IPO Note | NBFC

June 15, 2017

Central Depository Services Ltd

SUBSCRIBE

Issue Open: June 19, 2017

High entry barriers provide bright future

Issue Close: June 21, 2017

Central Depository Services Ltd (CDSL) is one of the two depositories operating in

India, which facilitate the holding of securities in electronic form and enable

Issue Details

securities to be processed by book entry. It was originally promoted by BSE, which

Face Value: `10

subsequently divested part of its stake to leading banks as its sponsors.

Depository services - Duopoly market with high entry barriers: The Indian

Present Eq. Paid up Capital: `104.5cr

depositories market is shared by two players i.e. CDSL and NSDL promoted by

O ffer for Sale: 3.52cr Shares

BSE and NSE. The business is highly regulated with entry barriers in place, and

hence, the market is likely to remain duopoly in nature. With little threat of new

Fresh issue: ` 0cr

entrants coming in the incremental business is to be shared by both CDSL &

NSDL and this makes the business model quite interesting.

Post Eq. Paid up Capital: `104.5cr

CDSL has wide base of revenue sources: CDSL has wide source of revenues, 35%

Issue size (amount): *`510cr -**524cr

from the annual issuer charges (which is recurring in nature) and 21% from

transactions having some correlation with volumes in the markets. Another 13%

comes from online data charges. As the capital markets have remained buoyant,

Price Band: `145-149

there has been an increasing trend of new listings, and thus, CDSL has generated

Lot Size: 100 shares and in multiple

11% of its revenues from the IPO/ Corporate action charges. Hence, broadly

thereafter

speaking, the revenue base of CDSL is quite diversified.

Post-issue implied mkt. cap: *`1,515cr

- **`1,557cr

Decent growth in number of demat accounts: The number of demat accounts of

CDSL has grown at a CAGR of 8.6% over FY2011-17 to 12.3 mn, compared to

Promoters holding Pre-Issue: 50.05%

5.1% for NSDL over the same period to 15.6 mn. While CDSL has an overall

Promoters holding Post-Issue: 24%

market share of 43% in the cumulative demat accounts, on the incremental

accounts opened, it had a market share of 59% in FY2017. With capital markets

*Calculated on lower price band

remaining buoyant, the growth in demat accounts is likely to remain strong.

** Calculated on upper price band

Revenue/PAT CAGR of 10%/12% over FY13-17, likely to sustain: Charges levied

Book Building

by CDSL to its clients like DPs are regulated by SEBI. However, a decent growth in

number of accounts has ensured revenue/PAT CAGR of 10%/ 12% over FY13-17.

QIBs

50% of issue

With markets remaining buoyant and increasing share of financial savings in

Non-Institutional

15% of issue

India, we expect the growth momentum to sustain going ahead as well.

Retail

35% of issue

Outlook & Valuation: CDSL has a unique business model with high entry barriers

coupled with decent growth prospects. The average ROE for the last six years has

been ~17%, which we believe will sustain going ahead as well. The incremental

Post Issue Shareholding Patter

capital required for doing business in this space is very minimal and this makes it

an interesting business model. At the issue price band of `145-149, the stock is

Promoters

24%

offered at 17.7x-18.2x its FY2017 EPS, which we believe is reasonably priced,

Others

76%

and hence, recommend SUBSRIBE to the issue.

Key Financials

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

FY2017

Operating Income

90.7

88.9

105.3

122.9

146.0

% chg

(6)

(2)

18

17

19

Net profit

49.9

49.4

57.7

90.9

85.8

% chg

(10)

(1)

17

58

(6)

Siddhart Purohit

EPS (`)

4.8

4.7

5.5

8.7

8.2

+022 39357600, Extn: 6872

Book Value (`)

31.4

33.8

35.3

39.4

51.0

P/E

31.2

31.6

27.0

17.1

18.2

P/BV (x)

4.7

4.4

4.2

3.8

2.9

RoE (%)

Please refer to important disclosures at the end of this report

1

CDSL | IPO Note

Company background

Central Depository Services (India) Limited (CDSL) commenced depository business

in 1999. The depository system in India is `240cr market (FY2016) comprising of

two depositories CDSL & NSDL. As a security depository, CDSL facilitates holding

of securities in electronic form and enables security transactions, including off

market transfer and pledge to be processed by book entry. CDSL was initially

promoted by the BSE, which subsequently divested part of its stake to leading

Indian banks. As on 30th April, 2017 CDSL had 589 registered DPs as its clients

and 12.4 million investor accounts. It had a 59% market share of incremental BO

(Beneficiary Owners) accounts in FY2017 and the net BO accounts grew by

13.68% in FY2017. CDSL has connectivity with all the leading stock exchange of

India viz. BSE, NSE and Metropolitan Stock Exchange.

It offers services to a range of clients

(1) Depository participants (DP) and other capital market intermediaries:

offers dematerialization for a wide range of securities.

(2) Corporates: Offers facilities to issuers to credit securities to shareholders

or applicant’s demat account to give effect to a range of non cash

corporate events.

(3) Capital market intermediaries: Offers KYC services in respect of investors

in Indian capital markets to capital market intermediaries including

mutual funds.

(4) Insurance Companies: Offers facilities to allow holding of insurance

policies in electronic form to the policy holders of several insurance

companies.

(5) Others: Offers other online services such as e-voting, e-locker, National

Academy Depository, etc.

Scope and functions of a depository like CDSL

A depository facilitates holding of securities in the electronic form and

enables securities to be processed by book entry.

The Depository Participants (DP), who acts as an agent of the depository

offers depository services to investors.

According to SEBI guidelines, financial institutions, banks, custodians,

stock brokers are eligible to act as DPs.

The investor who is known as Beneficiary Owner (BO) has to open a

demat account through any DP for dematerialization of his holdings and

transferring securities.

The balances in the investor accounts recorded and maintained with CDSL

can be obtained through the DP.

The DP is required to provide the investors, at regular intervals, a

statement of account, which gives the details of the securities holdings and

transactions.

June 15, 2017

2

CDSL | IPO Note

Issue details

CDSL is offering 3.52cr equity shares of `10 each via book building route in price

band of `145-149/share, entirely comprising offer for sale by current BSE limited.

Exhibit 1: Pre and Post-IPO shareholding pattern

No. of shares (Pre-issue)

(%)

No. of shares (Post-issue)

(%)

Promoters

5,22,97,850

50.0%

2,50,80,000

24.0%

Others

5,22,02,150

50.0%

7,94,20,000

76.0%

Total

10,45,00,000

10,45,00,000

Source: RHP

Exhibit 2: Top 10 share holders (%)

BSE Ltd

50.1

State Bank Of India

9.6

HDFC Bank Ltd

7.2

Standard Charted Bank Ltd

7.2

Canara Bank

6.5

Bank Of India

5.6

Bank Of Baroda

5.1

LIC

4.2

Union Bank Of India

1.9

Bank Of Maharastra

1.9

Source: Company, Angel Research

Objects of the offer

The objects of the offer are to achieve the benefits of listing the Equity Shares

on NSE and for the sale of Equity Shares by the Selling Shareholders.

The Company expects that listing of the Equity Shares will enhance its visibility

and brand image and provide liquidity to its existing Shareholders.

June 15, 2017

3

CDSL | IPO Note

Investment rationale

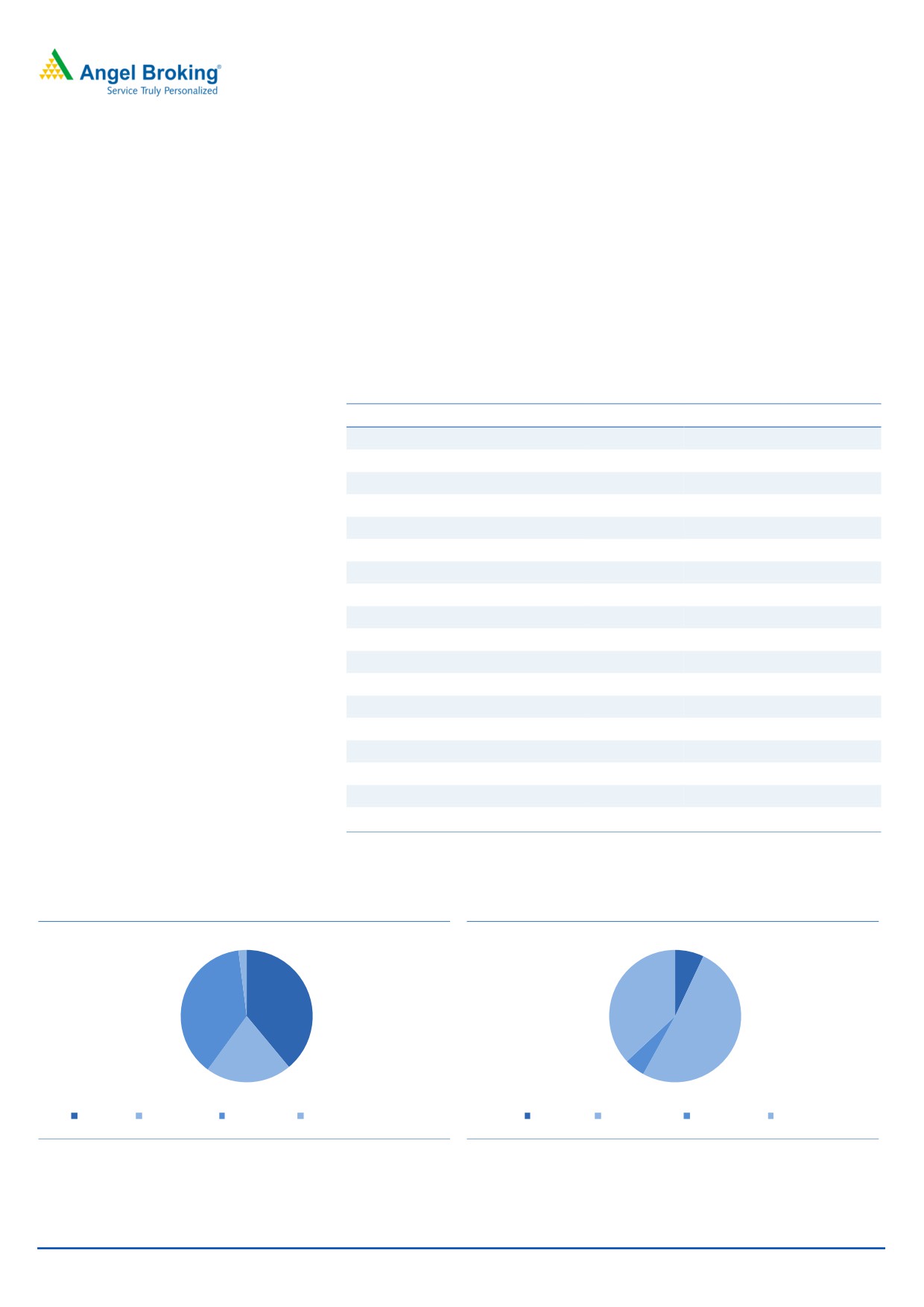

Wide source of revenues: CDSL has wide source of revenues at its privilege. Nearly

39% of the revenues come from the annual listing fees, which are steady in nature.

Further, 21% of the revenues come from the transaction charges, which it levies on

the DPs. While the transaction charges has co-relation with the markets and can

be volatile based on volume of transactions, the annual charges fees insulates the

company from any major volatility. On comparative basis, NSDL derives only 7%

of its revenues from the annual fees and 51% of the revenues from the transaction

charges. This lends higher revenue visibility for CDSL compared to NSDL.

Exhibit 3: Revenue Bifurcation of CDSL

Sources of revenues (` cr)

FY15

FY16

FY17

Annual Issuer Charges

36

48

52

Transaction Charges

28

26

31

Online data charges

15

15

19

IPO/ Corp action charges

6

11

17

ECAS Charges

2

8

Document storage charges

5

5

5

E-Voting charges

5

5

4

Others

11

11

11

Total

105.2

122.8

146.0

Annual Issuer Charges

34%

39%

35%

Transaction Charges

27%

21%

21%

Online data charges

14%

13%

13%

IPO/ Corp action charges

6%

9%

11%

ECAS Charges

0%

2%

5%

Document storage charges

5%

4%

4%

E-Voting charges

5%

4%

3%

Others

10%

9%

7%

Total

100%

100%

100%

Source: RHP

Exhibit 4: Sources of revenue CDSL

Exhibit 5: Sources of revenue NSDL

2%

7%

39%

37%

38%

51%

21%

5%

Annual fees Transaction fees Other Charges Annual maintenance charges

Annual fees

Transaction fees

Other Charges

Custody Fees

Source: RHP

Source: RHP

June 15, 2017

4

CDSL | IPO Note

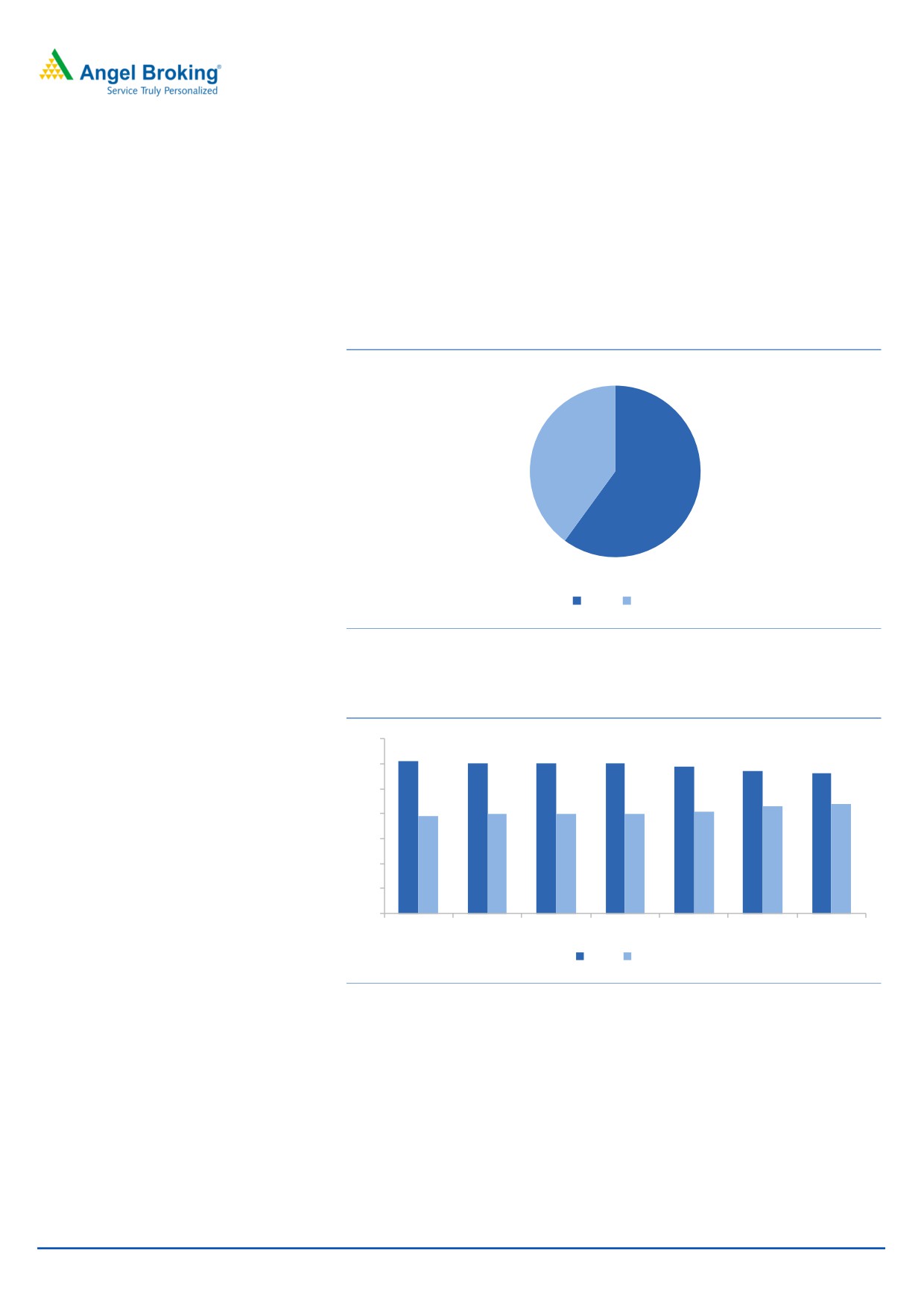

Depository services is a duopoly market with high entry barrier: In India there are

two depositories i.e. CDSL and NSDL promoted by the two leading stock

exchanges BSE and NSE, the operations of these depositories is highly regulated.

With strong entry barriers in place, the market is likely to remain duopoly in

nature, and hence, all the incremental business is to be shared by both CDSL &

NSDL. This makes the business model quite interesting. While CDSL has an overall

market share of 43% in the cumulative demat accounts, on the incremental demat

accounts opened, it had a market share of 59% in FY2017.

Exhibit 6: Incremental market share (%)

40

60

CDSL NSDL

Source: RHP

Exhibit 7: Market share trend (%) of CDSL & NSDL

70

61

60

60

60

59

57

56

60

50

44

43

39

40

40

40

41

40

30

20

10

0

FY11

FY12

FY13

FY14

FY15

FY16

FY17

NSDL CDSL

Source: RHP

June 15, 2017

5

CDSL | IPO Note

Decent growth in number of demat accounts: CDSL’s number of demat accounts

has grown at a CAGR of 8.6% over FY2011-17 to 12.3 mn, compared to 5.1% for

NSDL over the same period to 15.6 million. While CDSL has an overall market

share of 43% in the cumulative demat accounts, on the incremental demat

accounts opened, it had a market share of 59% in FY2017. The table below shows

that in the last four out of six years, CDSL had generated higher incremental

accounts compared to its competitors NSDL. With capital markets remaining

buoyant the growth in demat accounts is likely to remain strong going ahead.

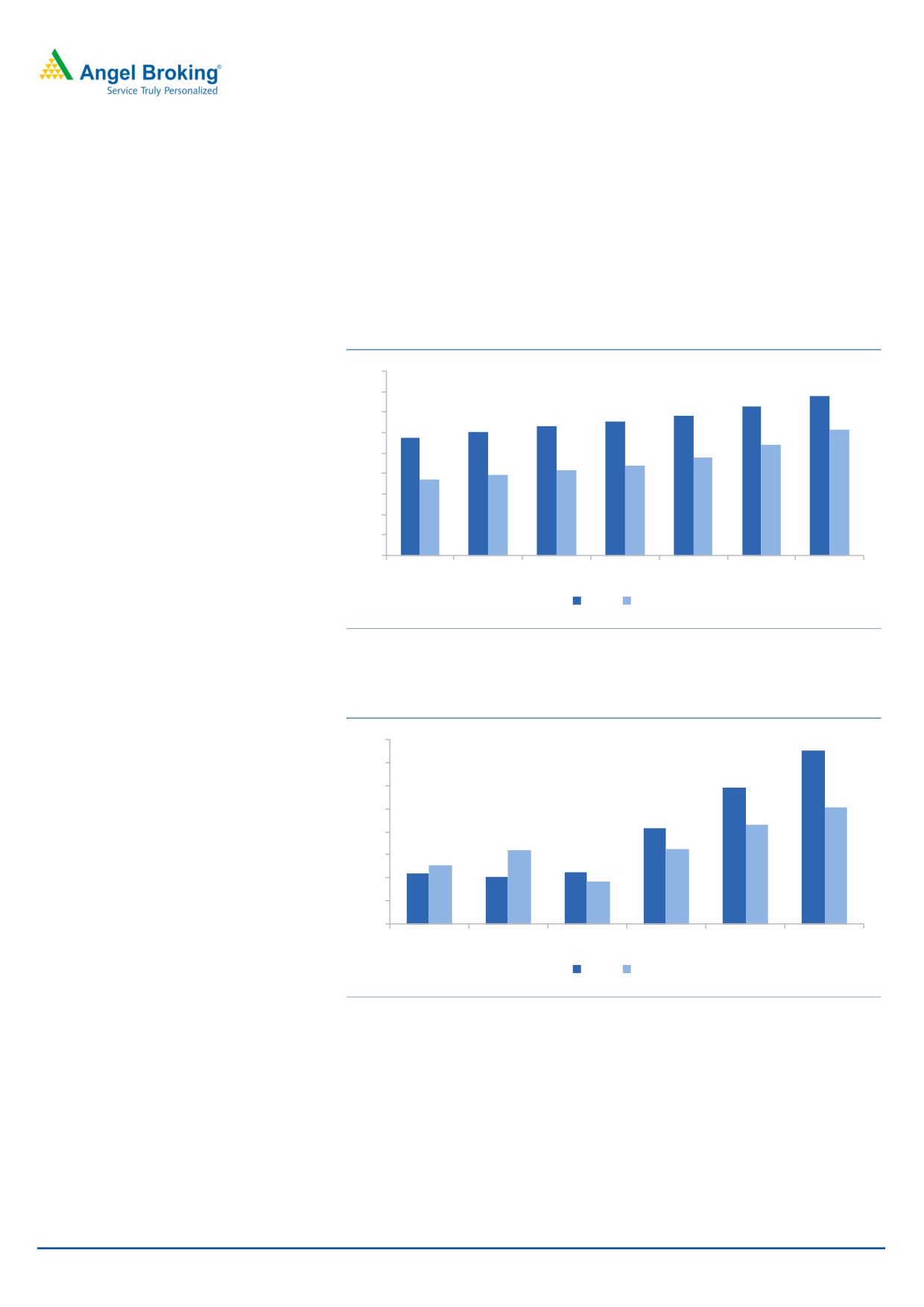

Exhibit 8: Demat account growth trend ( millions)

18

15.58

16

14.57

13.71

14

12.68

13.05

12.04

12.3

11.54

12

10.79

9.61

10

8.78

8.33

7.92

7.48

8

6

4

2

0

FY11

FY12

FY13

FY14

FY15

FY16

FY17

NSDL CDSL

Source: RHP

Exhibit 9: Incremental demat accounts opened ( millions)

1.6

1.51

1.4

1.18

1.2

1.01

1

0.86

0.83

0.8

0.64

0.65

0.6

0.51

0.45

0.44

0.41

0.37

0.4

0.2

0

FY12

FY13

FY14

FY15

FY16

FY17

CDSL NSDL

Source: RHP

June 15, 2017

6

CDSL | IPO Note

Revenue/PAT CAGR of 10%/12% over FY2013-17, likely to sustain over next few

years: The charges levied by CDSL to its clients like DPs are regulated by SEBI.

However, a decent growth in number of accounts has ensured revenue growth of

10% and PAT growth of 12% over FY2013-17. With markets remaining buoyant,

we expect the growth momentum to sustain going ahead as well

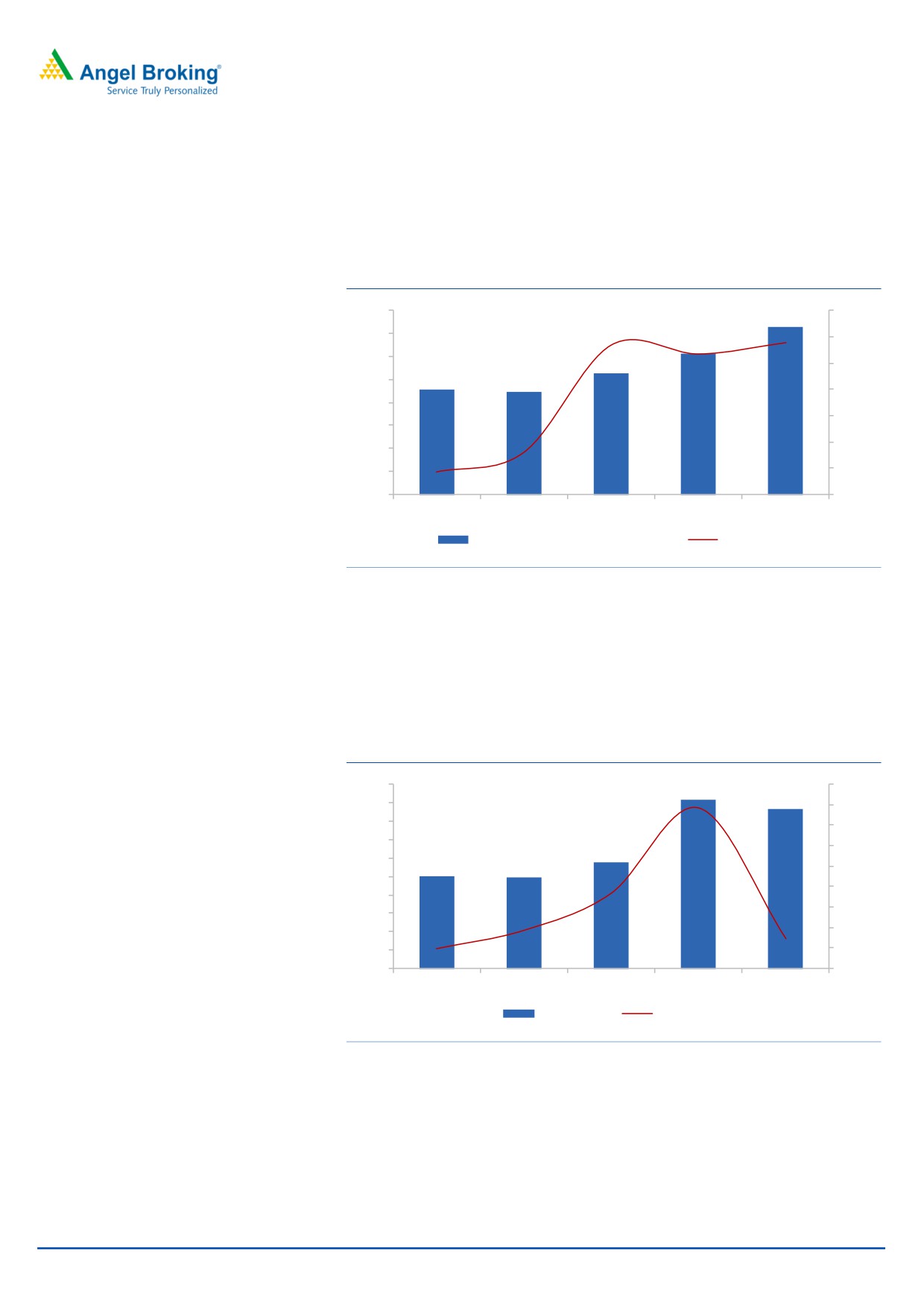

Exhibit 10: Revenue growth trend (` cr)

160

25.0

18.8

18.4

140

16.7

20.0

120

146

123

15.0

100

105

10.0

80

91

89

5.0

60

-2.0

0.0

40

-5.7

20

-5.0

0

-10.0

FY13

FY14

FY15

FY16

FY17

Revenues from Operations ( Rs Cr )

% Growth YoY

Source: Company, Angel Research

While ~21% of the company’s revenues is derived from the transaction charges

which is linked to market based trading volumes, a fairly large part i.e. 35% of the

revenues is derived from the annual issuer charges and 13% from the online data

charges, and hence, we believe that in addition to a decent growth in the revenue,

the company will be able to maintain stable margins.

Exhibit 11: PAT growth trend (` cr)

100

91

70.0

87

90

60.0

80

58.4

50.0

70

58

40.0

60

50

49

30.0

50

20.0

40

16.9

10.0

30

20

0.0

-1.2

-5.2

10

-10.0

-10.1

0

-20.0

FY13

FY14

FY15

FY16

FY17

PAT ( Rs Cr )

% Growth YoY

Source: RHP

June 15, 2017

7

CDSL | IPO Note

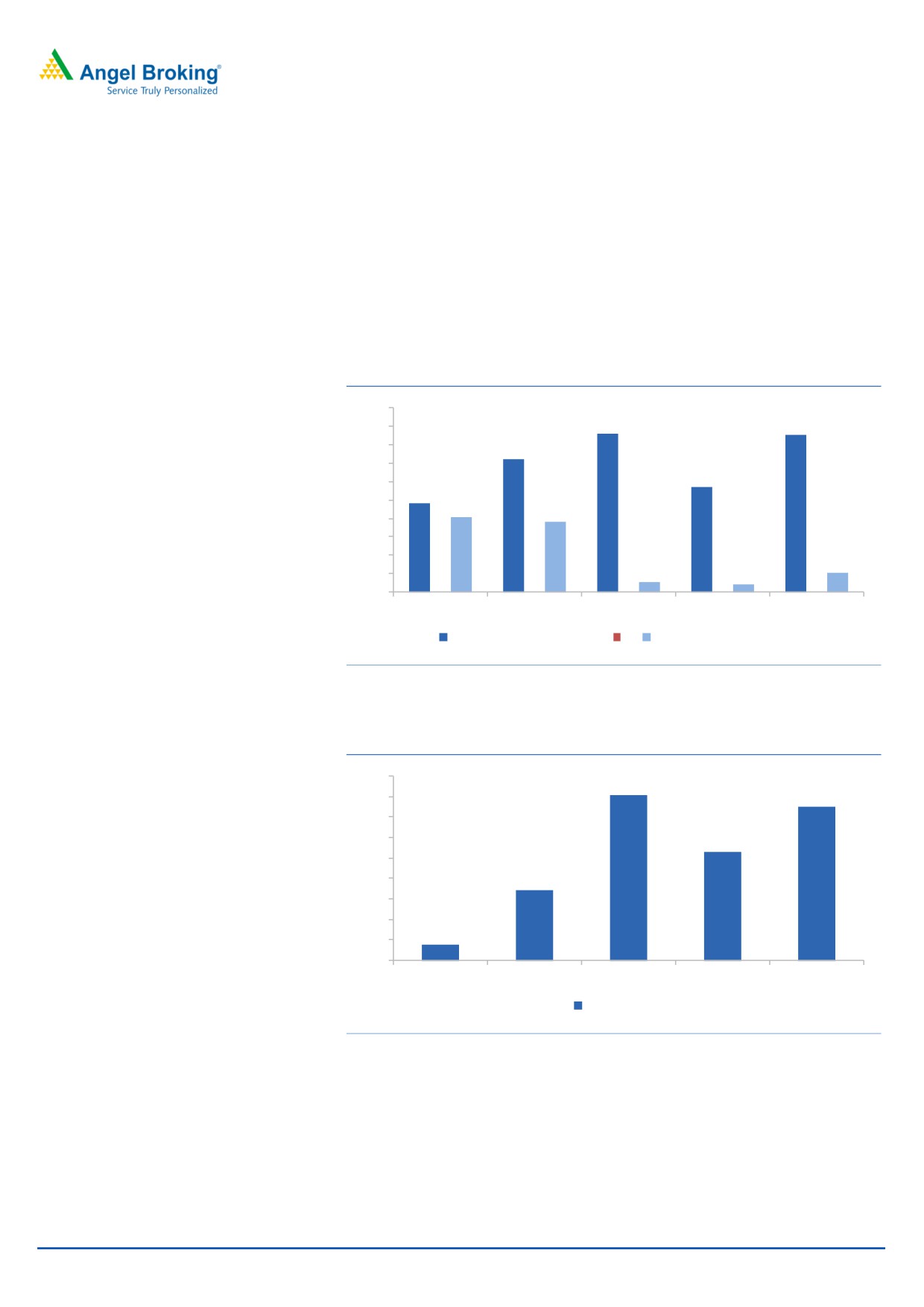

Strong free cash flow generation can be used for higher dividend payouts: The

working capital requirements are very minimal in case of CDSL due to its nature of

business, and hence, the cash flow operations have been healthy on a continuous

basis. Over FY2013-17 the cumulative cash flow from operations for CDSL was

`174 cr, while the investments in fixed assets were to the tune of `49 cr only. This

resulted in strong cumulative fresh cash flows of `125 cr over the last five years.

The average dividend payout of CDSL for the last five years is ~38% and with low

capital investment requirements going ahead, the company can very much

maintain the current dividend payout ratio.

Exhibit 12: Cash flow and Investments in fixed assets (` Cr)

50

43

43

45

40

36

35

28

30

24

25

20

19

20

15

10

5

3

2

5

-

FY13

FY14

FY15

FY16

FY17

Cash flow from operations

Investments In Fixed Assets

Source: RHP

Exhibit 13: Free Cash Flow Generations (` Cr)

45

40

40

37

35

30

26

25

20

17

15

10

4

5

-

FY13

FY14

FY15

FY16

FY17

Free cash flow

Source: RHP

June 15, 2017

8

CDSL | IPO Note

Outlook & Valuation

CDSL has a unique business model with high entry barriers coupled with decent

growth prospects. The average ROE for the last six years has been ~17%, which

we believe will sustain going ahead as well. The incremental capital required for

doing business in this space is very minimal and this makes it an interesting

business model. At the issue price band of `145-149, the stock is offered at

17. 7x-18.2x its FY2017 Earnings, which we believe is reasonably priced, and

hence, recommend SUBSRIBE to the issue.

Key Concerns:

CDSL operates in a highly regulated industry. The various charges levied

by CDSL to its users and clients are regulated by the market regulator

SEBI. Inability to increase the pricing when cost goes up can impact the

profitability.

A large proportion of the business is transaction related and dependent

on trading volume. Further, the business of the organization has direct

correlation with the level of delivery based volumes and price levels on

major stock exchanges. Hence, any declines in trading volume and

market liquidity could adversely affect the operations of the company.

June 15, 2017

9

CDSL | IPO Note

Exhibit 14: Income Statement

Income Statement (` cr)

FY13

FY14

FY15

FY16

FY17

Revenues from Operations

90.7

88.9

105.3

122.9

146.0

- YoY Growth (%)

(6)

(2)

18

17

19

Employee Expenses

17.2

17.5

19.2

21.5

24.9

- YoY Growth (%)

38

2

10

12

16

Other Expenses

37.9

38.8

39.8

36.3

41.5

- YoY Growth (%)

64

2

3

(9)

14

Total Expenses

55.0

56.2

59.0

57.8

66.4

- YoY Growth (%)

55

2

5

(2)

15

EBITDA

35.7

32.7

45.2

63.9

79.4

- YoY Growth (%)

(41)

(8)

38

41

24

Depreciation

2.6

5.0

6.2

4.2

3.7

- YoY Growth (%)

(35)

90

26

(33)

(12)

Other Income

33.3

33.9

40.2

38.5

40.8

- YoY Growth (%)

36

2

19

(4)

6

Profit Before Tax

66.4

61.6

79.1

98.2

116.6

- YoY Growth (%)

(18)

(7)

28

24

19

Exceptional Items

0.0

0.0

1.7

33.1

0.0

PBT After Exceptional Item

66.4

61.6

80.8

131.3

116.6

Prov. for Taxation

15.4

12.7

23.3

40.2

30.0

- as a % of PBT

23.2

20.5

28.9

30.6

25.7

PAT

49.9

49.4

57.7

91.3

86.6

- YoY Growth (%)

(10)

(1)

17

58

(5)

Source: RHP

June 15, 2017

10

CDSL | IPO Note

Exhibit 15: Balance Sheet

Y/E March (` cr)

FY13

FY14

FY15

FY16

FY17

Share Capital

105

105

105

105

105

Reserve & Surplus

224

249

312

375

429

Net Worth

329

353

416

479

533

Minority Interest

12.4

13.6

14.6

14.7

15.5

Other Long Term Liabilities

21.6

21.8

22.9

22.9

23.2

Total Current Liabilities

54.2

67.0

56.6

32.6

33.9

Total Non Current Liabilities

0.0

0.0

1.4

3.4

1.4

Total Liabilities

417

456

511

553

607

Total Fixed Assets

9.8

9.8

6.7

3.7

5.5

Total Non Current Assets

42

62

259

240

298

Investments

316

331

191

247

230

Trade Receivables, Loans & advances & other CA

13.4

11.9

8.8

15.2

15.8

Cash & Cash equivalents

35.3

41.0

43.1

40.4

48.3

Other Current Assets

0.0

0.0

3.3

6.5

9.7

Total Assets

417

456

511

553

607

Source: RHP

June 15, 2017

11

CDSL | IPO Note

Exhibit 16: Key Ratios

FY13

FY14

FY15

FY16

FY17

Per Share Data ( ` )

EPS

4.8

4.7

5.5

8.7

8.2

BVPS

31.4

33.8

35.3

39.4

51.0

DPS

2.0

2.0

2.2

2.5

3.0

Valuation Ratios

P/E

31.2

31.6

27.0

17.1

18.2

P/BV

4.7

4.4

4.2

3.8

2.9

EV/ EBITDA

33.7

36.2

29.1

20.1

16.1

EV/Sales

13.3

13.3

12.5

10.5

8.8

Dividend Yield (%)

1.3

1.3

1.5

1.7

2.0

Profitability Ratios

ROE %

15.2

14.0

15.6

22.1

16.1

ROIC %

0.0

0.0

19.8

28.9

28.0

EBITDA %

39.4

36.8

42.9

52.0

54.4

PAT %

55.0

55.5

54.8

74.0

58.8

Source: RHP

June 15, 2017

12

CDSL | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

June 15, 2017

13