OFS Note | Power

Aug 29, 2017

NTPC

SUBSCRIBE

sue Open: Aug 29, 2017

Is

Issue Close: Aug 30, 2017

NTPC is India’s largest power producer with an installed capacity of 51 GW,

accounting for ~16% share in overall capacity. In addition to this the company

has ~21 GW under construction. The NTPC group contributed 24% to all India’s

Issue Details

generation during FY17. Over FY11-17 the company added nearly 16 GW of

Face Value: `10

capacity.

Present Eq. Paid up Capital: `8245cr

PLF to remain steady, while lower coal cost will reduce cost: NTPC’s coal station

Offer for Sale: **41.23cr Shares

achieved Plant Load Factor of 78.6% against 59.9% at all India level. Compared

to FY16 the coal based station’s PLF has remained flat and we expect the same to

remain steady going ahead. The PLF for Gas based plants marginally declined in

FY17 to 24.4% vs 25.1%, which too is expected to bounce back. Further the

Post Eq. Paid up Capital: `8245cr

company expects coal cost to come down due to rationalistion of coal linkages,

Issue size (amount): **`7000 cr

re-grading of coal mines and implementation of GST. The above all factors

should be margin accretive for the company.

Price Band: `168

Next phase of growth likely on the back of new project commercialization: During

5% Discount for Retail

FY17 NTPC added 4,430 MW against 2,255 MW in FY16. During July 2017

NTPC commercialised 800 MW of capacity indicating it is on set for its next phase

of high capacity addition. In FY18 the company targets to add another 4,543 MW

and commercialise 3.6 GW of capacity.

Promoters holding Pre-Issue: 70%

We expect earnings growth to be healthy backed by aggressive capacity addition

Promoters holding Post-Issue: 65%

as well as commercialisation: NTPC had ~ `87,000 cr worth of CWIP on book

and conversion of the same into gross block and resultant revenue growth should

** if 5% OFS offered

lead to healthy ~15% earrings CAGR over FY17-19. The rate of capitalisation of

capacity is likely to be higher than the capex over the next two years and this is

Book Building

likely to be RoE accretive.

MF/Insurance

25% of issue

Valuations & View: The floor price of the issue has been fixed at `168/ share and

Non-Retail

55% of issue

retail investors are entitled for 5% discount on the floor price, which works out to `

Retail

20% of issue

159.6. At the offer price the stock is valued at 1.2x its FY19 BV, which looks

attractive and hence we recommend investors to SUBSCRIBE to the issue.

Post Issue Shareholding Pattern

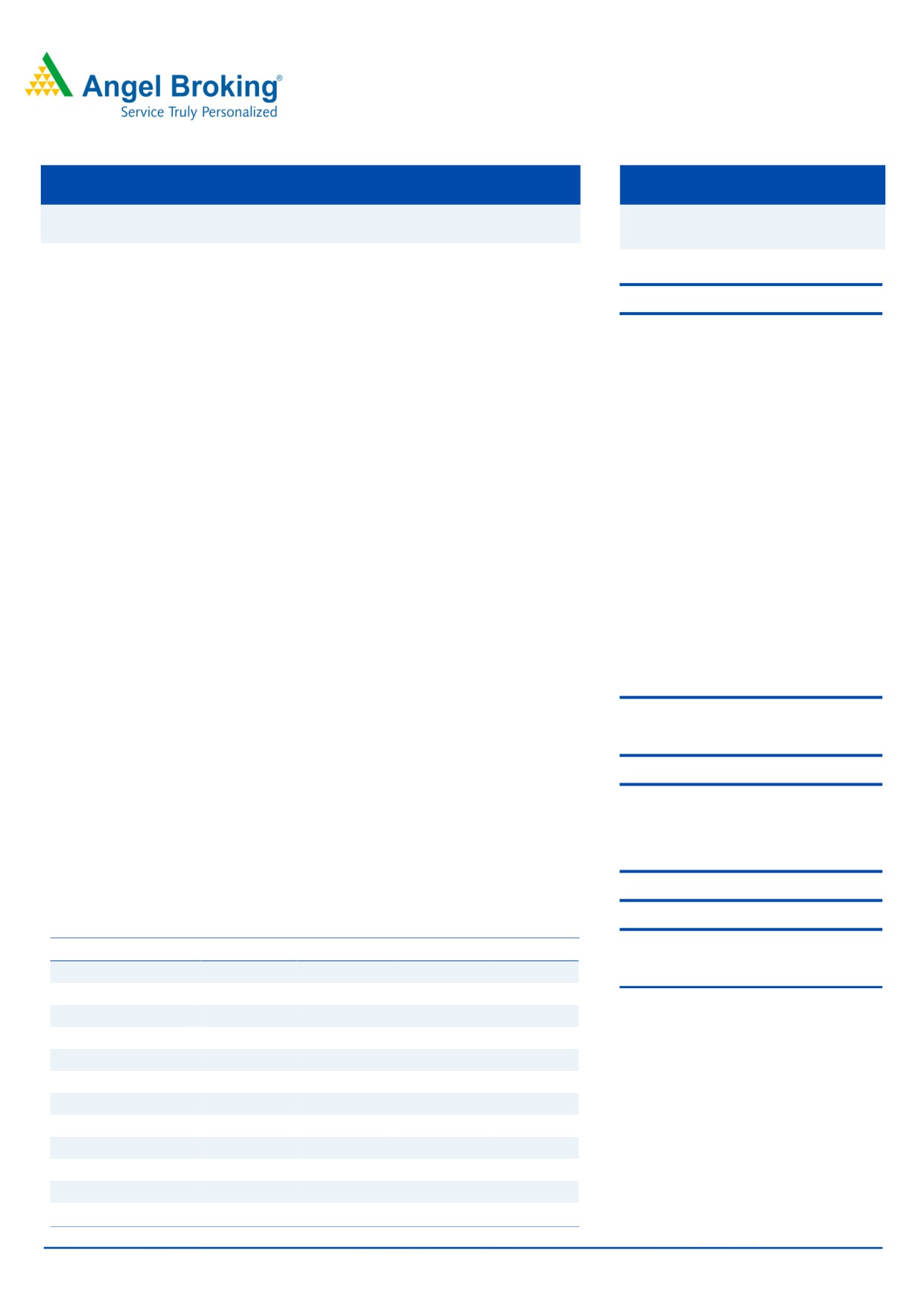

Key Financials (Consolidated)

Promoters

65%

Y/E March (` cr)

FY14

FY15

FY16

FY17

Revenue

78,951

80,612

73,426

82,081

Others

35%

% chg

10

2

-9

12

Adj. net profit

11,438

9,856

10,900

10,757

% chg

-0

-14

11

-1

Adj. EPS (`)

14

12

13

13

OPM (%)

25

21

25

27

P/E (x)

12

14

13

13

P/BV (x)

1.6

1.7

1.5

1.4

RoE (%)

13

12

12

11

RoCE (%)

9

6

7

7

Jaikishan J Parmar

EV/Sales (x)

2.5

2.8

3.1

2.9

+022 39357600, Extn: 6810

EV/EBIDTA

10.2

13.0

12.3

10.8

Source: Company, Angel Research, Valuation ratios based on floor price.

Please refer to important disclosures at the end of this report

1

NTPC | OFS Note

Issue Details

The government is offering up to 5% in NTPC, the country's largest power

producer, through an offer for sale (OFS) on Tuesday and Wednesday. The offer,

at the minimum base price of Rs 168 per share, could bring in around `7,000cr

into the exchequer. The government will sell a little over 41.22cr shares, consisting

of 5% of the company, at a base price of `168 per share. If there is demand for

additional shares during the OFS, the government could divest up to 5% more of

the company.

The retail investors would get the discount of 5% on floor price. As a result, retail

investor would get shares at `159.6 per share.

Exhibit 1: Pre and Post-OFS shareholding pattern (shares in cr)

No of shares (Pre-issue)

% No of shares (Post-issue)

%

Promoter (GOI)

575

70

534

65

Institution/Public

249

30

291

35

825

100

825

100

Considered 5% OFS offered

Objects of the offer

The stake sale in NTPC is part of the government's comprehensive divestment

plan to raise up to `72,500cr announced In the Budget. For fund its

infrastructure and welfare projects.

Aug 29, 2017

2

NTPC | OFS Note

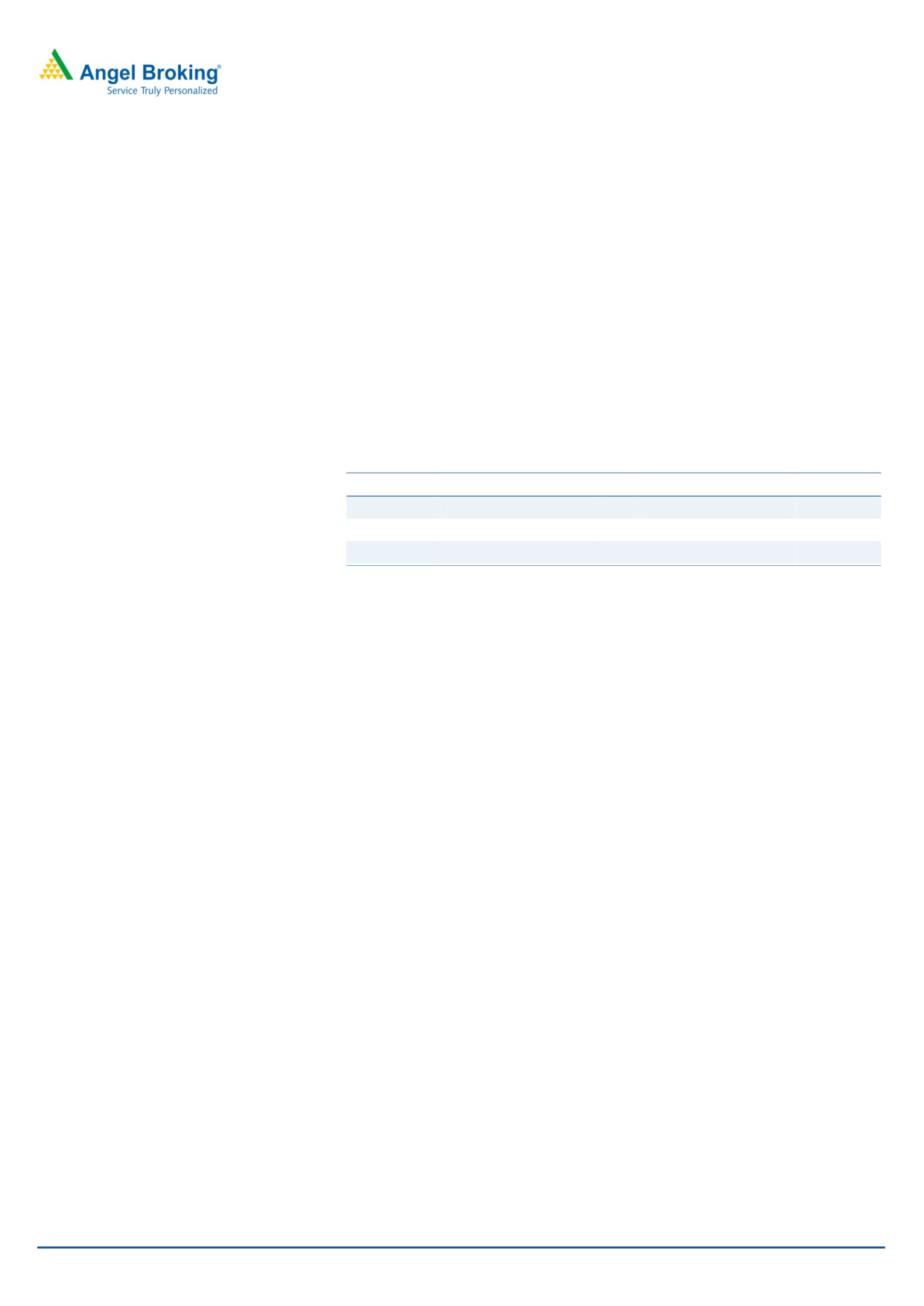

Exhibit 2: Profit & Loss Statement (Consolidated)

Y/E March (` cr)

FY14

FY15

FY16

FY17

Net Sales

78,951

80,612

73,426

82,081

% chg

10

2

-9

12

Total Expenditure

59,310

63,283

55,003

59,613

Fuel cost

50,772

54,268

47,727

1,675

Employee Costs

5,037

4,882

4,694

5,676

Other Expenses

3,501

4,133

2,581

52,262

EBITDA

19,641

17,329

18,424

22,468

% chg

9

-12

6

22

(% of Net Sales)

25

21

25

27

Depreciation& Amortisation

4,770

5,565

5,771

6,693

EBIT

14,871

11,764

12,652

15,775

% chg

4

-21

8

25

(% of Net Sales)

19

15

17

19

Interest & other Charges

3,263

3,669

3,366

3,753

Other Income

2,879

2,365

1,332

1,738

Profit before tax

14,487

10,461

10,618

13,761

% chg

-13

-28

2

30

Tax Expense

3,082

464

-163

3,047

(% of PBT)

21

4

-2

22

Recurring PAT

11,405

9,997

10,781

10,714

Minority Interest

-0

6

-20

-6

Share of associates

-32

135

-99

-37

Reported PAT

11,438

9,856

10,900

10,757

Adjusted PAT

11,438

9,856

10,900

10,757

% chg

-0

-14

11

-1

(% of Net Sales)

14

12

15

13

Aug 29, 2017

3

NTPC | OFS Note

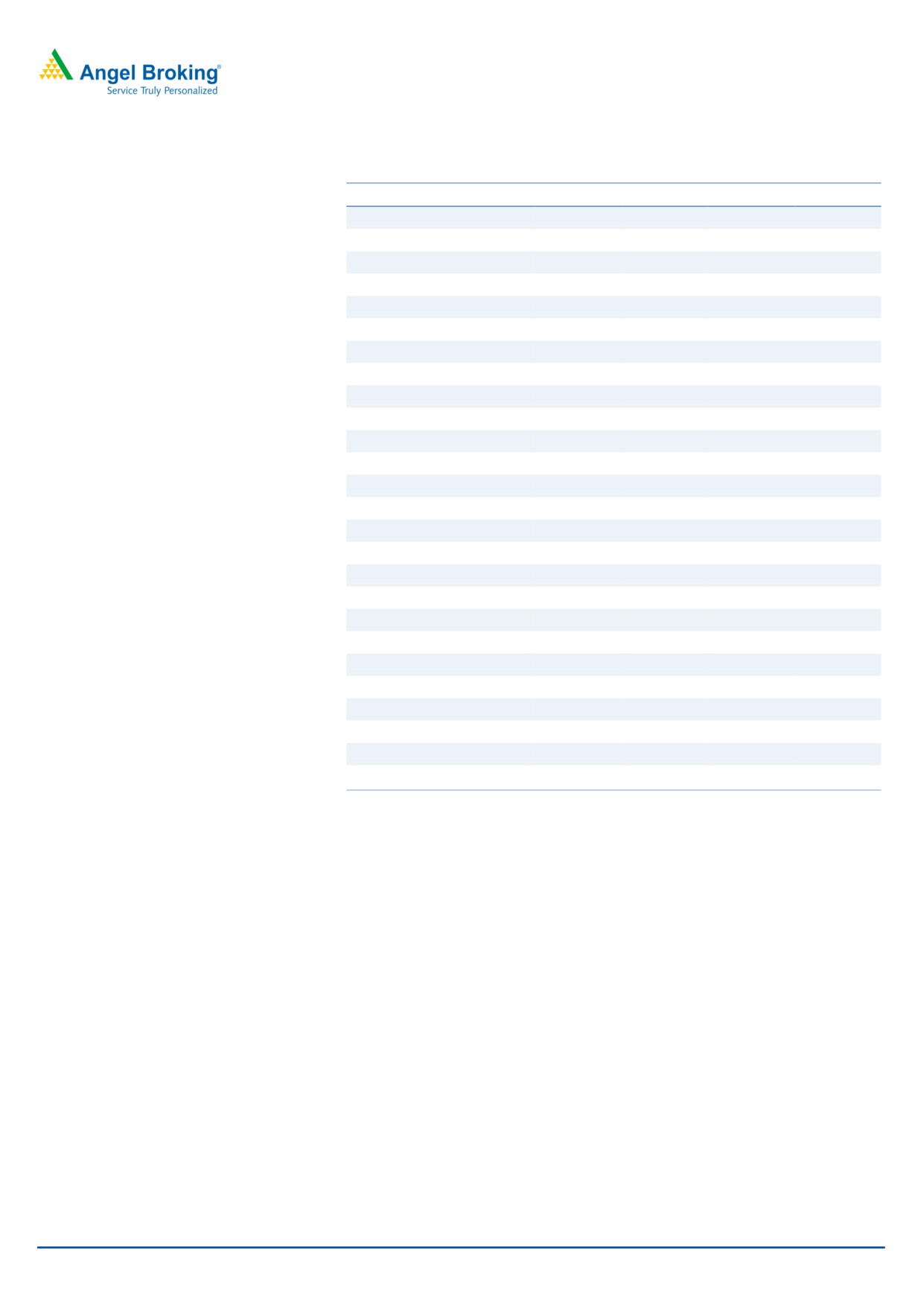

Exhibit 3: Balance Sheet (Consolidated)

Y/E March (` cr)

FY14

FY15

FY16

FY17

SOURCES OF FUNDS

Equity Share Capital

8,245

8,245

8,245

8,245

Reserves & Surplus

79,084

73,849

83,330

89,593

Shareholder Funds

87,330

82,094

91,576

97,838

Minority Interest

680

888

793

803

Total Loans

81,455

1,02,252

99,424

1,13,769

Deferred Tax Liability

6,913

8,098

8,153

10,066

Other Long term liabilities

5,588

6,068

6,302

5,746

Total Liabilities

1,81,966

1,99,400

2,06,248

2,28,222

APPLICATION OF FUNDS

Gross Block

1,31,394

1,44,361

98,844

1,17,088

Less: Acc. Depreciation

47,186

52,508

5,915

12,556

Net Block

84,208

91,853

92,929

1,04,532

Capital Work-in-Progress

53,825

67,555

75,046

86,896

Goodwill

Investments

3,300

1,902

6,473

7,802

Current Assets

42,822

39,991

30,599

30,113

Cash

17,051

14,252

4,938

3,301

Inventories

6,062

8,060

7,145

6,690

Debtor

6,726

9,250

8,289

8,964

Other

12,984

8,430

10,228

11,158

Current liabilities

23,826

27,144

25,417

28,960

Net Current Assets

18,996

12,847

5,182

1,154

Other Assets

21,637

25,243

26,618

27,839

Total Assets

1,81,966

1,99,400

2,06,248

2,28,222

Aug 29, 2017

4

NTPC | OFS Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Aug 29, 2017

5