Initiating coverage | Cons. Products

March 22, 2013

IFB Agro Industries

BUY

CMP

`151

High on Restructuring & Expansion plans

Target Price

`198

IFB Agro Industries (IFB), primarily present in West Bengal, is engaged in the business

Investment Period

12 Months

of manufacturing alcohol, bottling of branded alcoholic beverages as well as

Stock Info

processed and packed marine foods, both for domestic and export markets. The

Sector

Consumer products

company’s expansion plans in the liquor segment coupled with scope for higher

Market Cap (` cr)

136

market penetration are expected to drive growth. IFB’s presence in marine business

Net Debt (` cr)

(9)

provides ample opportunity in the domestic as well as export markets due to the niche

Beta

0.5

product categorization and presence of fewer competitors. Moreover, the recent

52 Week High / Low

220/116

preferential allotment, where the promoter has pumped ~`18cr (~13% of the current

Avg. Daily Volume

6,949

market cap), reflects promoters’ confidence in the company. We initiate coverage with

Face Value (`)

10

a Buy recommendation on the stock with a target price of `198.

BSE Sensex

18,736

Increased capacity with low penetration to drive growth: In India, the per capita

Nifty

5,651

consumption of alcohol stands low at 1lt p.a. As per ASSOCHAM, India’s alcohol

Reuters Code

IFBA.BO

consumption is expected to grow by 30% annually till FY2015. This provides ample

Bloomberg Code

IFBA IN

growth opportunity for the alcohol industry. Thus, IFB’s new bottling and

manufacturing capacity would complement the potential consumption opportunity

and thereby facilitate revenue growth going forward. In addition, IFB is the only

Shareholding Pattern* (%)

distillery player in West Bengal which would add to the company’s growth prospects.

Promoters

60.0

MF / Banks / Indian Fls

1.2

Marine business- a niche play: IFB is a major player in the marine business

FII / NRIs / OCBs

12.5

(90% prawns) in West Bengal with presence in domestic as well as export markets. The

Indian Public / Others

26.3

company also has a tie-up with Thailand’s C.P. Group for supply of feed to farmers. We

*after preferential allotment

believe there is huge potential for the company’s marine business, given the company’s

strong customer base, rising demand for frozen sea food, and overall global economic

growth which again will spur demand.

Abs. (%)

3m 1yr

3yr

Preferential allotment to raise investor confidence: IFB’s preferential allotment of

Sensex

(2.6)

6.4

7.6

9,98,000 shares in February

2013, amounting to

~`18cr (on a market

IFB Agro

(12.3)

(15.9)

82.1

capitalization of `136cr), raised the promoter holding from 55% to 60% which is

an indicator of the promoters’ confidence in the company. This has consequently

resulted in improved investor confidence.

Outlook and Valuation: We expect the company to post a CAGR of 19.5% and

15.1% in IFB’s revenue and net profit, respectively, over FY2013-2015. The company

plans to raise debt for expansion of its distillery unit which is expected to be

operational by FY2015. EBITDA margin is expected to improve by 149bp over

FY2013-2015 to 12.9% in FY2015 from 11.4% in FY2013 owing to discontinuation

of low margin businesses and better operating efficiencies. At the current market

price, the stock is trading at a PE of 3.8x its FY2015E earnings and P/B of 0.6x

FY2015E. We initiate coverage on the stock with a Buy recommendation and a target

price of `198 based on a target P/E of 5.0x for FY2015E.

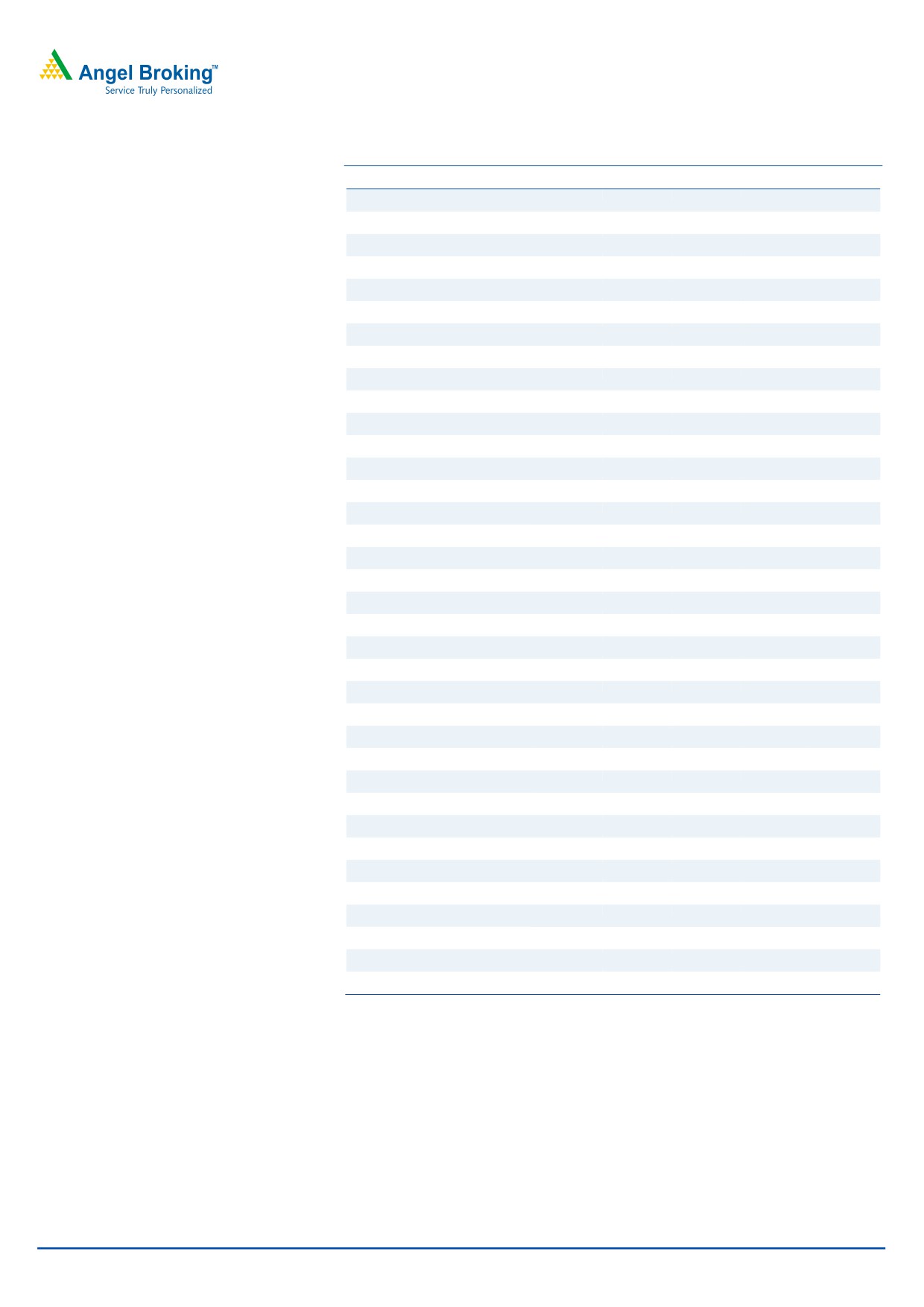

Key Financials (Consolidated)

Year End Net Sales OPM

PAT EPS RoE P/E P/BV EV/EBITDA EV/sales

March

(` cr)

(%)

(` cr)

(`)

(%) (x)

(x)

(x)

(x)

FY2013E

467

11.4

27

29.9

19.8

5.1

0.9

2.3

0.3

Shareen Batatawala

FY2014E

508

12.7

26

29.3

15.4

5.2

0.7

3.0

0.4

+91- 22- 3935 7800 Ext: 6849

FY2015E

667

12.9

36

39.5

17.6

3.8

0.6

2.1

0.3

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

Initiating Coverage | IFB Agro Ind.

Investment Rationale

Penetration opportunity to drive growth

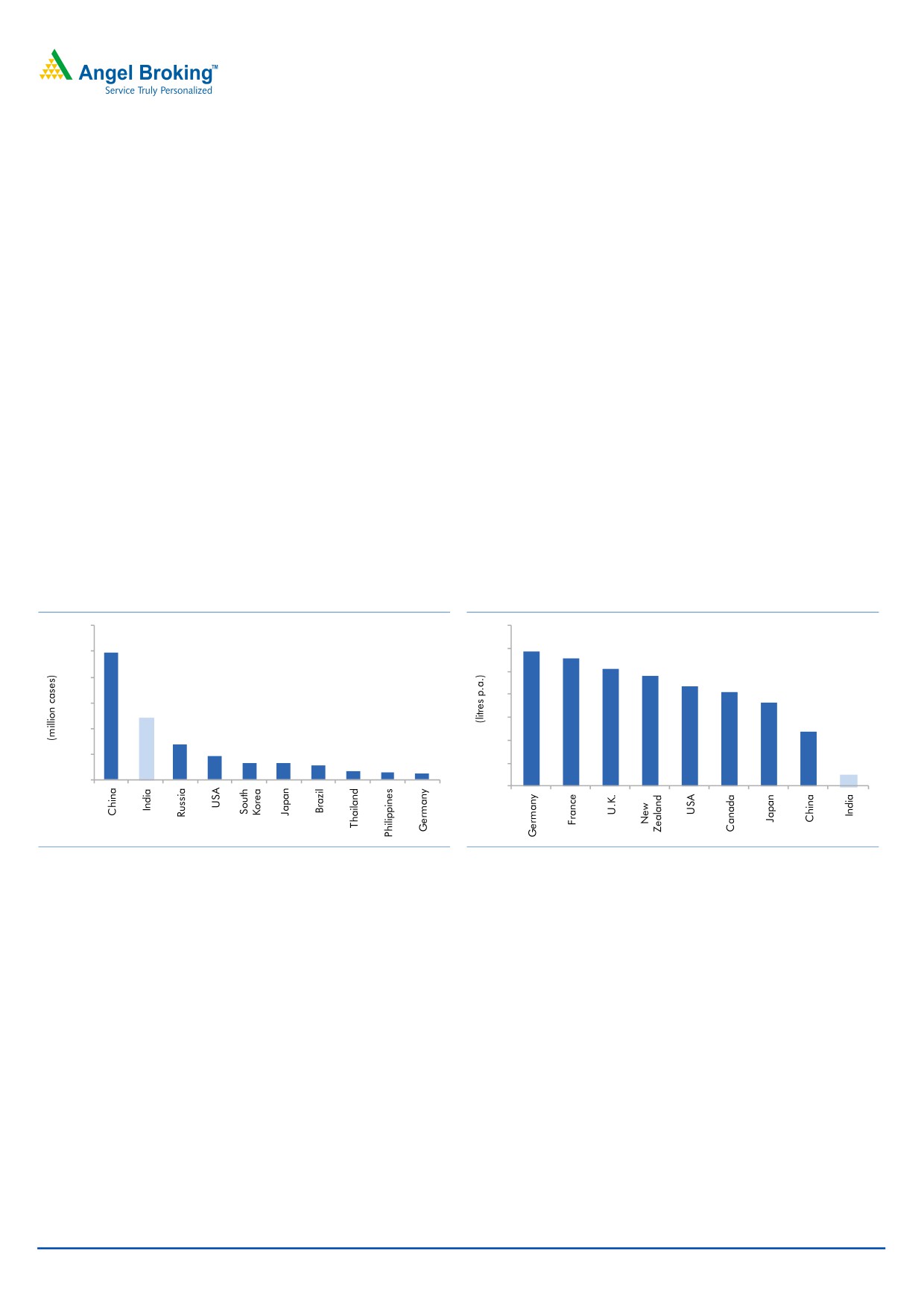

The Indian liquor industry is ranked second in volume terms and third in value

terms at ~$23 bn. In spite of this, per capita consumption in India stands low at

1lt/pa as compared to 4.7lt/pa for China, 8.7lt/pa for the US and 11.7lt/pa for

Germany. Thus, low per capita alcohol consumption coupled with increasing

population, favorable societal perception, and higher purchasing power is

expected to support volume growth going forward. As per Associated Chambers of

Commerce and Industry of India (ASSOCHAM), India’s alcohol consumption is

expected to grow by 30% annually till FY2015.

IFB has increased its production capacity by setting up a new bottling plant with

two bottling lines, at Panagarh in West Bengal. Additional capacity expansion at

the existing Panagarh plant has been completed. The company plans to replace

the Indian made foreign liquor (IMFL) bottling capacity with country liquor bottling.

In addition, it also plans to double its distillery manufacturing capacity and expects

it to be operational by FY2015. With there being a huge pent up demand for

distilleries in West Bengal and IFB being the only company with distillery capacity

in the region, the company’s revenue is expected to get a boost with the planned

expansion in capacities, going forward.

Exhibit 1: Alcohol Consumption- volume (2010)

Exhibit 2: Per Capita Alcohol Consumption

1,200

14

994

11.7

12

11.1

1,000

10.2

9.6

10

8.7

800

8.2

7.3

8

600

484

6

4.7

400

275

186

4

133

127

109

200

64

61

49

1.0

2

0

0

Source: IWSR

Source: WHO, Global health Observatory Date Repository, Angel Research

Marine business- a niche play

IFB is a major player in the seasonal marine foods business (primarily prawns

which constitute 90% of the total marine foods business of the company) in West

Bengal with presence in domestic & export markets, and the feeds business. In the

domestic market, the company has tie-ups with well-known brands like Le

Meridien, Jaypee Hotels, The Leela, Maharaja’s Express, Mainland China, Marriott

and Taj Hotels, which would continue to support business growth going forward.

IFB also exports its tailor-made products across geographies like the US, Europe,

Japan, Australia and the Middle East, to suit the customers' needs. The feeds

division distributes feeds from C.P. Group of Thailand and supplies farmers with

various types of soil and water probiotics and supplements, for healthy and

sustainable growth of shrimps. The company also operates "Aqua Shops" which

have inputs required for aqua culture, like nets, aerators, chemicals for soil and

water etc. With the overall global economic growth and better demand for frozen

sea food, we expect the marine products division to report a 15% CAGR over

FY2013-15.

March 22, 2013

2

Initiating Coverage | IFB Agro Ind.

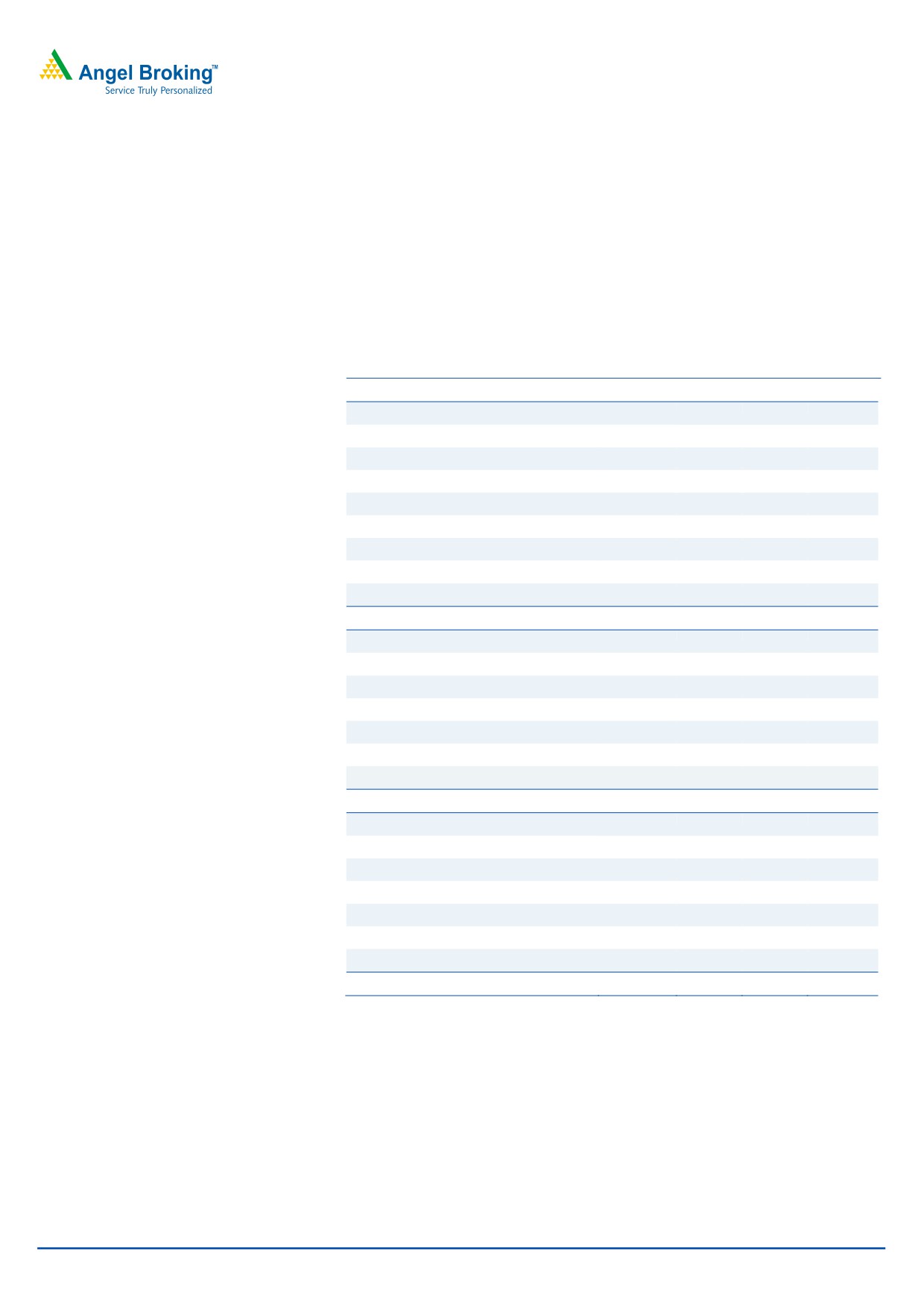

Change in business model to be margin lucrative

IFB has discontinued its low margin IMFL bottling business, which contributed 23%

to the total revenue in FY2012. It plans to replace the existing IMFL bottling

capacity with country liquor which is a ~7-8% EBIT margin business. Moreover, IFB

also plans to double its distillery capacity (EBIT margin of ~12%) on account of

abundant demand in West Bengal. Shift of IMFL bottling to country liquor and

expansion of distilleries as well as bottling units would benefit the company on the

margin front.

Exhibit 3: Segmental revenue and margin

FY2012

FY2013E

FY2014E FY2015E

Revenue (Net of excise duty & other taxes) (` cr)

Alcohol

430

436

463

627

Distillery

88

98

111

182

Own brands

22

26

28

31

Country liqour

220

255

324

413

IMFL Bottling

100

58

-

-

Marine Products + Marine trading

155

170

195

225

Total

585

606

658

851

Less: Other taxes

142

150

163

200

Net Sales

442

456

495

651

EBIT (` cr)

Alcohol

28

31

38

53

Distillery

11

12

13

22

Own brands

-

-

-

-

Country liqour

18

19

24

31

IMFL Bottling

-

-

-

-

Marine Products + Marine trading

8

7

4

6

Total EBIT

37

38

42

59

EBIT margin (%)

Alcohol

6.5

7.1

8.1

8.4

Distillery

12.0

12.0

12.0

12.0

Own brands

-

-

-

-

Country liqour

8.0

7.5

7.5

7.5

IMFL Bottling

-

-

-

-

Marine Products + Marine trading

5.5

4.4

2.2

2.8

Total EBIT margin

8.3

8.2

8.3

8.9

Source: Company, Angel Research

March 22, 2013

3

Initiating Coverage | IFB Agro Ind.

Preferential allotment improved investor confidence

The company has allotted 9,98,000 equity shares of IFB Agro Industries Ltd. of

`10 each at a premium of `172 per share on a preferential basis. Of the total,

7,63,000 equity shares were allotted to IFB Automotive Private Ltd and 2,35,000

shares to Asansol Bottling and Packaging Pvt ltd. With infusion of ~`18cr (~13%

of the current market capitalization) through the preferential allotment, the

promoter shareholding has increased from 55% to 60% which is an indicator of

promoters’ confidence in the company. This led to improved investor confidence.

Financials

Exhibit 4: Key Assumptions

FY2014E

FY2015E

Alcohol

6.9

32.5

Marine Products

15.0

15.0

Marine Feed Trading Goods

15.0

15.0

Source: Angel Research

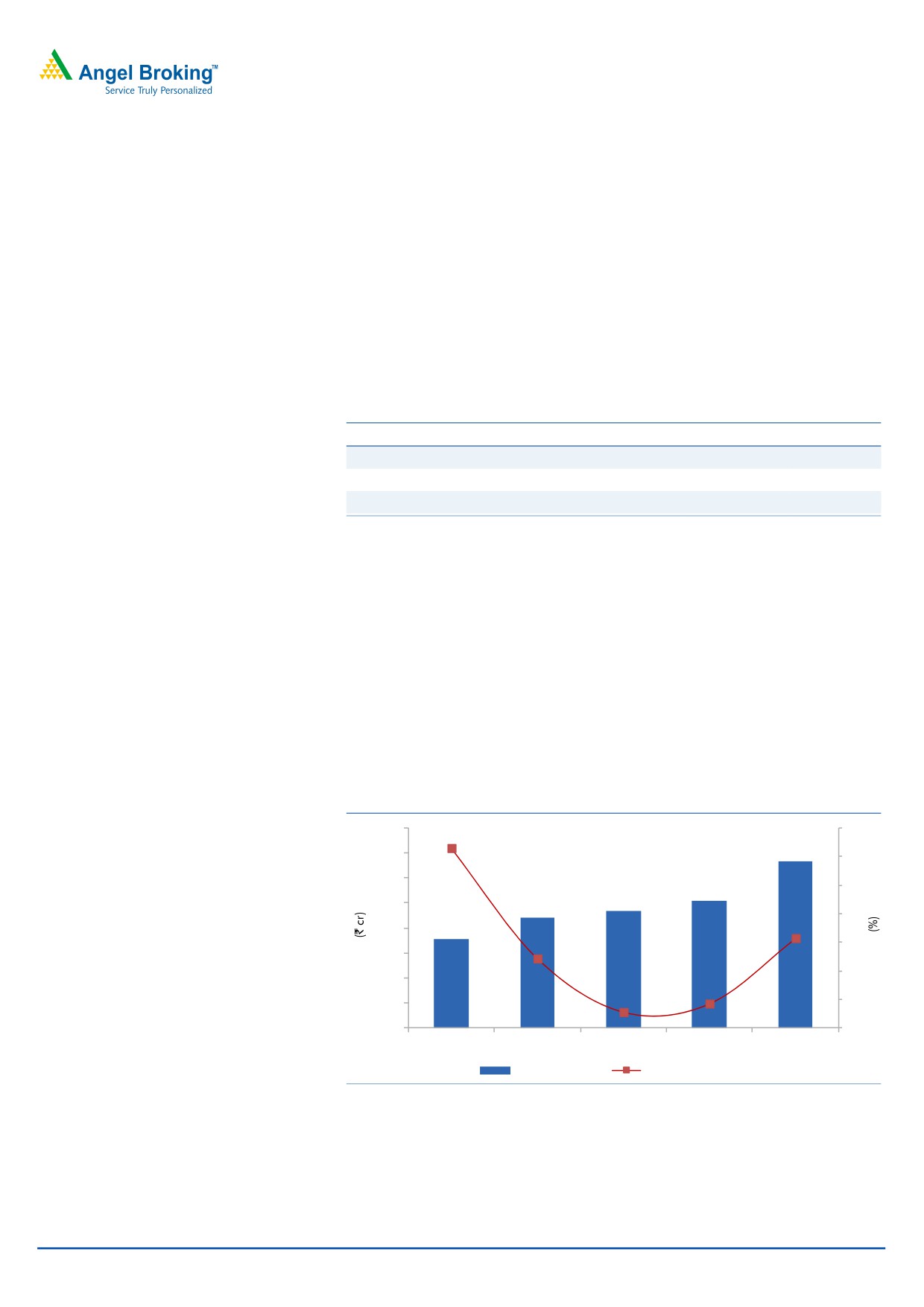

Capacity expansion and high demand support revenue growth

Capacity expansion of distillery unit, bottling plant and better demand for frozen

sea food are the major factors that support revenue growth. Lower revenue growth

in FY2013E is attributable to lower growth in alcohol division which resulted from

discontinuation of molasses distillery and closure of the Durgapur bottling plant.

We expect IFB to post a revenue CAGR of 19.5% over FY2013-15 from `467cr in

FY2013 to `667cr in FY2015 on account of higher volumes resulting from

doubling of distillery capacity which is expected to be operational by FY2015 and

new bottling plant in Panagarh, where the expansion has been completed recently.

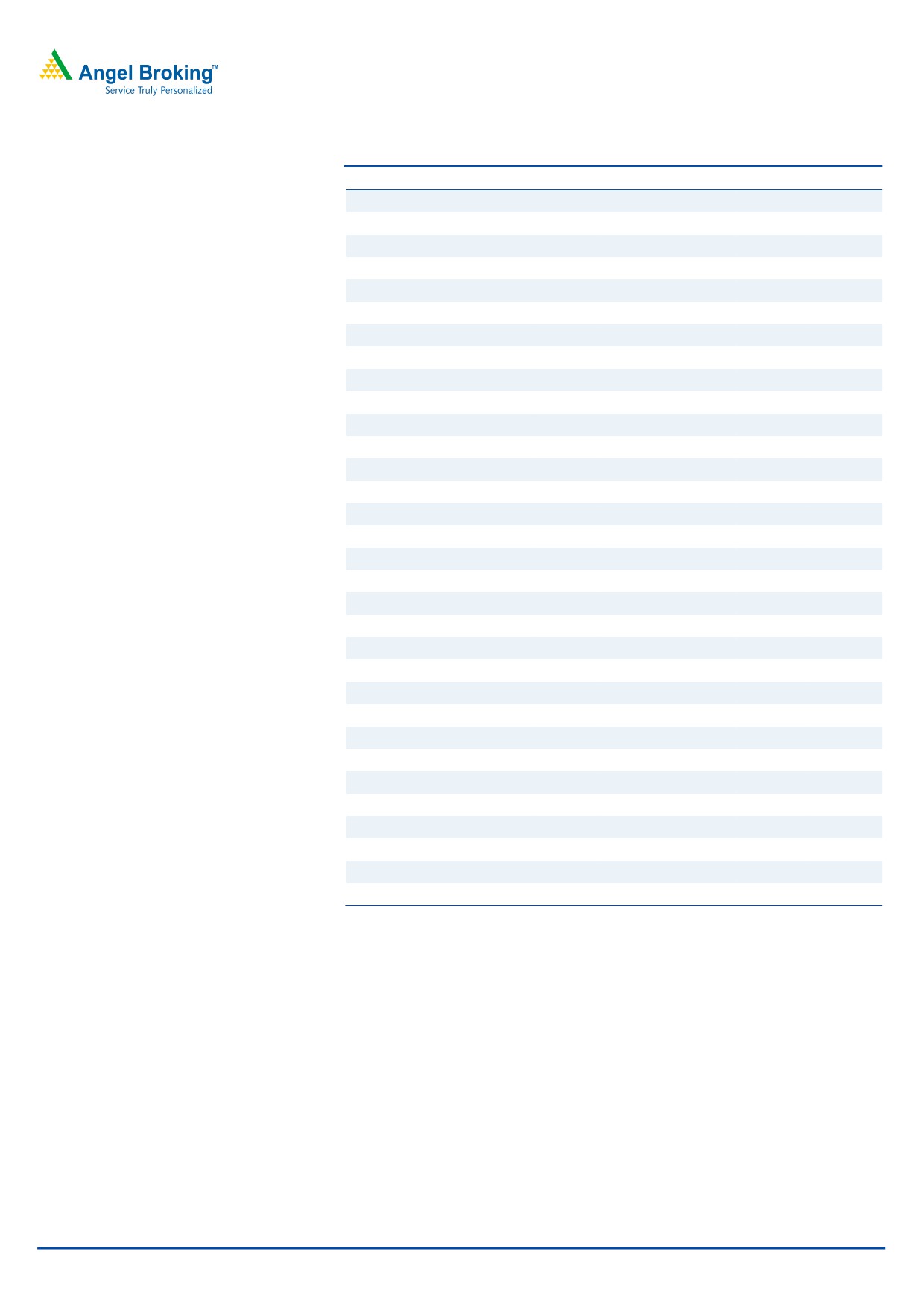

Exhibit 5: Revenue growth

800

70

700

63.0

60

600

50

500

40

400

31.5

30

300

24.4

20

200

100

8.6

10

356

442

4675.7

508

667

0

0

FY2011

FY2012

FY2013E

FY2014E

FY2015E

Revenue (LHS)

Revenue growth (RHS)

Source: Company, Angel Research

March 22, 2013

4

Initiating Coverage | IFB Agro Ind.

Replacement of IMFL bottling to country liquor to benefit margin

IFB has discontinued its low margin IMFL bottling business in 2QFY2013 and plans

to shift the capacity to country liquor, which has an EBIT margin of ~7-8%. This

would lead in expansion of EBITDA margin by 149bp over FY2013-15 from 11.4%

in FY2013 to 12.9% in FY2015. We expect depreciation and interest expenses to

increase as a result of new capacity and IFB’s plan to raise debt for expansion of

its distillery plant. This would consequently result in 15.1% CAGR in net profit over

FY2013-15 to `36cr in FY2015 from `27cr in FY2013.

Exhibit 6: EBITDA margin to expand

Exhibit 7: PAT margin to stabilize at higher level

100

13.5

40

6.0

90

5.8

12.9

13.0

35

5.8

80

12.6

5.6

12.5

30

70

12.0

5.3

25

60

5.2

5.2

11.4

11.5

50

20

5.0

11.1

11.0

40

4.8

15

10.5

30

10

20

9.9

10.0

4.4

10

9.5

5

35

49

53

64

86

18

26

27

26

36

0

9.0

0

4.0

FY2011

FY2012

FY2013E

FY2014E

FY2015E

FY2011

FY2012

FY2013E

FY2014E

FY2015E

EBITDA (LHS)

EBITDA margin (RHS)

PAT (LHS)

PAT margin (RHS)

Source: Company, Angel Research

Source: Company, Angel Research

Outlook and Valuation

We expect the company to post revenue CAGR of 19.5% over FY2013-15 to

`667cr on the back of capacity expansion of its distillery and bottling plant, while

margins are expected to expand by 149bp over the same period to 12.9% in

FY2015. Higher depreciation and interest expenses are expected to lead to a lower

net profit CAGR of 15.1% over FY2013-2015. At current market price, the stock is

trading at a PE of 3.8x its FY2015E earnings and P/B of 0.6x FY2015E. We initiate

coverage on the stock with a Buy recommendation and target price of `198 based

on a target P/E of 5.0x for FY2015E.

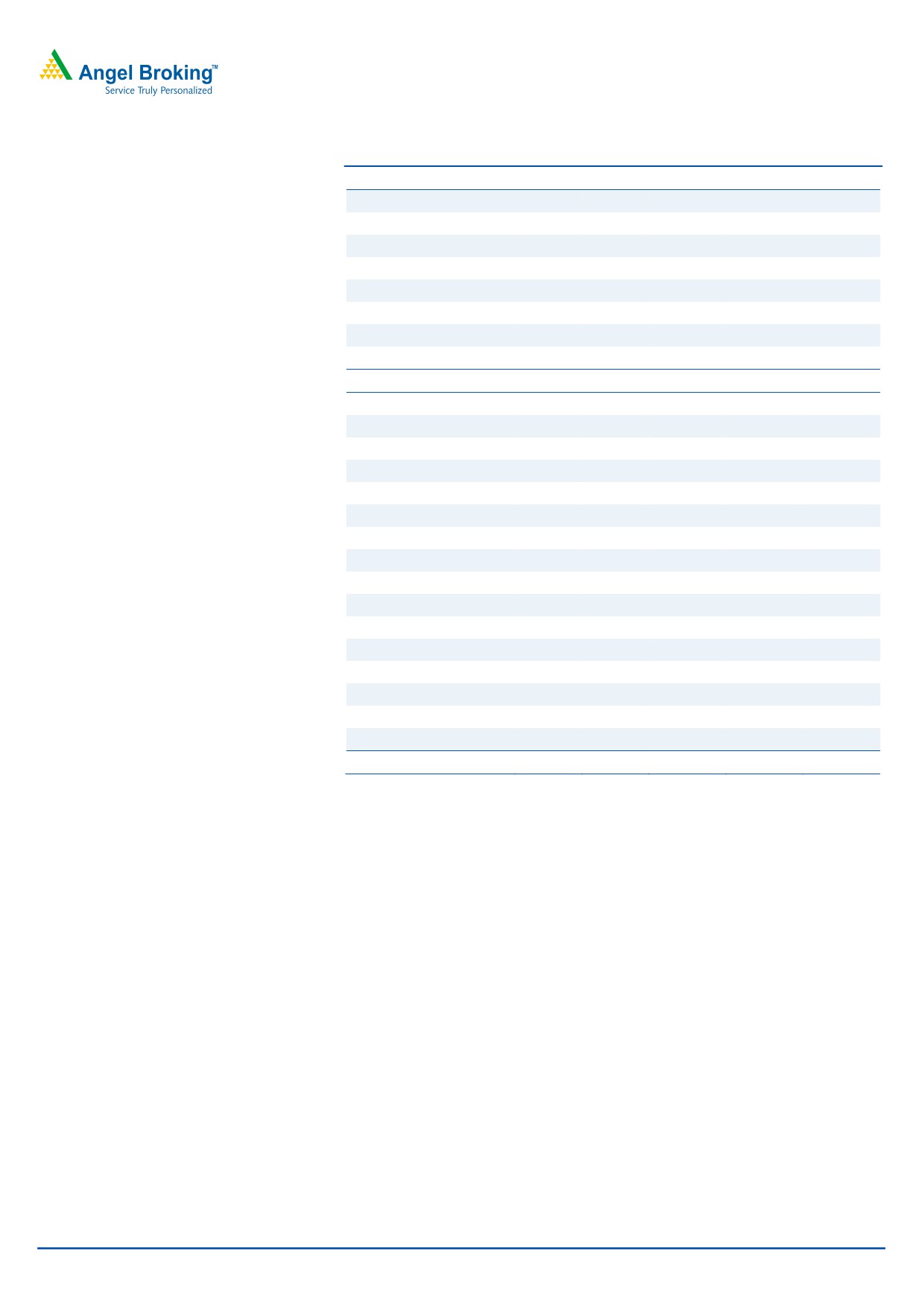

Exhibit 8: One year forward P/E chart

400

350

300

250

200

150

100

50

0

Mar-08

Mar-09

Mar-10

Mar-11

Mar-12

Mar-13

Price

2x

5x

8x

11x

Source: Company, Angel Research

March 22, 2013

5

Initiating Coverage | IFB Agro Ind.

Concerns

Regulations in liquor business

Liquor business is highly regulated in India. Major regulations which have a direct

impact on the companies include:

Volatility in excise duty on liquor

Ban on advertising

Price hike limited to once a year

Interstate transfer fees of molasses- a key raw material

Distribution barrier

Limited SKUs result in slower distribution expansion

Currency fluctuation may impact marine business

The marine feeds trading business constitutes ~12% of the total revenue. Volatility

in the foreign currency will impact the marine business and consequently impact

the profitability of the company.

March 22, 2013

6

Initiating Coverage | IFB Agro Ind.

Company Background

IFB Agro Industries is engaged in the business of manufacturing alcohol, bottling

of branded alcoholic beverages as well as processed and packed marine foods

both for domestic & export markets.

The company has two broad business categories:

Alcohol

This consists of distillery, IMFL and IMIL (Country liquor) segments.

Distillery: Distillery is situated at Noorpur, West Bengal with an installed

capacity of 60,000 liters per day based on molasses. In addition, the company

has grain distillery with capacity of 60,000 liters per day. The company plans

to convert the molasses distillery into a multi-feed distillery going forward.

IMFL: The IMFL division has two manufacturing units in Kolkata. Apart from

producing own brands, the unit also produces brands like "Smirnoff" of

DIAGEO and brands of United Spirits.

IMIL (Country Spirit): Company is the largest manufacturer of IMIL, popularly

known as Country spirit.

Marine

Domestic business: It comprises of products like IFB Royal Prawns, IFB Prawn

POPS and Breaded Fish Fillets, Ready to Fry Prawn/ Fish products, freshly

frozen prawn/ fish available from over 800 food stores across the country's

metros and tier 2 cities. The company has tie-ups with well-known brands like

Le Meridien, Jaypee Hotels, The Leela, Maharaja’s Express, Mainland China,

Marriott and Taj Hotels which would support domestic business growth going

forward.

Exports: The company exports its tailor-made products across geographies

including USA, Europe, Japan, Australia, and the Middle East, to suit

customers' needs. The products are sold under three major brands

-

Aquafresh, IFB Royal and IFB Crown.

Feeds business: IFB has tied up with C.P. Group of Thailand for farming and

distribution of feed to the farmers. The company is the largest distributor of

C.P. Feeds (Thailand) in West Bengal. IFB also operates "Aqua Shops" which

are a one-stop-shop for many other inputs required for aqua culture, like nets,

aerators, chemicals for soil and water etc.

March 22, 2013

7

Initiating Coverage | IFB Agro Ind.

Profit & Loss Statement

Y/E March (` cr)

FY2011

FY2012

FY2013E

FY2014E

FY2015E

Gross sales

556

740

785

853

1,096

Less: Excise duty & other taxes

228

312

330

358

445

Net Sales

328

428

456

495

651

Other operating income

27

14

12

13

16

Total operating income

356

442

467

508

667

% chg

67.1

24.4

5.7

8.6

31.5

Net Raw Materials

239

292

313

333

434

Personnel

14

22

18

19

25

Other expenses

68

80

83

91

121

Total Expenditure

320

393

414

443

581

EBITDA

35

49

53

64

86

% chg

-

39.8

8.7

20.8

33.7

(% of Net Sales)

9.9

11.1

11.4

12.7

12.9

Depreciation

8

13

15

23

27

EBIT

27

36

38

42

59

% chg

-

35.5

5.1

9.4

41.0

(% of Net Sales)

7.6

8.2

8.2

8.3

8.9

Interest & other charges

2

0

0

5

9

Other Income

1

2

2

2

3

(% of Net Sales)

0.3

0.5

0.5

0.5

0.5

PBT

26

38

40

39

53

% chg

302.7

45.6

5.2

(1.9)

34.9

Tax

8

12

13

13

18

(% of PBT)

32.0

30.4

33.0

33.0

33.0

PAT (reported)

18

27

27

26

36

Extraordinary (Exp)/Inc.

(0)

1

-

-

-

ADJ. PAT

18

26

27

26

36

% chg

300.3

44.1

4.2

(1.9)

34.9

(% of Net Sales)

5.0

5.8

5.8

5.2

5.3

Basic EPS (`)

22.4

32.3

29.9

29.3

39.5

Fully Diluted EPS (`)

22.4

32.3

29.9

29.3

39.5

% chg

300.3

44.1

(7.4)

(1.9)

34.9

March 22, 2013

8

Initiating Coverage | IFB Agro Ind.

Balance Sheet

Y/E March (` cr)

FY2011

FY2012

FY2013E

FY2014E

FY2015E

SOURCES OF FUNDS

Equity Share Capital

8

8

9

9

9

Reserves& Surplus

79

105

149

176

211

Shareholders’ Funds

87

113

158

185

220

Total Loans

2

0

0

70

70

Deferred Tax Liability (Net)

8

7

7

7

7

Other Long-term liabilities

4

4

4

5

6

Long Term Provisions

1

1

1

1

1

Total Liabilities

102

125

170

267

304

APPLICATION OF FUNDS

Gross Block

135

154

200

301

361

Less: Acc. Depreciation

65

77

92

114

141

Net Block

71

78

109

186

220

Capital Work-in-Progress

0

1

20

40

30

Investments

3

3

3

3

3

Long term Loans & adv

1

0

0

0

0

Other non-current assets

2

1

1

1

2

Current Assets

61

82

77

79

102

Cash

8

13

12

11

18

Loans & Advances

15

11

12

13

17

Inventory

27

37

37

37

44

Debtors

11

20

16

18

23

Current liabilities

37

40

40

43

53

Net Current Assets

25

42

37

36

50

Misc. Exp. not written off

-

-

-

-

-

Total Assets

102

125

170

267

304

March 22, 2013

9

Initiating Coverage | IFB Agro Ind.

Cash Flow Statement

Y/E March (` cr)

FY2011 FY2012 FY2013E FY2014E FY2015E

Profit before tax

26

38

40

39

53

Depreciation

8

13

15

23

27

Change in Working Capital

8

(12)

4

0

(7)

Other income

(1)

(2)

(2)

(2)

(3)

Direct taxes paid

(8)

(12)

(13)

(13)

(18)

Others

1

1

-

-

-

Cash Flow from Operations

34

26

44

47

53

(Inc.)/Dec. in Fixed Assets

(11)

(19)

(66)

(120)

(50)

(Inc.)/Dec. in Investments

-

-

-

-

-

(Inc.)/Dec. in L.T. Loans & advances

1

(1)

(0)

(0)

(0)

(Inc.)/Dec. In other long term assets

2

(1)

(0)

(0)

(0)

Other income

1

2

2

2

3

Others

(4)

1

-

-

-

Cash Flow from Investing

(11)

(18)

(63)

(118)

(47)

Issue of Equity

-

-

1

-

-

Inc./(Dec.) in loans

(29)

(2)

-

70

-

Inc./(Dec.) in Other long term liab.

4

-

0

0

1

Inc./(Dec.) in Long Term Prov.

1

0

0

0

0

Dividend Paid (Incl. Tax)

-

-

-

-

-

Others

(5)

(0)

17

-

-

Cash Flow from Financing

(30)

(2)

18

70

2

Inc./(Dec.) in Cash

(7)

5

(1)

(1)

7

Opening Cash balances

15

8

13

12

11

Closing Cash balances

8

13

12

11

18

March 22, 2013

10

Initiating Coverage | IFB Agro Ind.

Key Ratios

Y/E March

FY2011

FY2012

FY2013E

FY2014E

FY2015E

Valuation Ratio (x)

P/E (on FDEPS)

7.6

5.3

5.1

5.2

3.8

P/CEPS

5.2

3.5

3.2

2.8

2.2

P/BV

1.6

1.2

0.9

0.7

0.6

Dividend yield (%)

-

-

-

-

-

EV/Sales

0.4

0.3

0.3

0.4

0.3

EV/EBITDA

3.6

2.4

2.3

3.0

2.1

EV / Total Assets

1.3

1.0

0.7

0.7

0.6

Per Share Data (`)

EPS (Basic)

22.4

32.3

29.9

29.3

39.5

EPS (fully diluted)

22.4

32.3

29.9

29.3

39.5

Cash EPS

32.5

48.9

46.6

54.3

69.6

DPS

-

-

-

-

-

Book Value

108.2

141.3

175.7

205.0

244.5

Dupont Analysis

EBIT margin

7.6

8.2

8.2

8.3

8.9

Tax retention ratio

0.7

0.7

0.7

0.7

0.7

Asset turnover (x)

4.4

5.1

3.9

2.6

2.6

ROIC (Post-tax)

22.8

29.0

21.4

14.6

15.5

Cost of Debt (Post Tax)

0.1

0.2

1.3

0.1

0.1

Leverage (x)

0.0

(0.1)

(0.1)

0.1

0.3

Operating ROE

23.9

25.5

19.0

16.1

19.6

Returns (%)

ROCE (Pre-tax)

25.5

32.2

26.0

19.2

20.7

Angel ROIC (Pre-tax)

33.5

41.7

31.9

21.8

23.2

ROE

23.1

25.9

19.8

15.4

17.6

Turnover ratios (x)

Asset Turnover (Gross Block)

2.7

3.1

2.6

2.0

2.0

Inventory / Sales (days)

29

27

29

27

22

Receivables (days)

11

13

13

13

13

Payables (days)

42

35

35

35

33

WC Cycle (ex-cash) (days)

21

19

21

18

15

Solvency ratios (x)

Net debt to equity

(0.1)

(0.1)

(0.1)

0.3

0.2

Net debt to EBITDA

(0.3)

(0.3)

(0.3)

0.9

0.6

Interest Coverage (EBIT/ Int.)

14.6

101.2

106.2

8.6

6.5

March 22, 2013

11

Initiating Coverage | IFB Agro Ind.

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

IFB Agro Ind.

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to -15%)

Sell (< -15%)

March 22, 2013

12

Initiating Coverage | IFB Agro Ind.

6th Floor, Ackruti Star, Central Road, MIDC, Andheri (E), Mumbai- 400 093. Tel: (022) 39357800

Research Team

Fundamental:

Sarabjit Kour Nangra

VP-Research, Pharmaceutical

Vaibhav Agrawal

VP-Research, Banking

Bhavesh Chauhan

Sr. Analyst (Metals & Mining)

Viral Shah

Sr. Analyst (Infrastructure)

Sharan Lillaney

Analyst (Mid-cap)

V Srinivasan

Analyst (Cement, Power, FMCG)

Yaresh Kothari

Analyst (Automobile)

Ankita Somani

Analyst (IT, Telecom)

Sourabh Taparia

Analyst (Banking)

Bhupali Gursale

Economist

Vinay Rachh

Research Associate

Amit Patil

Research Associate

Shareen Batatawala

Research Associate

Twinkle Gosar

Research Associate

Tejashwini Kumari

Research Associate

Technicals:

Shardul Kulkarni

Sr. Technical Analyst

Sameet Chavan

Technical Analyst

Sacchitanand Uttekar

Technical Analyst

Derivatives:

Siddarth Bhamre

Head - Derivatives

Institutional Sales Team:

Mayuresh Joshi

VP - Institutional Sales

Hiten Sampat

Sr. A.V.P- Institution sales

Meenakshi Chavan

Dealer

Gaurang Tisani

Dealer

Akshay Shah

Sr. Executive

Production Team:

Tejas Vahalia

Research Editor

Dilip Patel

Production Incharge

Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Securities Ltd:BSE: INB010994639/INF010994639 NSE: INB230994635/INF230994635 Membership numbers: BSE 028/NSE:09946

Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

March 22, 2013

13