2QFY2016 Result Update | Logistics

October 31, 2015

Transport Corporation of India

NEUTRAL

CMP

`280

Performance Highlights

Target Price

-

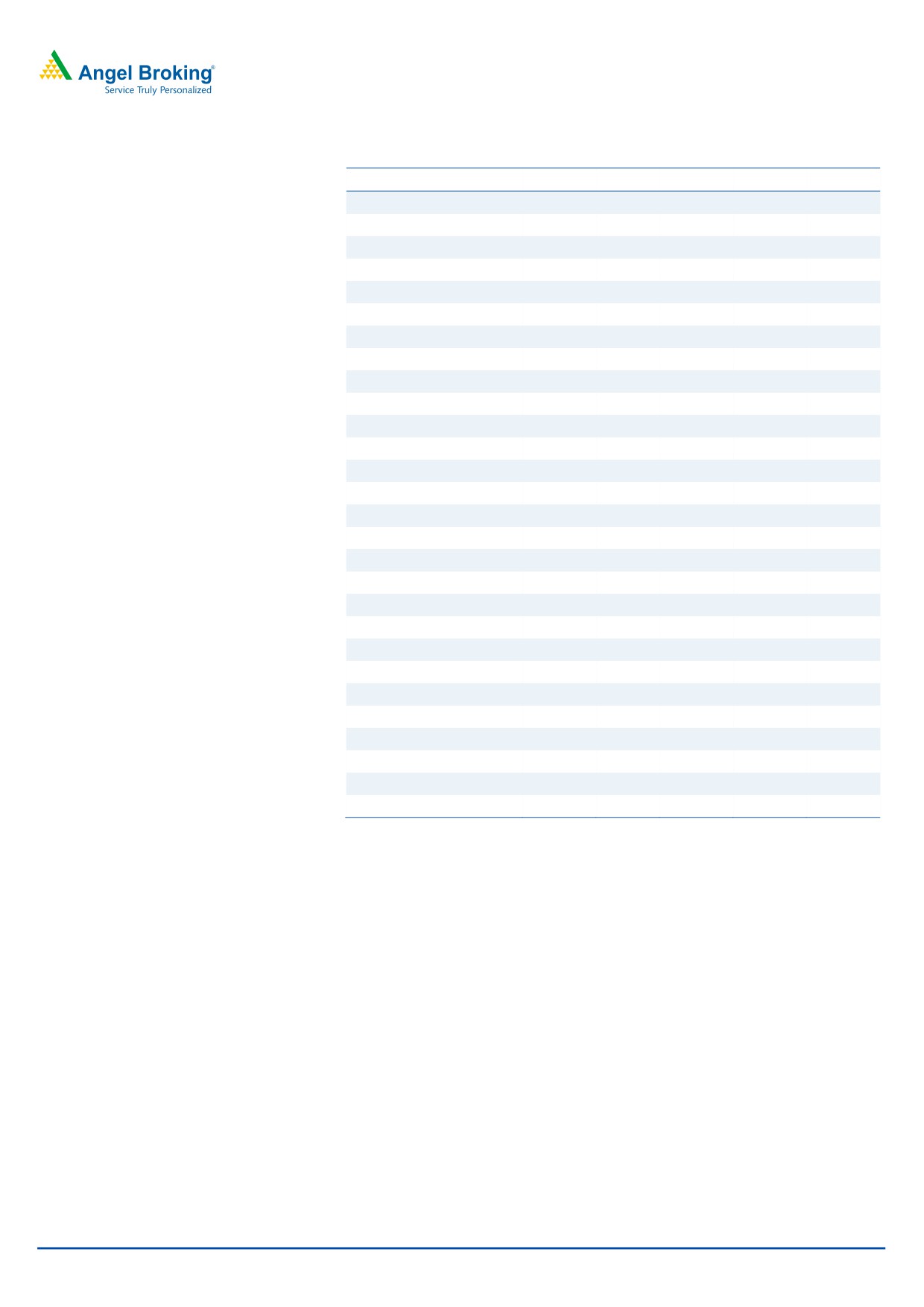

Quarterly Data (Standalone)

Investment Period

-

(` cr)

2QFY16

2QFY15

% yoy

1QFY15

% qoq

Revenue

556

556

(0.0)

548

1.4

EBITDA

44

41

7.2

41

5.8

Stock Info

Margin (%)

7.9

7.3

53bp

7.5

33bp

Sector

Logistics

Reported PAT

23

21

9.0

19

24.1

Market Cap (` cr)

2,131

Source: Company, Angel Research

Net Debt (` cr)

286

Transport Corporation of India Ltd (TCIL)’s earnings has come in below our

Beta

1.6

estimates, for 2QFY2016. The top-line was flat on a yoy basis, mainly due to

52 Week High / Low

322 / 199

poor performance of all business segments, barring Seaways, which reported a

Avg. Daily Volume

42,736

growth of ~11% yoy. On the operating front, the company showed a slight

Face Value (`)

2

improvement in margins. Further, lower interest costs boosted the overall

BSE Sensex

26,838

profitability.

Nifty

8,112

Muted standalone top-line performance: TCIL’s earnings for the quarter

Reuters Code

TCIL.BO

have come in below our estimates. The top-line, at ~`556cr (our estimate was of

Bloomberg Code

TRPC@IN

~`625cr), is flat on a yoy basis, with all business segments posting poor

performances, barring Seaways, which reported a growth of ~11% yoy to `32cr.

Shareholding Pattern (%)

Slight improvement in operating margin and lower interest costs boost overall

Promoters

66.5

PAT: For the quarter, the company reported an operating profit of ~`44cr, up

MF / Banks / Indian Fls

6.5

~7% yoy. Further, the company’s operating margin expanded by 53bp yoy to

FII / NRIs / OCBs

2.9

7.9%, primarily on account of decline in operating expenses as a percentage of

Indian Public / Others

24.1

sales by 245bp yoy. The net profit grew by ~9% yoy to ~`23cr (which is below

our estimates of `25cr), mainly due to lower sales growth during the quarter.

Abs. (%)

3m 1yr

3yr

Outlook and valuation: TCIL benefits from its pan-India scale, which gives it

Sensex

2.3

10.3

44.0

competitive advantage in higher margin segments of the logistics industry; as well

as from its asset-light business model which cushions its profitability in cyclical

TCIL

9.2

28.0

340.5

downturns and gives it an attractive ROE profile. The company is well-placed to

be a key beneficiary of the anticipated implementation of the GST. However, in

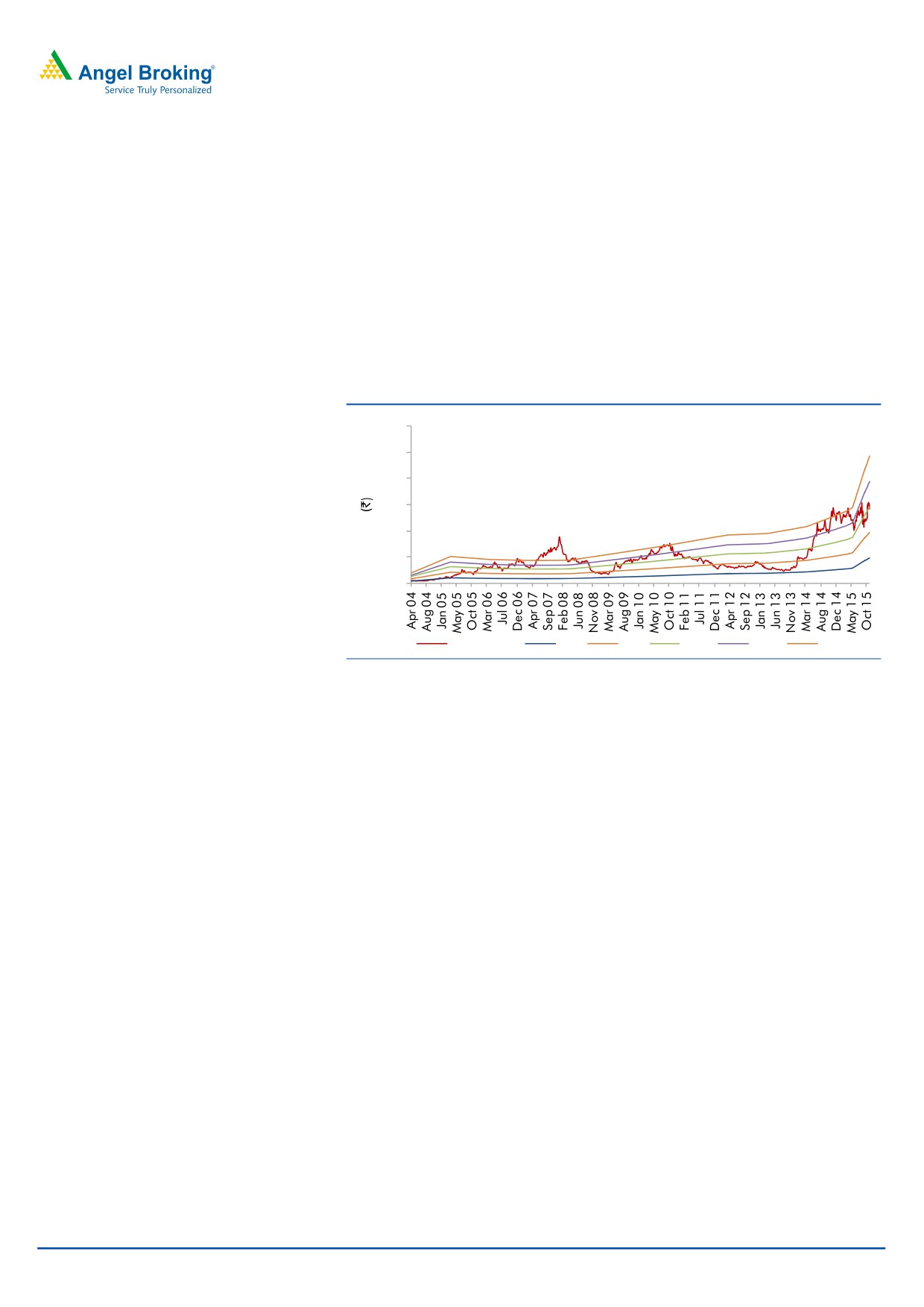

3-year price chart

the last few quarters, the company has not been able to report good numbers,

350

300

both on the top-line and bottom-line fronts, due to delay in pick-up in economic

250

activities. Hence we are downgrading our estimates. Currently, we have a

200

NEUTRAL rating on the stock.

150

100

Key financials (Consolidated)

50

Y/E March (` cr)

FY2014

FY2015

FY2016E

FY2017E

0

Net sales

2,228

2,417

2,570

2,851

% chg

4.5

8.4

6.3

10.9

Net profit

72

81

93

108

% chg

3.0

13.6

14.8

15.7

Source: Company, Angel Research

EBITDA margin (%)

7.6

8.0

8.3

8.5

EPS (`)

9.5

10.8

12.4

14.3

P/E (x)

29.9

26.3

22.9

19.8

P/BV (x)

4.4

3.5

3.1

2.8

RoE (%)

14.6

13.2

13.6

14.0

RoCE (%)

14.9

14.6

14.5

14.8

Amarjeet S Maurya

EV/Sales (x)

1.1

1.0

0.9

0.9

022-39357800 Ext: 6831

EV/EBITDA (x)

14.3

12.6

11.4

10.2

Source: Company, Angel Research, Note: CMP as of October 29, 2015

Please refer to important disclosures at the end of this report

1

Transport Corporation of India | 2QFY2016 Result Update

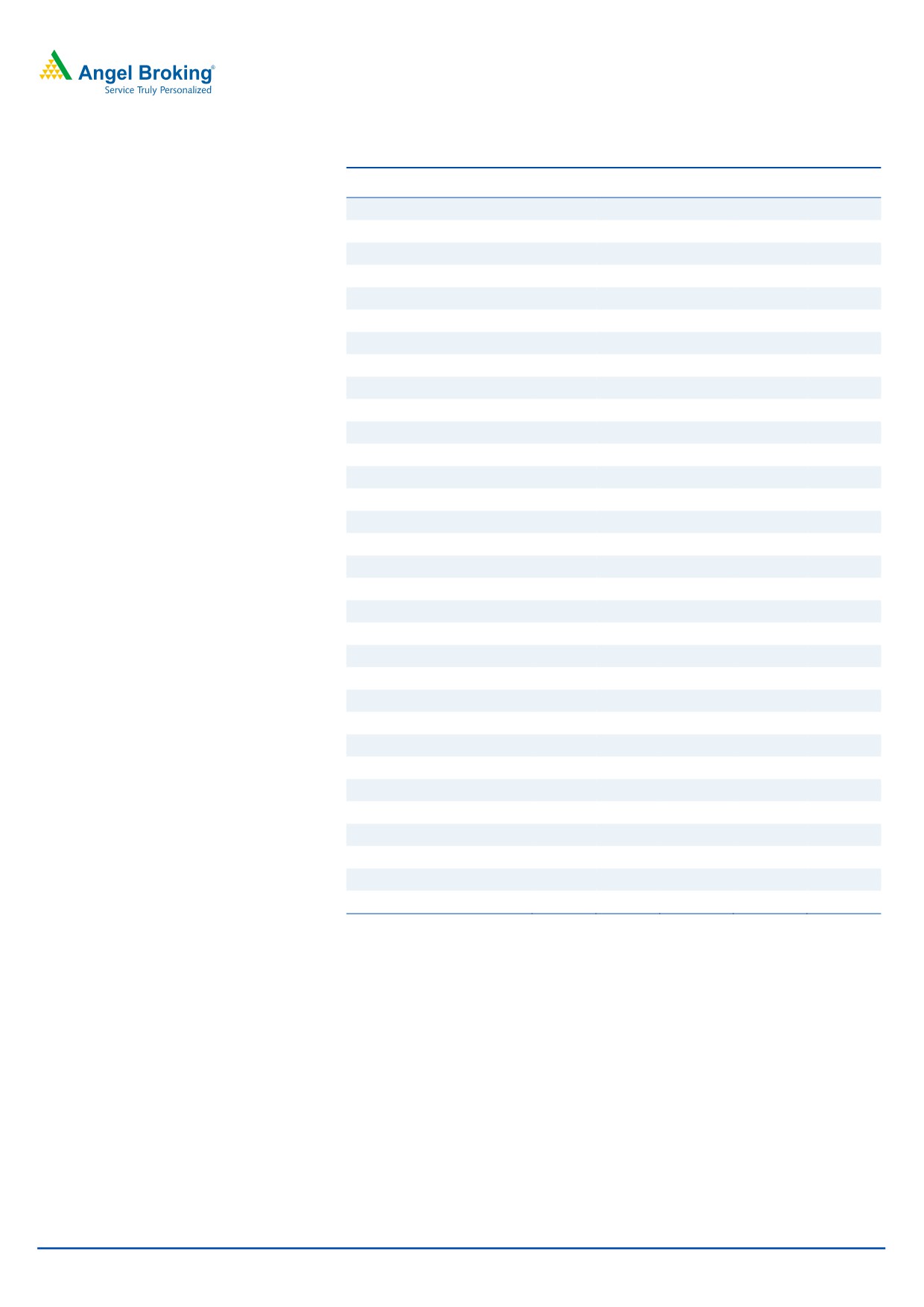

Exhibit 1: Standalone quarterly performance

Y/E March (` cr)

2QFY16

2QFY15

% yoy

1QFY15

% qoq

FY2015

FY2014

% chg

Net Sales

556

556

(0.01)

548

1.4

2,197

2,027

8.4

Operating Expense

437

451

(3.0)

439

(0.5)

1,765

1,641

7.5

(% of Sales)

78.6

81.1

80.1

80.3

81.0

Staff Costs

37

31

18.7

35

5.1

125

113

11.0

(% of Sales)

6.6

5.6

6.4

5.7

5.6

Other Expense

38

33

14.7

33

16.8

137

124

10.0

(% of Sales)

6.9

6.0

6.0

6.2

6.1

Total Expenditure

512

515

(0.6)

507

1.0

2,026

1,878

7.9

Operating Profit

44

41

7.2

41

5.8

170

149

14.1

OPM (%)

7.9

7.3

7.5

7.8

7.4

Interest

7

8

(15.4)

7

3.7

32

30

Depreciation

13

12

8.2

13

1.6

49

42

16.6

Other Income

6.2

6.7

(7.0)

4.0

55.1

12

6

116.4

PBT

30

27

10.2

26

16.0

101

83

22.2

Ext Income/(Expense)

0

-

PBT (incl. Ext Items)

30

27

10.2

26

(60.4)

101

83

22.0

(% of Sales)

5.4

4.9

4.7

4.6

4.1

Provision for Taxation

7

6

14.8

7

(5.4)

25

21

20.6

(% of PBT)

22.3

21.4

27.4

24.9

25.2

Minority Interest

Recurring PAT

23

21

9.0

19

24.1

76

62

22.5

PATM

4.2

3.8

3.4

3.5

3.1

Exceptional items

Reported PAT

23

21

9.0

19

24.1

76

62

22.5

Equity shares (cr)

7.6

7.6

7.6

7.6

7.6

FDEPS (`)

3.1

2.8

9.0

2.5

24.1

10.0

8.2

22.5

Source: Company, Angel Research

October 31, 2015

2

Transport Corporation of India | 2QFY2016 Result Update

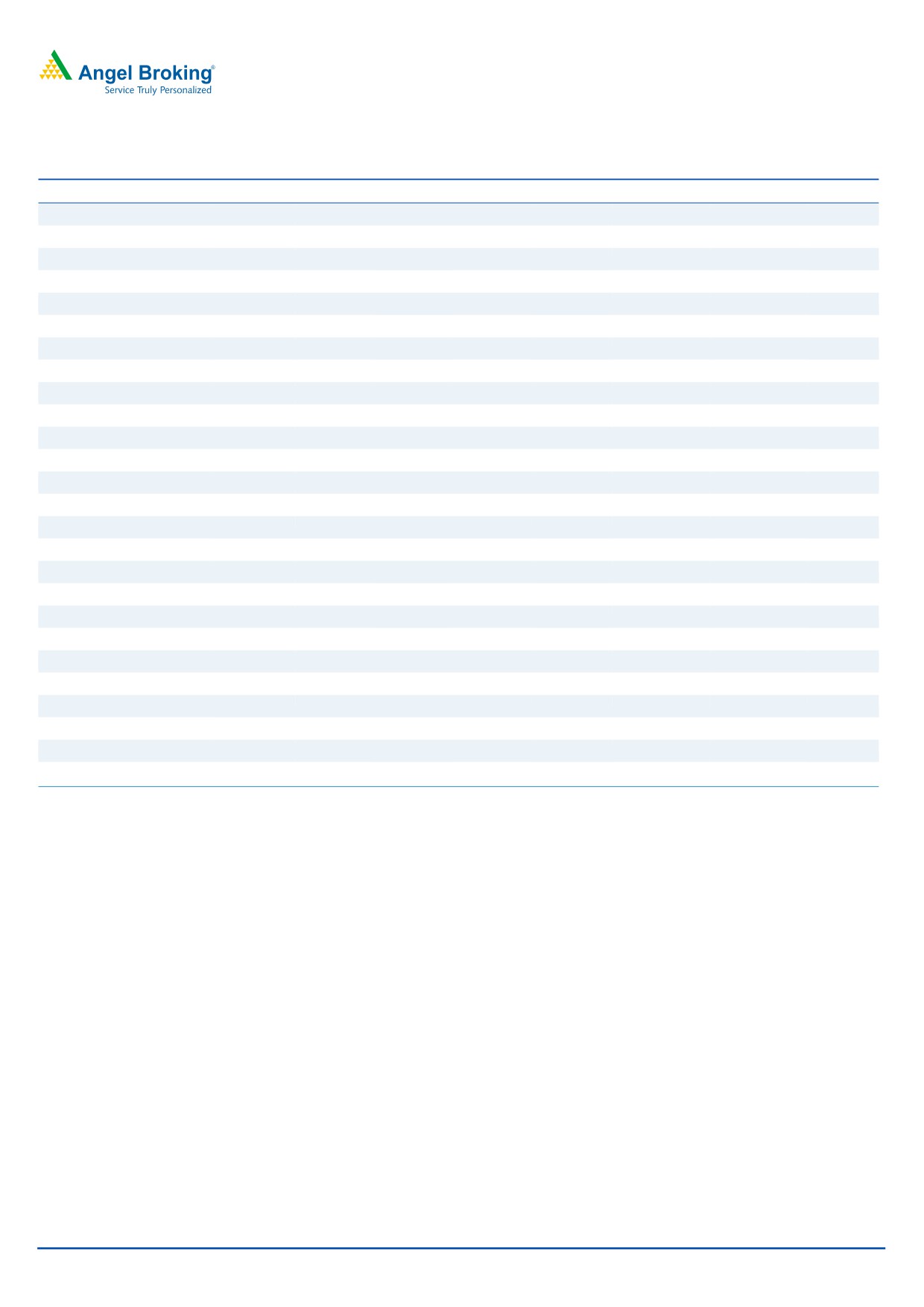

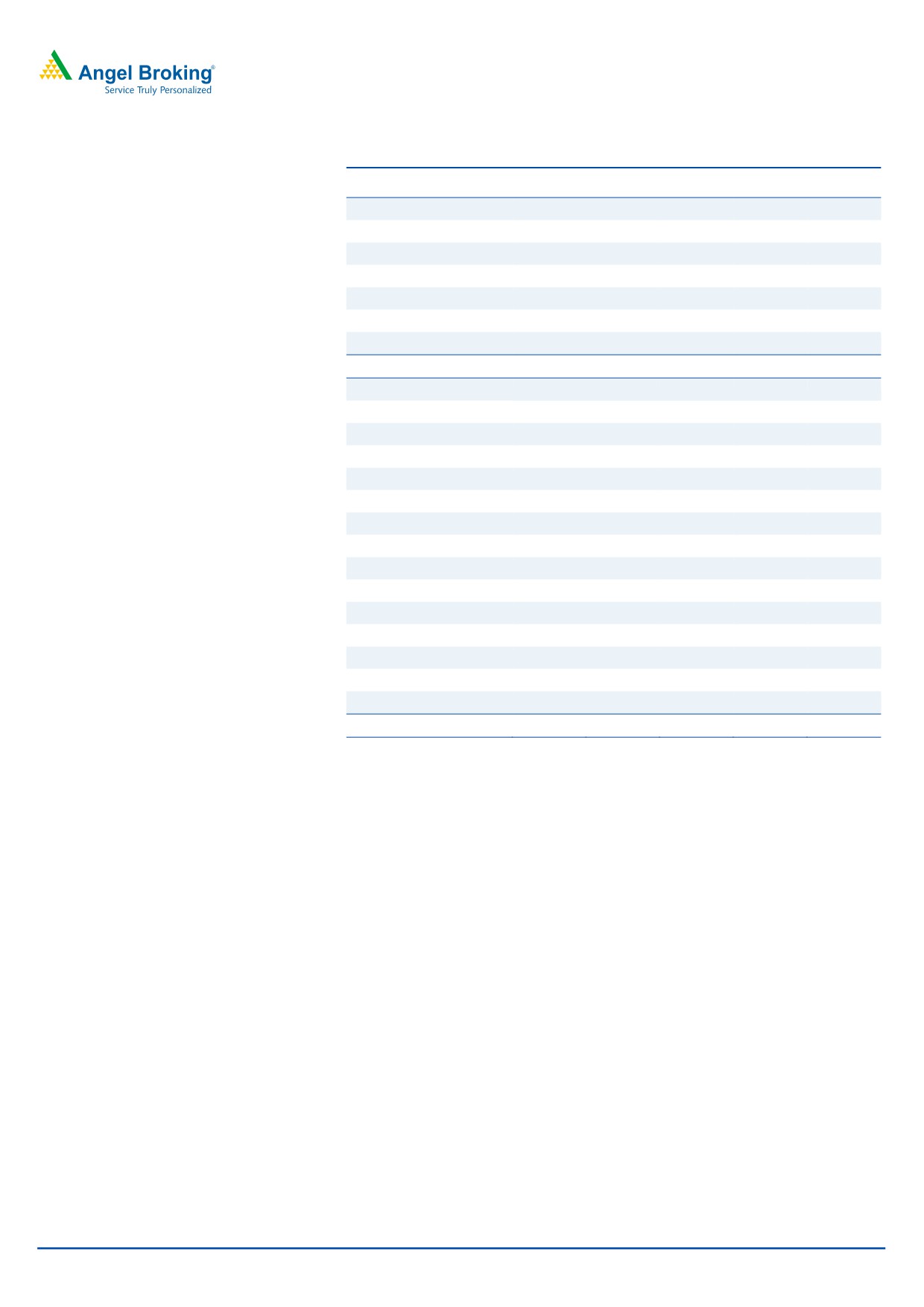

Muted standalone top-line performance

For the quarter, TCIL reported a flat standalone top-line on a yoy basis of

~`556cr, owing to lower growth in Freight, XPS and Supply Chain Solutions

segments. The company’s Freight segment reported a growth of ~1% while the

XPS segment reported a de-growth of ~4% yoy. The Supply Chain Solutions

segment reported a subdued ~2% yoy growth due to slowdown in the automobile

sector (~75% of this segment’s business comes from the automobile sector).

However, TCIL reported a decent revenue growth of ~11% yoy in the Seaways

segment.

Exhibit 2: Top-line growth trend

Exhibit 3: Segment wise revenue trend

8

580

250

211

210

560

6

205

203.6

207.44

190

200

540

4

167

171

169

157

158

160.2

153151

147

151.3

520

2

150

159.5

159.0

500

-

100

480

(2)

50

30

34

36.9

32.0

460

(4)

28

29

2

3

1

1

1.8

2.6

0

1QFY15

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

Standalone Top-line

QoQ growth (%)

Freight

XPS Cargo

Wind Power

Supply Chain

Seaways

Source: Company, Angel Research

Source: Company, Angel Research

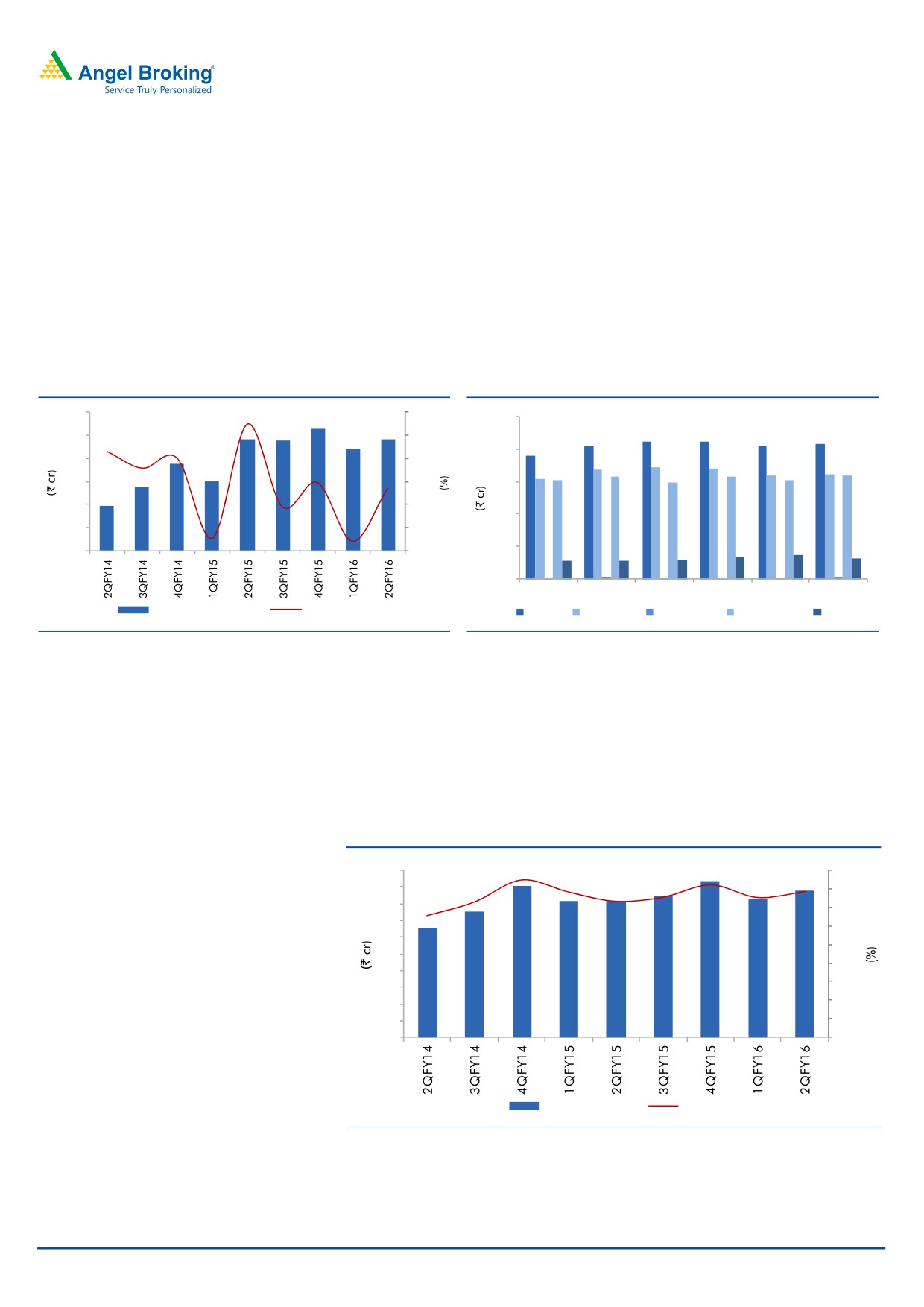

Operating margin expands due to lower operating expenses

For the quarter, the company reported an operating profit of ~`44cr, up ~7% yoy.

Further, the company’s operating margin expanded by 53bp yoy to

7.9%,

primarily on account of lower operating expenses, which declined by 245bp yoy as

a percentage of sales.

Exhibit 4: Operating profit and margin trend

50

9.0

45

8.0

40

7.0

35

6.0

30

5.0

25

4.0

20

3.0

15

2.0

10

5

1.0

0

0.0

Operating Profit

Margin (%)

Source: Company, Angel Research

October 31, 2015

3

Transport Corporation of India | 2QFY2016 Result Update

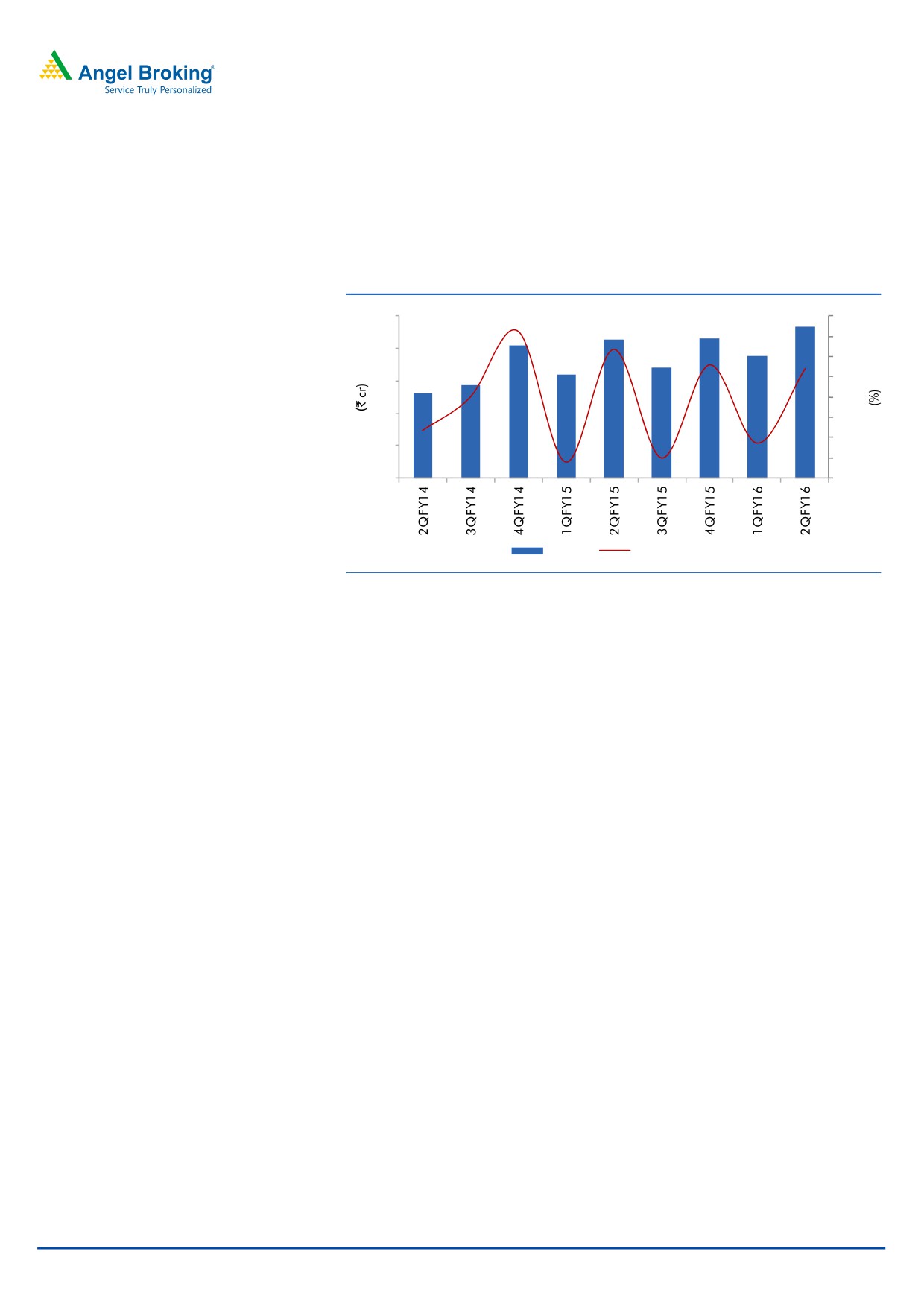

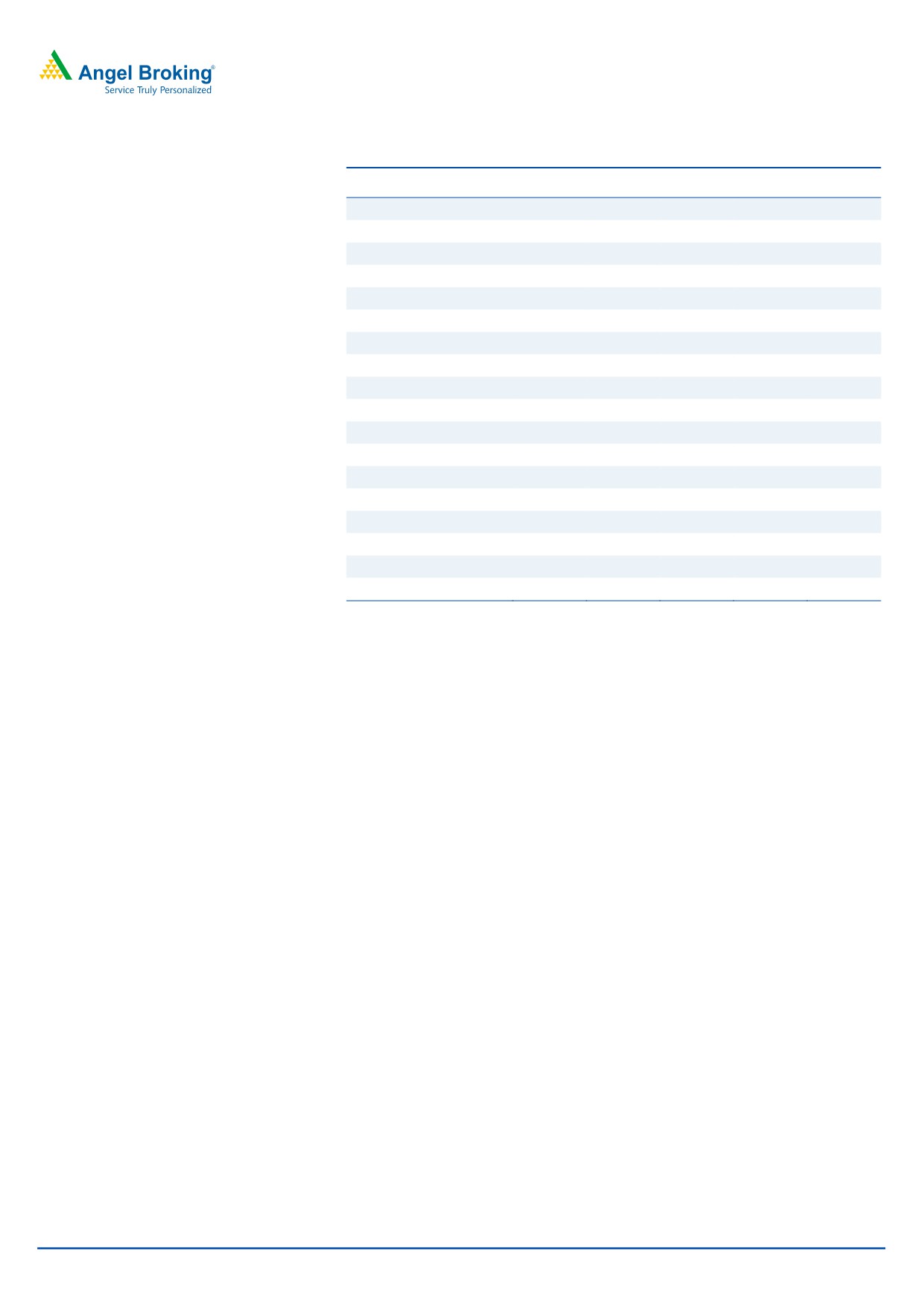

Slight improvement in operating margin and lower interest

costs boost overall PAT

In 2QFY2016, TCIL posted a earnings growth of ~9% yoy to ~`23cr, owing to

operating improvement and lower interest costs.

Exhibit 5: Net Profit and growth trend

25

50

40

20

30

15

20

10

10

-

(10)

5

(20)

0

(30)

PAT

QoQ growth (%)

Source: Company, Angel Research

October 31, 2015

4

Transport Corporation of India | 2QFY2016 Result Update

Investment rationale

Top-line to report 9% CAGR over FY2015-17E on economic

revival; eventual GST implementation would provide further

boost

We expect TCIL to report a healthy top-line growth of

~9% CAGR over

FY2015-17E on the back of revival in the Indian economy. Among TCIL’s four

business segments, we expect the Express segment to report ~12% CAGR. TCIL is

also well-placed to garner e-commerce business, as bulkier categories like

furniture and white goods see more traction in online sales. We expect the Supply

Chain Solutions segment to report a ~11% CAGR owing to recovery in the

automobile sector, growth in e-commerce fulfillment hubs, as well as new

customer wins due to increasing outsourcing of supply chain in other sectors like

FMCG, chemicals, cold storage, etc, especially once GST kicks in. The other two

segments, viz Freight and Seaways, are also likely to benefit from economic revival

and are expected to report ~5% and 13% CAGR respectively.

Stepped-up capex spending in higher margin businesses to aid

overall earnings growth trajectory

As the demand environment improves, we expect margins to improve across

segments for TCIL. Moreover, we expect the company to increase focus on higher

margin businesses like XPS and Supply Chain Solutions. As a result, the revenue

contribution of these businesses is expected to increase from ~56% in FY2014 to

~61% in FY2017E, with the company having aggressive expansion plans in these

businesses (`500cr capex over FY2015-17E). As a result, we expect overall

margins to improve from 8% in FY2015 to 9% in FY2017, thereby driving a

30% CAGR in net profits over the same period.

Well positioned due to its Asset light business model

TCIL operates on an asset light business model where it owns 20% of the total fleet

and leases the remaining 80%. The company has scaled its business model to

7,000 trucks/trailers/reefer vehicles as of today. On the same lines, TCIL has been

prudent in managing warehousing space, as a majority of its total 10mn sq ft of

warehousing space is on lease basis. With its focus to invest less on building the

asset base, the company has been able to generate healthy return ratios even in

the worst phases of business cycles. Given the company’s unlevered business

model, we are of the view that the long-term growth prospects of the company

would not be impacted due to lack of capital availability.

TCIL is one of the few companies in Surface Transportation & Logistics space,

which has consistently enjoyed a healthy asset turnover (FY2015 asset turnover

ratio at 4.8x) and ROE (FY2015 ROE at 13.3%). Given the strong matrices the

company displays, we are confident that TCIL at any phase of the business cycle

would be well positioned compared to its peers, which have levered business

models and have lower ROEs.

October 31, 2015

5

Transport Corporation of India | 2QFY2016 Result Update

Outlook and valuation

TCIL benefits from its pan-India scale, which gives it competitive advantage in

higher margin segments of the logistics industry; as well as from its asset-light

business model which cushions its profitability in cyclical downturns and gives it an

attractive ROE profile. The company is well-placed to be a key beneficiary of the

anticipated implementation of the GST. However, in the last few quarters the

company has not been able report good numbers, both on the top-line and

bottom-line fronts, due to delay in pick-up in economic activities. Hence we are

downgrading our estimates. Currently, we have a NEUTRAL rating on the stock.

Exhibit 6: One-year forward P/E band

600

500

400

300

200

100

0

Share Price

4x

8x

12x

16x

20x

Source: Company, Angel Research

Company Background

Transport Corporation of India Limited (TCI) is an integrated supply chain and

logistics solutions provider. The company operates in six business divisions: TCI

Freight, TCI XPS, TCI Supply Chain Solutions, TCI Seaways, TCI Global and TCI

Foundation. TCI Freight offers multimodal transport solutions for cargo of any

dimension. TCI XPS is a door-to-door express distribution specialist. TCI Supply

Chain Solutions provides supply chain solutions and services right from

conceptualization to implementation. TCI Seaways caters to the costal cargo

requirements for transporting container and bulk cargo from parts on the east

coast of India to Port Blair in the Andaman and Nicobar Islands and further

distribution within the islands. TCI Global provides a single window advantage to

its customers across all South East Asian countries.

October 31, 2015

6

Transport Corporation of India | 2QFY2016 Result Update

Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

Total operating income

2,132

2,228

2,417

2,570

2,851

% chg

9.0

4.5

8.4

6.3

10.9

Total Expenditure

1,957

2,058

2,224

2,357

2,608

Personnel Expenses

112

117

130

146

171

Others Expenses

1,845

1,941

2,093

2,210

2,437

EBITDA

175

170

193

213

242

% chg

10.6

(2.7)

13.6

10.4

13.6

(% of Net Sales)

8.2

7.6

8.0

8.3

8.5

Depreciation & Amortisation

46

47

55

60

69

EBIT

128

123

139

153

174

% chg

10.3

(4.0)

12.5

10.3

13.6

(% of Net Sales)

6.0

5.5

5.7

6.0

6.1

Interest & other Charges

34

31

33

35

37

Other Income

6

7

9

14

16

(% of PBT)

6.3

7.2

7.9

10.6

10.5

Share in profit of Associates

-

-

-

-

-

Recurring PBT

101

99

114

132

153

% chg

18.1

(1.8)

15.2

15.3

15.6

Prior Period & Extra. Exp./(Inc.)

-

-

0

-

-

PBT (reported)

101

99

114

132

153

Tax

32

27

33

38

44

(% of PBT)

31.2

27.7

28.5

29.0

29.0

PAT (reported)

70

72

82

94

108

Add: Share of earnings of asso.

-

-

-

-

-

Less: Minority interest (MI)

0

0

0

0

0

PAT after MI (reported)

70

72

81

93

108

ADJ. PAT

70

72

82

93

108

% chg

16.8

3.0

13.6

14.8

15.7

(% of Net Sales)

3.3

3.2

3.4

3.6

3.8

Basic EPS (`)

9.2

9.5

10.8

12.4

14.3

Fully Diluted EPS (`)

9.2

9.5

10.8

12.4

14.3

% chg

16.8

3.0

13.6

14.8

15.7

October 31, 2015

7

Transport Corporation of India | 2QFY2016 Result Update

Consolidated Balance sheet

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E FY2017E

SOURCES OF FUNDS

Equity Share Capital

15

15

15

15

15

Reserves& Surplus

422

476

601

674

756

Shareholders Funds

437

491

616

689

772

Minority Interest

1

3

3

3

3

Total Loans

354

336

336

366

406

Deferred Tax Liability

32

33

33

33

33

Total Liabilities

824

863

988

1,091

1,213

APPLICATION OF FUNDS

Gross Block

652

693

823

973

1,123

Less: Acc. Depreciation

234

262

316

376

445

Net Block

418

432

507

597

678

Capital Work-in-Progress

5

18

18

18

18

Investments

8

8

7

7

7

Current Assets

534

543

603

640

705

Inventories

2

2

2

2

2

Sundry Debtors

395

380

420

437

476

Cash

46

43

42

63

73

Loans & Advances

67

65

79

77

80

Other Assets

24

53

60

62

74

Current liabilities

141

138

148

171

195

Net Current Assets

393

405

455

469

510

Mis. Exp. not written off

-

-

-

-

-

Total Assets

824

863

988

1,091

1,213

October 31, 2015

8

Transport Corporation of India | 2QFY2016 Result Update

Consolidated Cash flow

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E FY2017E

Profit before tax

101

99

114

132

153

Depreciation

46

47

55

60

69

Change in Working Capital

(46)

15

(51)

8

(31)

Interest / Dividend (Net)

29

25

33

35

37

Direct taxes paid

(26)

(28)

(33)

(38)

(44)

Others

0

0

-

-

-

Cash Flow from Operations

104

158

118

197

183

(Inc.)/ Dec. in Fixed Assets

(55)

(98)

(128)

(150)

(150)

(Inc.)/ Dec. in Investments

(6)

-

1

-

-

Cash Flow from Investing

(61)

(98)

(129)

(150)

(150)

Issue of Equity

1

1

60

-

-

Inc./(Dec.) in loans

13

(19)

-

30

40

Dividend Paid (Incl. Tax)

(8)

(12)

(16)

(21)

(26)

Interest / Dividend (Net)

(35)

(33)

(33)

(35)

(37)

Cash Flow from Financing

(28)

(63)

10

(26)

(23)

Inc./(Dec.) in Cash

15

(3)

(1)

21

10

Opening Cash balances

31

46

43

42

63

Closing Cash balances

46

43

42

63

73

October 31, 2015

9

Transport Corporation of India | 2QFY2016 Result Update

Key Ratios

Y/E March

FY2013

FY2014

FY2015

FY2016E

FY2017E

Valuation Ratio (x)

P/E (on FDEPS)

30.8

29.9

26.3

22.9

19.8

P/CEPS

18.5

18.1

15.7

13.9

12.1

P/BV

4.9

4.4

3.5

3.1

2.8

Dividend yield (%)

0.5

0.6

0.8

1.0

1.2

EV/Sales

1.1

1.1

1.0

0.9

0.9

EV/EBITDA

14.0

14.3

12.6

11.4

10.2

EV / Total Assets

2.5

2.4

2.1

1.9

1.8

Per Share Data (`)

EPS (Basic)

9.2

9.5

10.8

12.4

14.3

EPS (fully diluted)

9.2

9.5

10.8

12.4

14.3

Cash EPS

15.3

15.7

18.0

20.4

23.4

DPS

1.5

1.8

2.2

2.7

3.4

Book Value

57.8

64.9

81.4

91.1

102.0

Returns (%)

ROCE

16.2

14.9

14.6

14.5

14.8

Angel ROIC (Pre-tax)

17.4

15.9

15.4

15.5

15.8

ROE

15.9

14.6

13.2

13.6

14.0

Turnover ratios (x)

Asset Turnover (Gross Block)

5.1

5.2

4.8

4.3

4.2

Inventory / Sales (days)

0

0

0

0

0

Receivables (days)

68

62

63

62

61

Payables (days)

15

13

12

12

12

WC cycle (days)

53

50

52

50

49

Solvency ratios (x)

Net debt to equity

0.7

0.6

0.4

0.5

0.5

Net debt to EBITDA

1.7

1.7

1.3

1.5

1.4

Interest Coverage (EBIT / Int.)

3.8

4.0

4.4

4.8

5.7

October 31, 2015

10

Transport Corporation of India | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Transport Corporation of India

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15%)

October 31, 2015

11