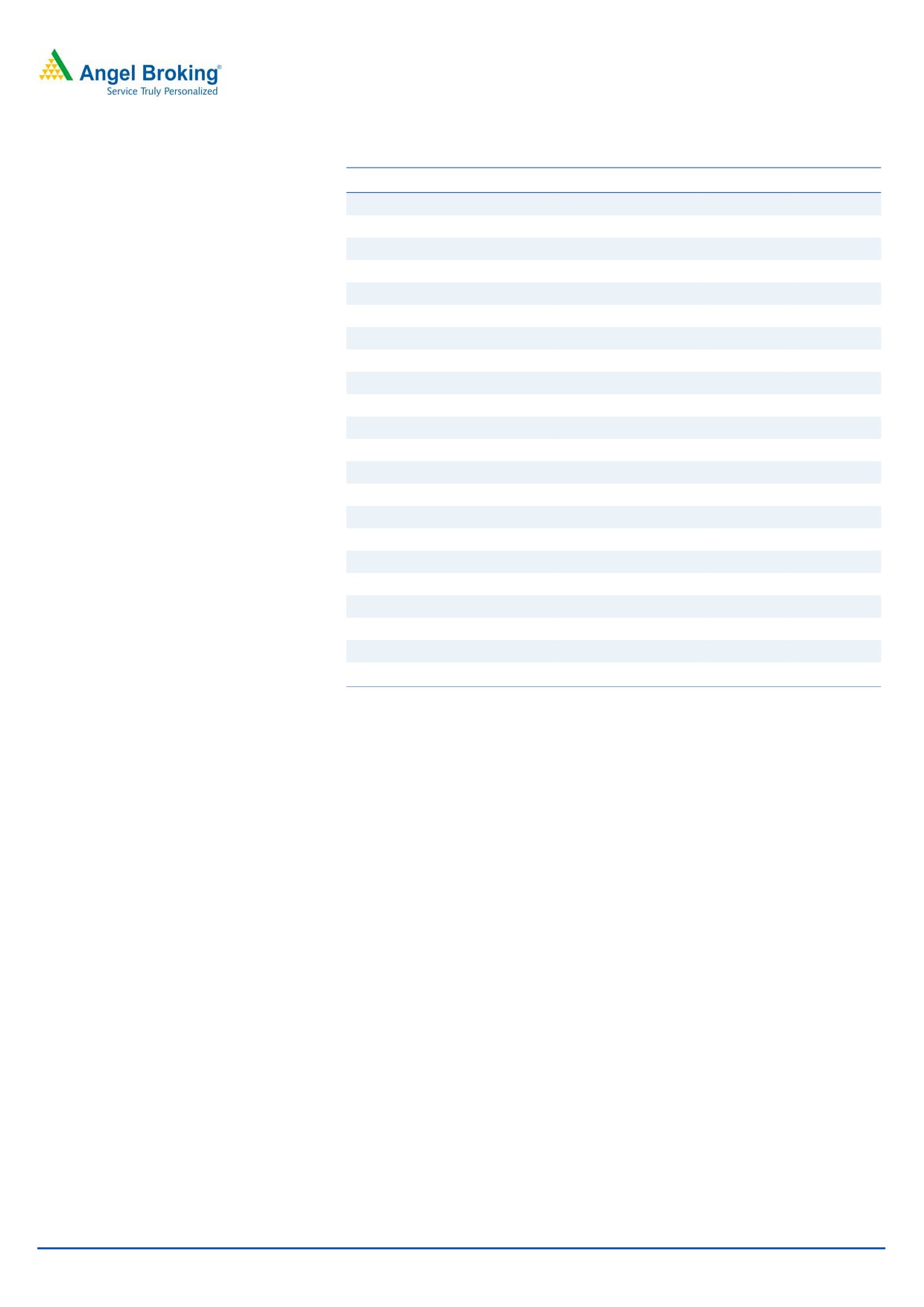

Exhibit 7: Expected realizations to grow

Exhibit 8: Expect improvement in EBITDA/tonne

(mn/tn)

(mn/tn)

1000

60.0

4500

30.0

53.9

3638

3972

900

3712

45.7

4000

3594

25.0

40.0

25.2

3375

800

3500

2907

20.0

700

779

879

3000

20.0

15.0

600

2500

10.0

500

719

0.0

2000

511

10.0

400

5.0

1500

7.0

(20.0)

2.3

300

0.0

(29.8)

1000

(32.6)

(1.2)

200

(5.0)

(40.0)

500

(6.1)

100

0

(10.0)

0

(60.0)

FY11

FY12

FY13

FY14

FY15E

FY16E

FY13

FY14

FY15E

FY16E

Net Realization

yoy%

EBITDA/tonne

% chg

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 9: Revenue Growth Trend

Exhibit 10: Profitability Trend

(` cr)

(` cr)

600

25.0

2500

40.0

34.7

35.0

22.0

500

21.2

19.3

20.0

2000

30.0

25.0

400

14.9

2185

15.0

1500

1622

20.0

300

1502

1438

15.0

10.8

12.8

10.0

10.0

1000

10.0

7.0

200

7.3

5.0

313

319

481

5.0

100

162

215

163

160

500

8.4

0.0

101

(4.2)

(5.0)

0

0.0

0

(10.0)

FY13

FY14

FY15E

FY16E

FY13

FY14

FY15E

FY16E

Net Sales

% chg

EBITDA

PAT

EBITDA %

PAT%

Source: Company, Angel Research

Source: Company, Angel Research

December 22, 2014

4

Orient Cement | Initiating coverage

Outlook and Valuation

Orient’s capacity addition would drive volume growth. Further, a possible uptick in

realizations and better cost efficiency will improve profitability, going forward.

At CMP of `148, the stock is trading at FY2016E EV/ton of $86 (on its 8mtpa

expanded capacity), which is at a huge discount to its south based peers (Ramco

Cement trades at $120/tonne). The stock is trading at 8.8x and 8.9x of its

FY2015E and FY2016E EV/EBITDA, respectively. We initiate coverage on Orient

Cement with a Buy recommendation and a target price of `183 based on 10.6x

FY2016E EV/EBIDTA and at EV/tonne at $95.

December 22, 2014

5

Orient Cement | Initiating coverage

Company Background

Orient Cement Ltd (Orient) a CK Birla group company was incorporated in 1979.

Orient has 5mtpa cement grinding capacity plant located at Devapur, Telengana

(3mtpa capacity) and Jalgaon, Maharashtra (2mtpa capacity) along with 50MW

captive power capacity. Orient is setting up greenfield plant with proposed

capacity of 3mtpa at Gulbarga, Karnataka which would take the total cement

capacity to 8mtpa. Orient offers its product under Birla-A1 under PPC category

and Orient Gold 53-grade under OPC category. Currently, Orient sells its

products through a network of 2760 dealers spread across west, central and south

India.

December 22, 2014

6

Orient Cement | Initiating coverage

Profit & Loss Statement

Y/E March (` cr)

FY13

FY14

FY15E

FY16E

Net Sales

1,502

1,438

1,622

2,185

% Chg

(4.2)

12.8

34.7

Total expenditure

1,183

1,224

1,309

1,703

Net Consumption of Materials

226

259

266

346

Power and Fuel

379

389

408

504

Employee benefit expenses

52

58

66

88

Transport, clearing & for. charges

310

313

350

470

EBITDA

319

215

313

481

% Chg

(32.6)

45.7

53.9

EBIDTA %

21.2

14.9

19.3

22.0

Depreciation

56

56

58

128

EBIT

263

158

255

354

% Chg

0.0

(39.7)

60.8

38.9

Interest and Financial Charges

19

14

17

121

Other Income

5

9

9

9

PBT

249

153

247

242

Tax

87

52

84

82

% of PBT

35.0

34.1

34.0

34.0

PAT before Exceptional item

162

101

163

160

Exceptional item

0

0

0

0

PAT

162

101

163

160

% Chg

(37.5)

61.2

(1.7)

PAT %

10.8

7.0

10.0

7.3

Basic EPS

8

5

8

8

Diluted EPS

8

5

8

8

% Chg

0.0

(37.5)

61.2

(1.7)

December 22, 2014

7

Orient Cement | Initiating coverage

Balance Sheet

Y/E March (` cr)

FY13

FY14

FY15E

FY16E

Sources of Funds

Equity Capital

20

20

20

20

Reserves Total

736

808

923

1,037

Networth

757

829

944

1,057

Total Debt

46

328

1,328

1,378

Other long term liabilities

29

46

46

46

Deferred Tax Liability

129

127

127

127

Total Liabilities

962

1,329

2,445

2,608

Application of Funds

Gross Block

1,277

1,293

1,293

3,043

Accumulated Depreciation

423

468

526

654

Net Block

854

826

767

2390

Capital WIP

40

328

1528

28

Investments

0

0

0

0

Current Assets

Inventories

87

71

69

81

Sundry Debtors

76

65

73

98

Cash and Bank Balance

76

82

75

113

Loans, Advances and Deposits

106

160

294

314

Other Current Asset

19

25

37

39

Current Liabilities

297

232

423

481

Net Current Assets

68

170

125

164

Miscellaneous Expenditure

0

0

0

0

Total Assets

962

1,329

2,445

2,608

December 22, 2014

8

Orient Cement | Initiating coverage

Cash Flow Statement

Y/E March (` cr)

FY13

FY14

FY15E

FY16E

Profit before tax

249

153

247

242

Depreciation

56

56

58

128

Change in Working Capital

20

(97)

38

(1)

Less: Other income

5

9

9

9

Direct taxes paid

87

52

84

82

Cash Flow from Operations

233

51

250

278

(Inc)/ Dec in Fixed Assets

(44)

(305)

(1,200)

(250)

(Inc)/ Dec in Investments

0

(0)

0

0

Other income

5

9

9

9

Cash Flow from Investing

(39)

(295)

(1,191)

(241)

Issue/(Buy Back) of Equity

0

0

0

0

Inc./(Dec.) in loans

(117)

281

1000

50

Dividend Paid (Incl. Tax)

48

36

48

47

Others

(11)

(4)

19

2

Cash Flow from Financing

(154)

250

934

2

Inc./(Dec.) in Cash

39

5

(7)

38

Opening Cash balances

37

76

82

75

Closing Cash balances

76

82

75

113

December 22, 2014

9

Orient Cement | Initiating coverage

Key Ratios

Y/E March

FY13

FY14

FY15E

FY16E

Valuation Ratio (x)

P/E (on FDEPS)

18.8

30.0

18.6

19.0

P/CEPS

13.9

19.3

13.7

10.5

Dividend yield (%)

1.4

1.0

1.3

1.3

EV/Sales

2.0

2.1

1.7

2.0

EV/EBITDA

9.3

13.7

8.8

8.9

EV / Total Assets

3.1

2.2

1.1

1.6

Per Share Data (`)

EPS (Basic)

7.9

4.9

7.9

7.8

EPS (fully diluted)

7.9

4.9

7.9

7.8

Cash EPS

10.6

7.7

10.8

14.0

DPS

2.0

1.5

2.0

2.0

Operating ROE

-

11.2

17.1

14.1

Returns (%)

RoCE (Pre-tax)

-

13.8

13.5

14.0

Angel RoIC (Pre-tax)

-

17.9

28.9

21.4

RoE

-

12.7

18.4

16.0

Turnover ratios (x)

Asset Turnover (Gross Block) (x)

-

1.1

1.3

1.0

Inventory / Sales (days)

-

20

16

13

Receivables (days)

-

18

15

14

Payables (days)

-

79

91

97

December 22, 2014

10

Orient Cement | Initiating coverage

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking

or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Orient Cement

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to -15%)

Sell (< -15%)

December 22, 2014

11

Orient Cement | Initiating coverage

6th Floor, Ackruti Star, Central Road, MIDC, Andheri (E), Mumbai- 400 093. Tel: (022) 39357800

Research Team

Fundamental:

Sarabjit Kour Nangra

VP-Research, Pharmaceutical

Vaibhav Agrawal

VP-Research (Banking)

Amarjeet Maurya

Analyst (FMCG, Media, Mid-Cap)

Bharat Gianani

Analyst (Automobile)

Shrenik Gujrathi

Analyst (Cap Goods, Cement)

Umesh Matkar

Analyst (Banking)

Twinkle Gosar

Analyst (Mid-Cap)

Tejas Vahalia

Research Editor

Technicals and Derivatives:

Siddarth Bhamre

Head - Technical & Derivatives

Sameet Chavan

Technical Analyst

Sneha Seth

Associate (Derivatives)

Institutional Sales Team:

Mayuresh Joshi

VP - Institutional Sales

Meenakshi Chavan

Dealer

Gaurang Tisani

Assistant Manager

Production Team:

Dilip Patel

Production Incharge

CSO & Registered Office: G-1, Ackruti Trade Centre, Road No. 7, MIDC, Andheri (E), Mumbai - 93. Tel: (022) 3083 7700. Angel Broking Pvt. Ltd: BSE Cash: INB010996539 / BSE F&O: INF010996539, CDSL Regn. No.: IN - DP - CDSL - 234 - 2004, PMS Regn. Code: PM/INP000001546, NSE Cash: INB231279838 /

NSE F&O: INF231279838 / NSE Currency: INE231279838, MCX Stock Exchange Ltd: INE261279838 / Member ID: 10500. Angel Commodities Broking (P) Ltd.: MCX Member ID: 12685 / FMC Regn. No.: MCX / TCM / CORP / 0037 NCDEX: Member ID 00220 / FMC Regn. No.: NCDEX / TCM / CORP / 0302.

December 22, 2014

12