IPO Note | IT

July 8, 2016

L&T InfoTech

SUBSCRIBE

Issue Open: July 11, 2016

IPO Note - Decent upsides

Issue Close: July 13, 2016

L&T InfoTech (LTI) is one of India’s global IT services and solutions companies. In

2015, NASSCOM ranked the company as the sixth largest Indian IT services

Issue Details

company in terms of export revenues. The company is a subsidiary of engineering

Face Value: `1

and construction giant Larsen and Toubro (L&T). L&T holds close to 95% in LTI

Present Eq. Paid up Capital: `16.9cr

and is launching an IPO to offload 10.3% of its stake. Its clients comprise some of

Fresh Issue**: NA

the world’s largest and well-known organisations, including 49 of the Fortune

Global 500 companies.

Offer for sale: 1.75cr Shares

Post Eq. Paid up Capital: `16.9cr

One of the leading mid-tier IT companies: LTI has been one of the leading

players in the IT industry with it having posted a 20.1% CAGR in sales during

Market Lot: 20 Shares

FY2011-2015. A small part of the same was driven by acquisitions that the

Issue (amount): `1,234-1,243cr

company made during the period. Among the acquisitions were Citigroup’s IT

Price Band: `705-710 (Discount of `10 on

platform (acquired in Jan 2011; had revenues of ~`204.8cr) and Otis Elevator

issue price (per equity share) to all

eligible retail applicants)

Co’s IT arm (ISRC) (acquired in Oct 2014; had revenues of ~`56.5cr). In USD

Post-issue implied mkt. cap `12,056cr*-

terms, LTI outperformed the industry by posting a 12.1% CAGR in sales as against

12,141cr**

an 11.2% sales CAGR posted by the Indian IT industry during FY2011-2015.

Note:*at Lower price band and **Upper price band

Good capital allocation: LTI generates a healthy RoE of ~40% compared to the

peer group’s average of ~30%. This is mainly because the company holds a

Book Building

relatively low amount of cash on its books vis-a-vis its peers by following an

QIBs

50%

aggressive dividend policy. LTI has had a dividend pay-out ratio as high as ~75%

over the last five years, while the commensurate figure for its peers stood at 30-50%

Non-Institutional

15%

over the same period. On capital invested basis also, the company earns a ROIC of

Retail

35%

around 46%, again outperforming its mid-cap peers, which earn ~35-40%.

Outlook and Valuation: LTI has reported a strong CAGR of 20.1% and 23.1% on

Post Issue Shareholding Pattern(%)

the revenue and net profit fronts respectively over FY2011-2015. At `710, which

Promoters Group

84.6

is the upper end of the offer price band, the company is available at ~13x its

FY2016E earnings, which is at a slight discount to its mid-cap peers trading at an

MF/Banks/Indian

FIs/FIIs/Public & Others

15.4

average PE of ~15x FY2016E earnings. Plus, assuming that the company

maintains its historical average rate of dividend payouts, it would translate into a yield

of 4-5% for the investor. Apart from the favorable prospects of the company, we also

foresee decent gains on listing. Thus, we recommend a SUBSCRIBE to the issue.

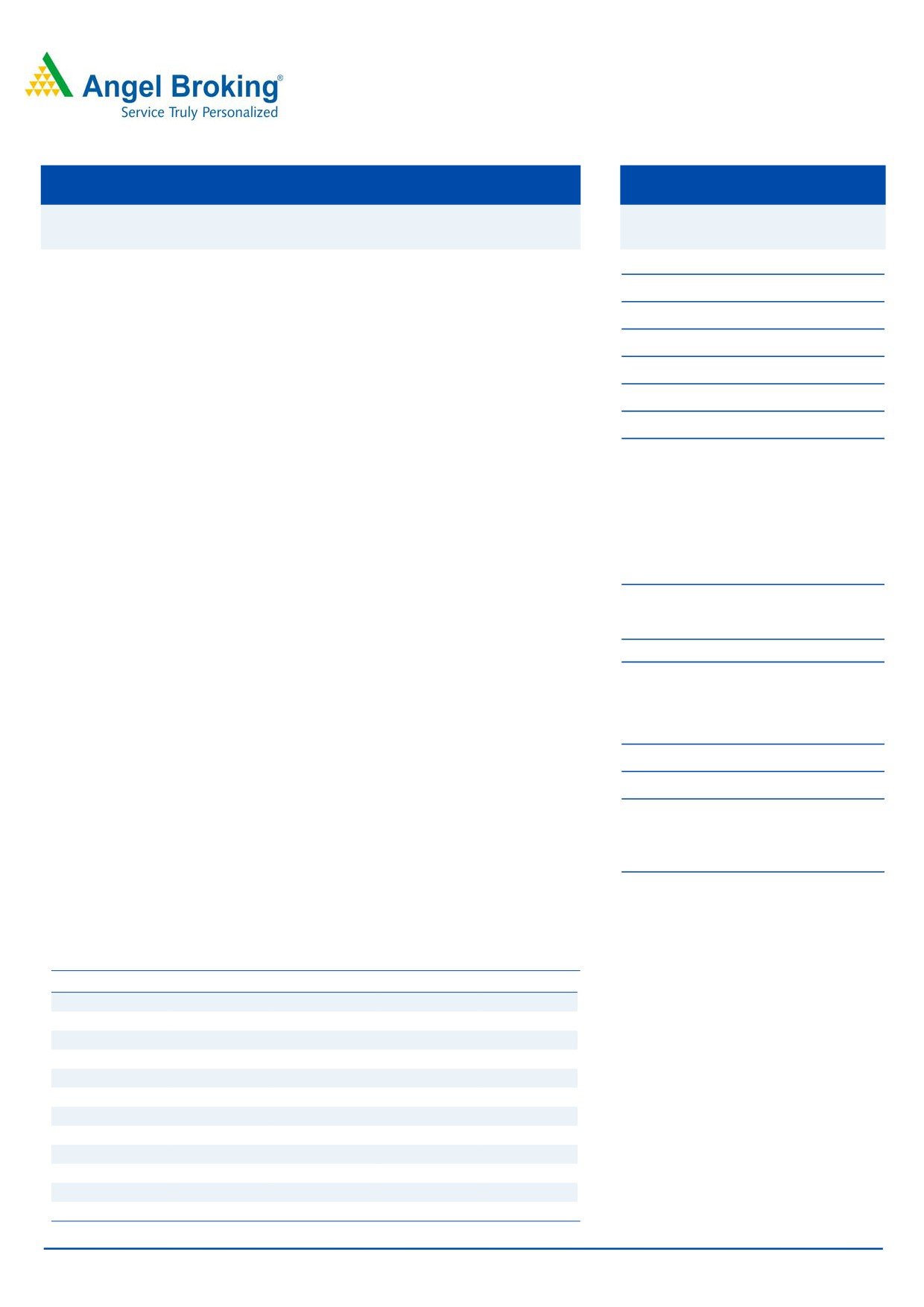

Key Financials

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

Net Sales

3,182

3,851

4,920

4,978

% chg

33.1

21.0

27.8

1.2

Net Profit

433

574

689

761

% chg

30.9

32.5

20.0

10.5

EPS (`)

26.8

35.5

42.6

47.1

EBITDA Margin (%)

21.7

22.6

23.3

20.2

P/E (x)

26.5

20.0

16.7

15.1

RoE (%)

38.7

47.0

46.7

41.9

RoCE (%)

42.8

49.0

57.6

39.8

P/BV (x)

10.4

8.6

7.1

5.7

Sarabjit Kour Nangra

EV/Sales (x)

3.6

3.0

2.3

2.3

+91 22 3935 7800 Ext: 6806

EV/EBITDA (x)

16.6

13.1

9.9

11.3

Source: Company, Angel Research; Note: The valuations are on the higher price band

Please refer to important disclosures at the end of this report

1

L&T InfoTech | IPO Note

Company background

Incorporated in 1996, L&T InfoTech (LTI) is a Mumbai-based ~100% owned

subsidiary of the L&T group that provides information technology services to clients

primarily based in US and Europe. Post the IPO, the L&T group’s stake in the

company will come down to 84.5%. As of June 30, 2015, the company had a

network of 22 delivery centers and 42 sales offices globally. It employed ~19,500

people as of March 2015.

LTI is one of India’s global IT services and solutions companies. In

2015,

NASSCOM ranked the company as the sixth largest Indian IT services company in

terms of export revenues. Its clients comprise some of the world’s largest and well-

known organizations, including 43 of the Fortune Global 500 companies.

The company’s growth has been marked by significant expansion of business

verticals and geographies. For FY2015, the percentage of its revenue from

continuing operations from North America, Europe, Asia Pacific and the rest of the

world amounted to 68.6%, 17.9%, 2.4% and 6.9%, respectively.

In terms of services, LTI derives a large proportion of its revenues from providing

Application Development and Maintenance (43.4% of FY2015 revenues) and

Enterprise Solutions (24.8% of FY2015 revenues). The fast growing digital business

accounts for 9.5% of its FY2015 revenues. The company has a modest presence in

Infrastructure Management Services (8.7% of FY2015 revenues) and aims to grow

further in this segment through the inorganic route.

In terms of verticals, the banking, financial services and insurance (BFSI) is LTI’s

largest industry vertical accounting for 47% of its FY2015 revenue. The company

also has the highest exposure among peers to the energy segment which

constituted 16.2% of its FY2015 revenues.

Issue details

The objects of the Offer are to achieve the benefits of listing the equity shares on

the stock exchanges and to carry out the sale of up to ~17,500,000 equity shares

by the existing shareholder. LTI will not receive any proceeds from the offer and

the company will not receive any proceeds from the issue.

Exhibit 1: Shareholding pattern

Particulars

Pre-Issue

Post-Issue

No. of shares

(%)

No. of shares

(%)

Promoter group

16,120,812

94.94

14,371,872

84.64

Others

8,59,188

5.06

26,08,128

15.36

Total

16,980,000

100.0

16,980,000

100.0

Source: Company, Angel Research

July 8, 2016

2

L&T InfoTech | IPO Note

Industry

According to a recent report released by NASSCOM, Indian IT’s (US$132bn) share

in the country’s total service exports is estimated at over 45% and the industry’s

contribution relative to India’s GDP is over 9.3%. Overall, the industry is estimated

to employ nearly 3.7mn people going forward, implying an addition of ~200,000

people from the current numbers. The industry’s share in the global sourcing

arena was ~56% in 2015. In 2015, a turbulent economic environment, volatility in

currency, and technological shifts impacted global IT spend, which grew by a

meager 0.4% to US$1.2trn. Unlike global spending, global sourcing continued its

growth journey, posting an 8.5% growth in 2015 to an estimated US$162-166bn.

India’s IT-BPM sector’s total revenue is projected to reach US$350bn by 2025, ie a

CAGR of 10.5%.

Key investment rational

One of the leading mid-tier IT companies

LTI has been one of the leading players in the IT industry, with it having posted a

CAGR of 20.1% in sales during FY2011-2015. A small part of the same was

driven by acquisitions that the company made during the period. Among the

acquisitions were Citigroup’s IT platform (acquired in Jan 2011; had revenues of

~`204.8cr) and Otis Elevator Co’s IT arm (ISRC) (acquired in Oct 2014; had

revenues of ~`56.5cr). In USD terms, LTI outperformed the industry by posting a

12.1% CAGR in sales as against an 11.2% sales CAGR posted by the Indian IT

industry during FY2011-2015.

A detailed analysis of the company’s client concentration reveals that its growth is

getting broad-based but at a slower pace. For FY2015 the top client of the

company accounted for 14.1% of sales and posted a CAGR of 12.2% during

FY2013-16, while the top-5 of its clients accounted for 37.2% of sales and posted

a CAGR of 13.2%. Further, its top-10 clients accounted for 50.5% of sales in

FY2015 and posted a CAGR of 17.4% during FY2013-16. Excluding the top-10

clients the company has posted a CAGR of 10.9% during the same period. Thus,

the top-10 clients contribute substantially to the company’s growth. This is also

evident from the fact that new business has been around only ~2% of its sales.

In terms of industry mix the BFSI segment contributed 38% of its sales in FY2015

which is significant but in line with the trend followed by its peers; the BSFI industry

is expected to contribute ~41% of the overall IT industry’s revenues in FY2016. LTI

also has the highest exposure among peers to the energy segment which

accounted for 16.2% of its FY2015 revenues, where Chevron is its second biggest

client contributing 7% of its revenues. This is in contrast to its peers where the

energy segment contributes by a far lesser proportion to the overall revenues.

Wipro is far next in terms of highest exposure to the energy segment with only

~6-7% of its revenues coming from the segment in FY2015. Whilst exposure to

energy will weigh on LTI’s growth in the near term, the company could likely boost

revenue growth in the long term and emerge as a stronger player with a higher

market share.

On the operating front, with margins (EBDITA) at ~21%, the company is in line

with its mid-cap peers in terms of productivity per employee.

July 8, 2016

3

L&T InfoTech | IPO Note

Better capital allocation: LTI generates a healthy RoE of ~40% compared to the

peer group’s average of ~30%. This is mainly because the company holds a

relatively low amount of cash on its books vis-a-vis its peers by following an

aggressive dividend policy. LTI has had a dividend pay-out ratio as high as ~75%

over the last five years, while the commensurate figure for its peers stood at

30-50% over the same period. The total assets turnover ratio is helped by low cash

on the balance sheet as a result of which the company’s total assets figure is not

high as is the case of many of its peers. This is prudent given that the cash on book

if unutilized could dilute the ROE. On capital invested basis also the company

earns a ROIC of around 46%, which is better than ~35-40% earned by its mid-cap

peers, and is also better than that of some of its large cap peers like Wipro and

Tech Mahindra.

Valuation

LTI, the sixth largest IT company in India, has a solid parentage of L&T, and has an

experienced Management and a strong business model. LTI has reported a strong

CAGR of 20.1% and 23.1% on the revenue and net profit fronts respectively over

FY2011-2015. At `710, which is the upper end of the offer price band, the

company is available at ~13x its FY2016E earnings, which is at a slight discount

to its mid-cap peers trading at an average PE of ~15x FY2016E earnings. Plus,

assuming that the company maintains its historical average rate of dividend

payouts, it would translate into a yield of 4-5% for the investor. We believe that the

valuations are bit attractive in spite of the concerns related to the company’s

business risk like client concentration and employee productivity. Also, retail

investors are being offered a discount of `10/share on the offer price and we

foresee a fair likelihood of decent gains on listing. Thus, we recommend a

SUBSCRIBE to the issue.

July 8, 2016

4

L&T InfoTech | IPO Note

Risks to upside

Like other IT companies, LTI has high dependence on USA and is hence

exposed to the economic risks of the geography.

Its largest client (Citigroup is LTI’s largest customer since 2001) accounted for

~14.1% of its revenues in FY2015, which is higher than its comparable large

cap peers. Another client, Chevron, contributed ~7.0% of its FY2015 sales. In

BSFI, Barclays contributed 3.4% of sales in FY2015. Thus the company is

exposed to client concentration risk.

Also, its top 5 clients contributed ~ 37.2% of its sales in FY2015, which is high

in comparison to its large cap peers. This is also evident from the fact that the

company gets almost 97-98% of its sales from the repeat business (unlike its

peers which have a higher new business share of ~3-5% V/s 2.5% for LTI).

Given the export nature of the company’s business, it is exposed to currency

risk.

Inability to address senior Management attrition could affect performance of

the business. The attrition rate of the company has been around 19% (LTM

March 2015).

Lack of diversification in terms of business verticals (BSFI and Energy segments

accounted for 63.2% of its FY2015 revenues) can impact the company’s

performance as it did in FY2015. The possibility of LTI losing out on business

from large BFSI and energy clients due to vendor consolidation cannot be

ruled out.

LTI has historically availed to direct and indirect tax benefits given by the

government for the export of IT services from SEZs. As a result, a substantial

portion of its profits are exempt from income tax, thus leading to a lower

overall effective tax rate. If there is a change in tax regulations, then LTI’s tax

liabilities may increase and thus adversely affect its financial position.

LTI runs an active ESOP programme pertaining to which there are vested and

unexercised stock options owned by its current and former employees. As per

the company’s DRHP, a total of 1.12cr shares will have to be issued if all the

options that were granted were to be exercised. This represents 6.6% dilution;

in case all ESOP are exercised at one go.

July 8, 2016

5

L&T InfoTech | IPO Note

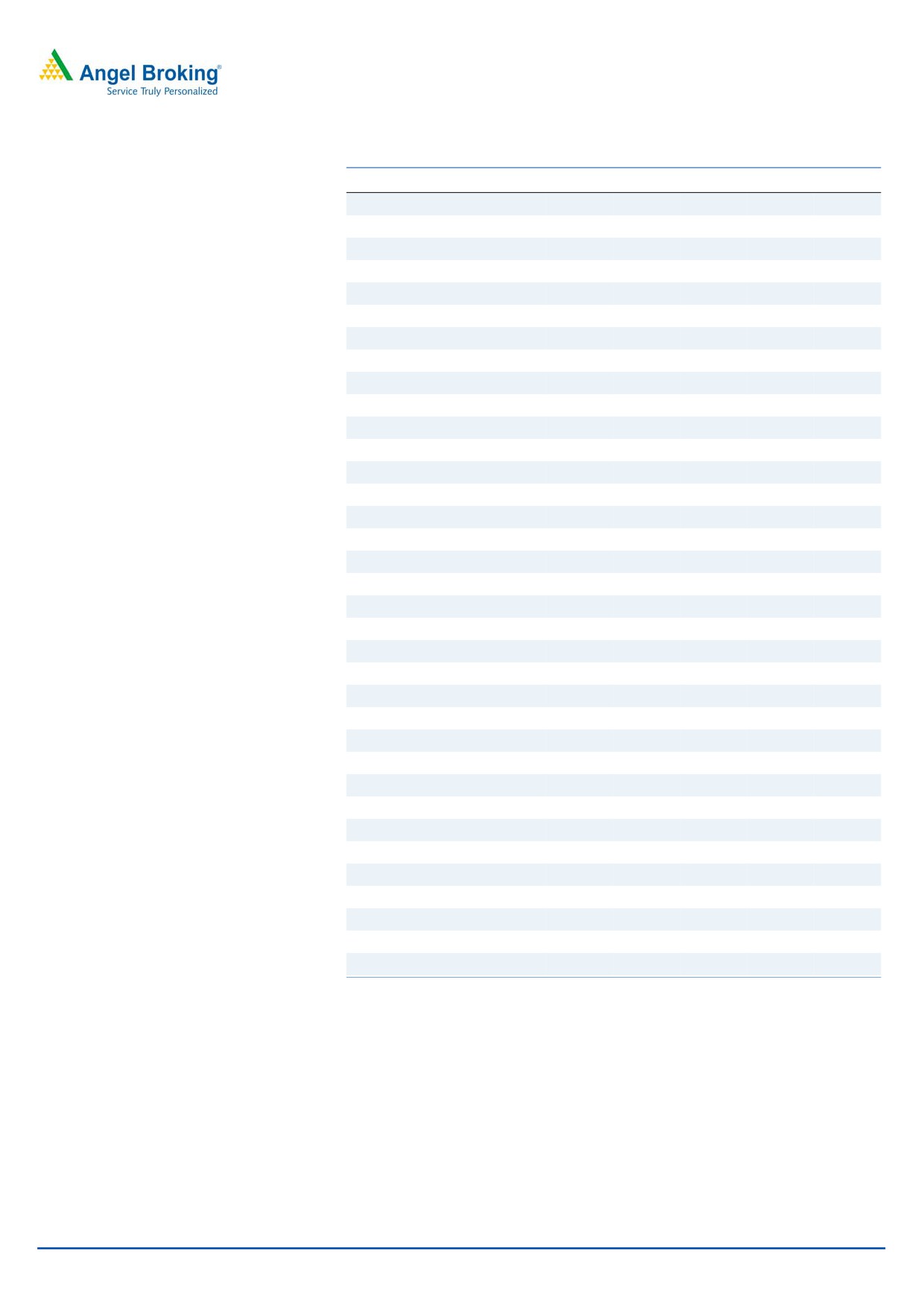

Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2011

FY2012

FY2013

FY2014

FY2015

Gross sales

2,391

3,182

3,851

4,920

4,978

Less: Excise duty

-

-

-

-

-

Net sales

2,391

3,182

3,851

4,920

4,978

Other operating income

71.5

9.6

22.1

(83.3)

91.5

Total operating income

2,463

3,192

3,874

4,837

5,070

% chg

44.2

29.6

21.4

24.9

4.8

Total expenditure

1,997

2,492

2,981

3,773

3,974

Employee Expenses

1,449

1,864

2,249

2,758

2,924

Operating Expenses

222

258

292

489

489

Sales, Admin and other Exp.

327

371

440

526

561

EBITDA

394

690

870

1,147

1,004

% chg

75.2

26.2

31.8

(12.4)

(% of Net Sales)

16.5

21.7

22.6

23.3

20.2

Depreciation& amortisation

81

105

123

130

158

Interest & other charges

10

34

21

31

10

Other income

-

-

-

-

-

(% of PBT)

-

-

-

-

-

Share in profit of Associates

-

-

-

-

-

Recurring PBT

375

560

749

903

928

% chg

Extraordinary expense/(Inc.)

-

-

-

(300)

(8)

PBT (reported)

375

560

749

1,204

936

Tax

58.7

140.9

187.0

207.2

166.8

(% of PBT)

32.0

30.6

32.7

32.0

17.8

PAT (reported)

316

419

562

997

769

Add: Share of earnings of asso.

-

-

-

-

-

Less: Minority interest (MI)

-

-

0

0

0

Prior period items

15

14

12

(68)

1

PAT after MI (reported)

331

433

574

929

769

ADJ. PAT

331

433

574

689

761

% chg

53.5

30.9

32.5

20.0

10.5

(% of Net Sales)

13.8

13.6

14.9

18.9

15.5

Basic EPS (`)

20.5

26.8

35.5

42.6

47.1

Fully Diluted EPS (`)

20.5

26.8

35.5

42.6

47.1

% chg

53.5

30.9

32.5

20.0

10.5

July 8, 2016

6

L&T InfoTech | IPO Note

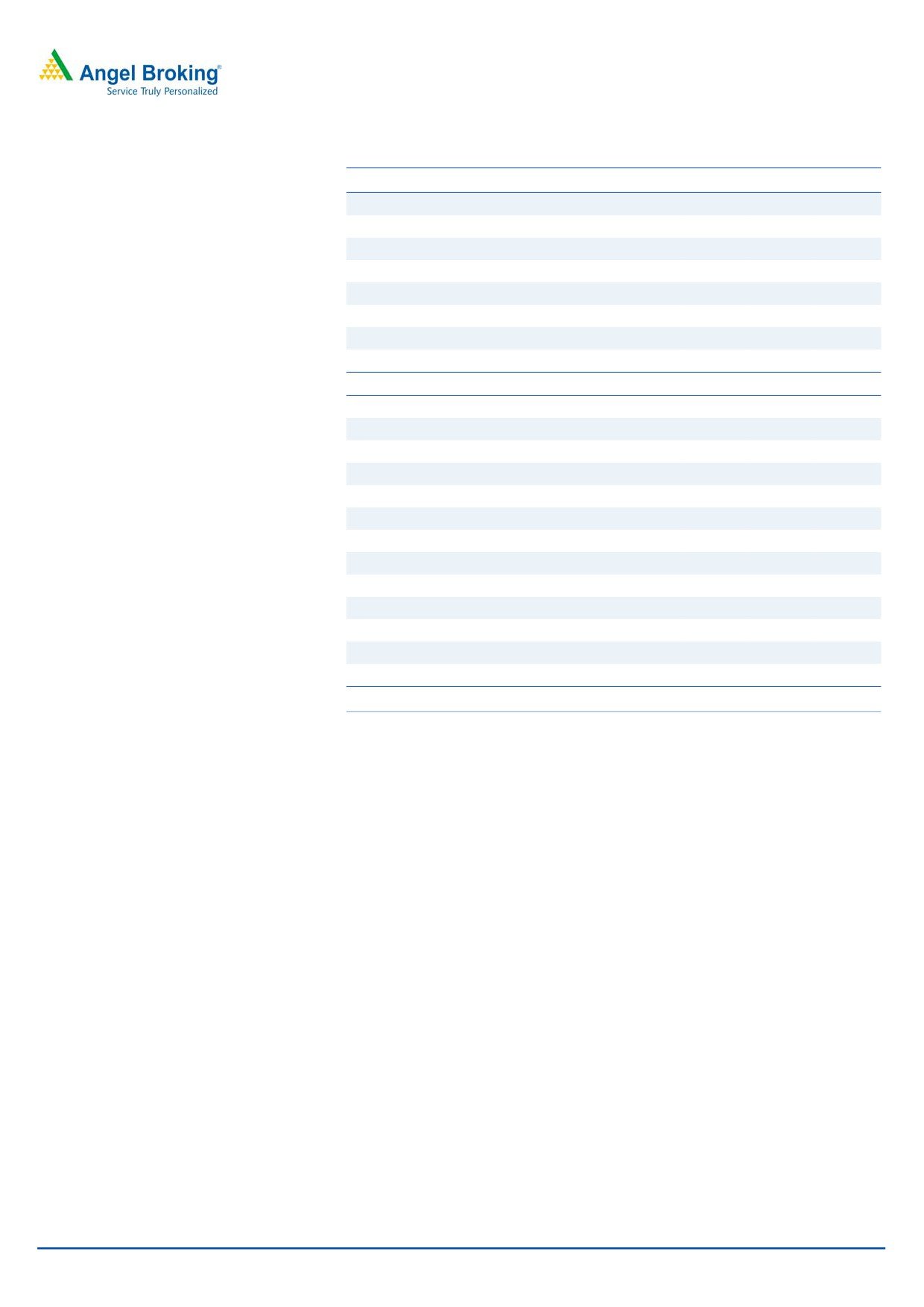

Consolidated Balance Sheet

Y/E March (` cr)

FY2011

FY2012

FY2013

FY2014

FY2015

SOURCES OF FUNDS

Equity share capital

16

16

16

16

16

Preference Capital

-

-

-

-

-

Reserves & surplus

1,120

1,089

1,323

1,594

2,010

Shareholders funds

1,136

1,105

1,339

1,610

2,026

Minority Interest

-

-

0.1

0.2

0.4

Total loans

113

253

171

113

56

Deferred tax liability

(31)

10

15

41

45

Total liabilities

1,218

1,368

1,525

1,765

2,127

APPLICATION OF FUNDS

Net block

523

632

699

649

683

Capital work-in-progress

8

10

48

9

5

Goodwill

68

98

94

47

20

Long Term Loans and Advances

179

137

193

253

244

Investments

6.0

2.0

-

-

-

Current assets

1,153

1,247

1,325

1,741

2,104

Cash

146

132

119

159

201

Loans & advances

259

284

283

363

555

Other

747

831

923

1,219

1,348

Current liabilities

720

758

835

936

929

Net current assets

433

489

490

805

1,175

Mis. Exp. not written off

-

-

-

-

-

Total Assets

1,218

1,368

1,525

1,765

2,127

July 8, 2016

7

L&T InfoTech | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

July 8, 2016

8