2QFY2017 Result Update | Pharmaceutical

November 9, 2016

GlaxoSmithKline Pharmaceuticals

NEUTRAL

CMP

`2,719

Performance Highlights

Target Price

-

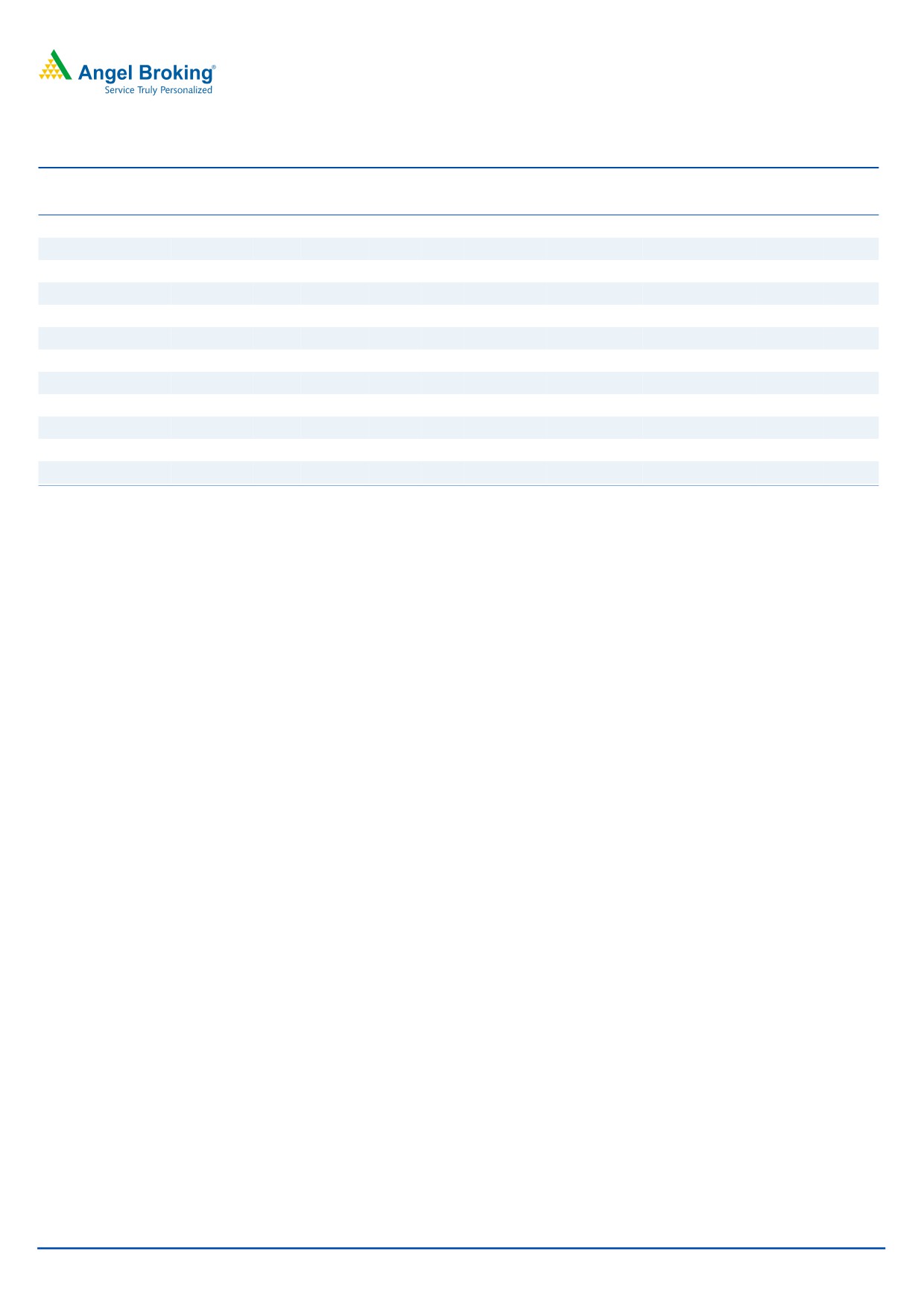

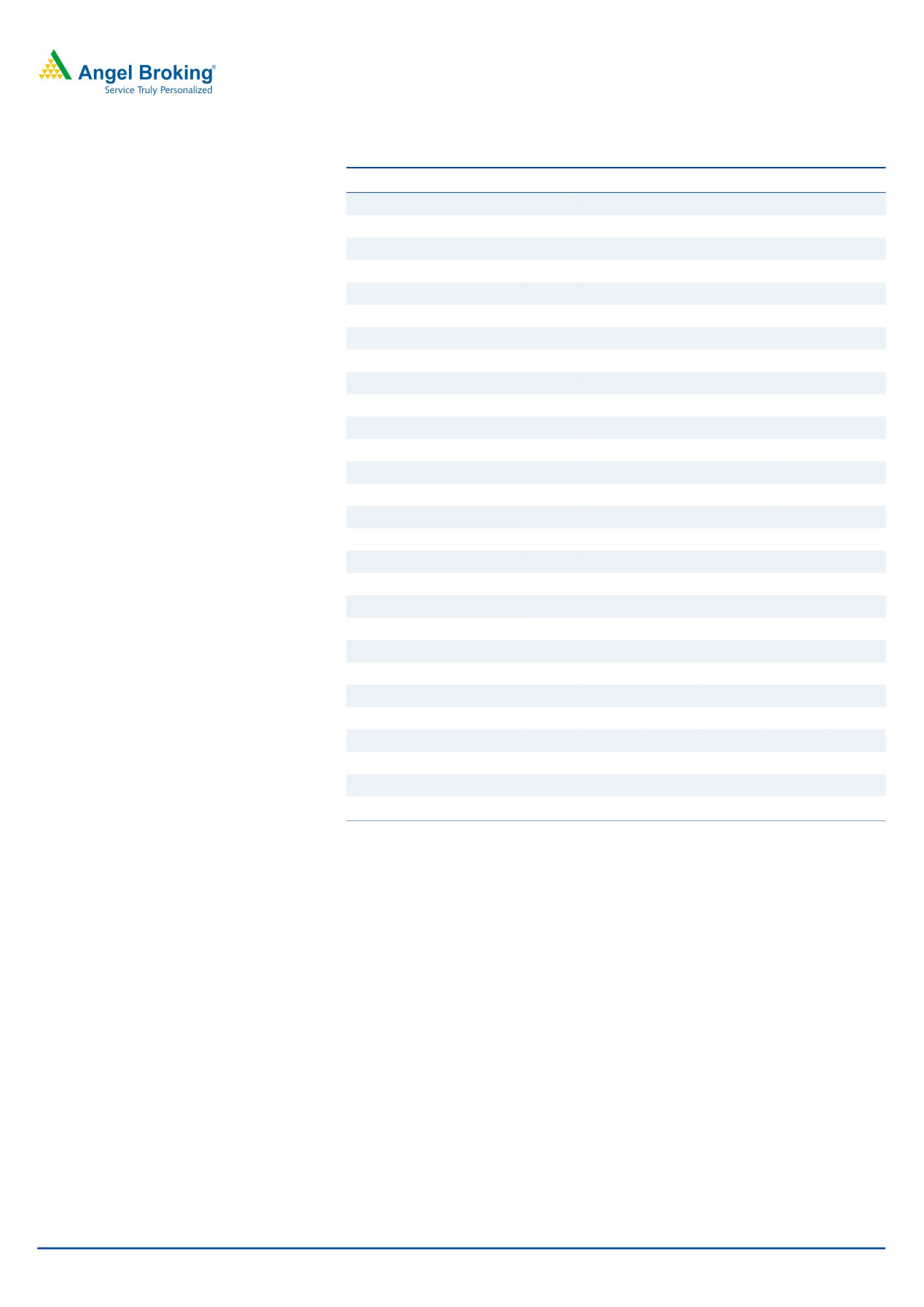

Y/E Mar (` cr)

2QFY2017 1QFY2017

% chg (QoQ) 2QFY2016

% chg (YoY)

Investment Period

-

Net Sales

783

685

14.3

700

11.8

Stock Info

Other income

34

44

(22.2)

40

(14.2)

Sector

Pharmaceutical

Gross profit

421

371

13.6

390

8.0

Market Cap (`

cr)

23,030

Operating profit

124

70

77.2bp

121

3.3bp

Net Debt (` cr)

(1,055)

Adj. PAT

98

71

37.6

101

(2.9)

Beta

0.43

Source: Company, Angel Research

52 Week High / Low

3,850/2,710

Avg. Daily Volume

1,838

For 2QFY2017, sales stood at `783cr vs. `700cr expected and vs. `700cr in

Face Value (`)

10

2QFY2016, a yoy growth of 11.8%. On the operating front, the OPM came in at

BSE Sensex

27,591

15.9% vs. 17.2% in 2QFY2016 and vs. 17.0% expected. The company’s OPM

Nifty

8,544

was impacted by other expenses, which grew by 40.5% yoy. Thus, the company

Reuters Code

GLAX.BO

posted an Adj. net profit of `98cr vs. `101cr in 2QFY2016, a yoy de-growth of

Bloomberg Code

GLXO@IN

2.9%. We maintain our Neutral rating on the stock.

Results below expectations: For 2QFY2017, sales stood at `783cr vs. `700cr

Shareholding Pattern (%)

expected and vs. `700cr in 2QFY2016, a yoy growth of 11.8%. On the

Promoters

75.0

operating front, the OPM came in at 15.9% vs. 17.2% in 2QFY2016 and vs.

MF / Banks / Indian Fls

10.5

17.0% expected. The company’s OPM was impacted by other expenses, which

FII / NRIs / OCBs

2.4

grew by 40.5% yoy. Thus, the company posted an Adj. net profit of `98cr vs.

Indian Public / Others

12.1

`101cr in 2QFY2016, a yoy de-growth of 2.9%.

Outlook and valuation: Company has a strong balance sheet with cash of

Abs. (%)

3m 1yr

3yr

~`2,000cr, which could be used for future acquisitions or higher dividend pay

Sensex

(2.1)

5.0

33.5

outs. On the operational front, we expect the company’s net sales to post a

Glaxo

(12.7)

(14.8)

9.6

CAGR of 9.9% to `3,312cr and EPS to register a mere CAGR of 17.3% to `60.8

over FY2016-18E. We remain Neutral on the stock.

3-year price chart

Key financials (Consolidated)

4,000

Y/E Mar (` cr)

FY2015*

FY2016

FY2017E

FY2018E

3,500

Net sales

3,272

2,741

3,000

3,312

3,000

% chg

28.9

(16.2)

9.4

10.4

2,500

Net profit

509

374

394

515

2,000

% chg

9.8

(26.5)

5.2

30.9

1,500

EPS (`)

60.1

44.2

46.5

60.8

EBITDA (%)

17.8

16.5

15.4

20.6

P/E (x)

Source: Company, Angel Research

45.2

61.5

58.5

44.7

RoE (%)

26.7

21.2

23.9

32.1

RoCE (%)

26.7

21.7

22.8

34.6

P/BV (x)

12.6

13.6

14.4

14.3

Sarabjit Kour Nangra

EV/Sales (x)

6.5

7.9

7.3

6.7

+91 22 39357800 Ext: 6806

EV/EBITDA (x)

36.3

48.0

47.4

32.4

Source: Company, Angel Research; Note: CMP as of November 8, 2016; * 15 months numbers

Please refer to important disclosures at the end of this report

1

Glaxo Pharma | 2QFY2017 Result Update

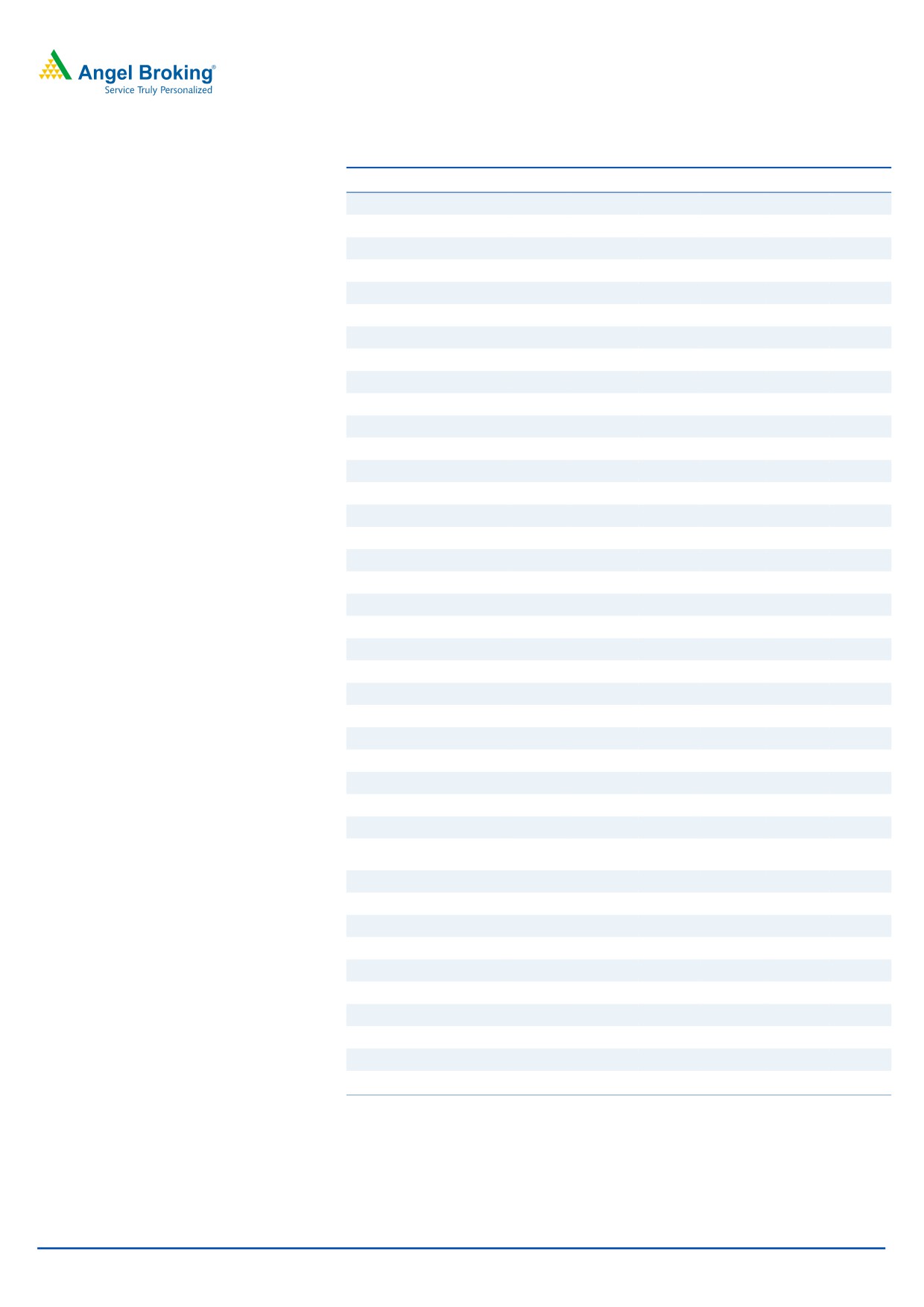

Exhibit 1: 2QFY2017 - Standalone performance

Y/E March (` cr)

2QFY2017

1QFY2017

% chg (QoQ) 2QFY2016

% chg (YoY) 1HFY2017 1HFY2016

% chg

Net Sales

783

685

14.3

700

11.8

1,468

1,334

10.0

Other income

34

44

(22.2)

40

(14.2)

78

86

(8.7)

Total Income

817

729

12.0

740

10.4

1,547

1,420

8.9

Gross profit

421

371

13.6

390

8.0

792

732

8.2

Gross margin

53.8

54.1

55.7

54.0

54.9

Operating profit

124

70

77.2

121

3.3

195

224

(13.1)

Operating margin (%)

15.9

10.2

17.2

13.3

16.8

Interest

0

0

-

0

-

0

0

-

Depreciation & Amortization

7

5

22.5

5

22.5

12

10

19.5

PBT & Exceptional Items

152

109

39.7

155

(1.9)

261

300

(12.9)

Less : Exceptional Items

2

2

-

(8)

-

3

(10)

Profit before tax

154

111

38.8

147

4.6

265

290

(8.7)

Provision for taxation

54

39

38.9

51

5.0

92

100

(7.9)

Reported PAT

99

72

36.8

96

3.5

171

190

(9.7)

Adj. Net profit

98

71

37.6

101

(2.9)

170

196

(13.5)

EPS (`)

11.5

8.4

11.9

20.1

23.2

Source: Company, Angel Research, Note- Full year numbers are consolidated numbers

Exhibit 2: 2QFY2017 - Actual Vs Angel estimates

(` cr)

Actual

Estimates

Variation (%)

Net sales

783

700

11.8

Other income

34

44

(22.2)

Operating profit

124

119

4.6

Tax

54

54

(0.2)

Adj. net profit

98

102

(4.3)

Source: Company, Angel Research

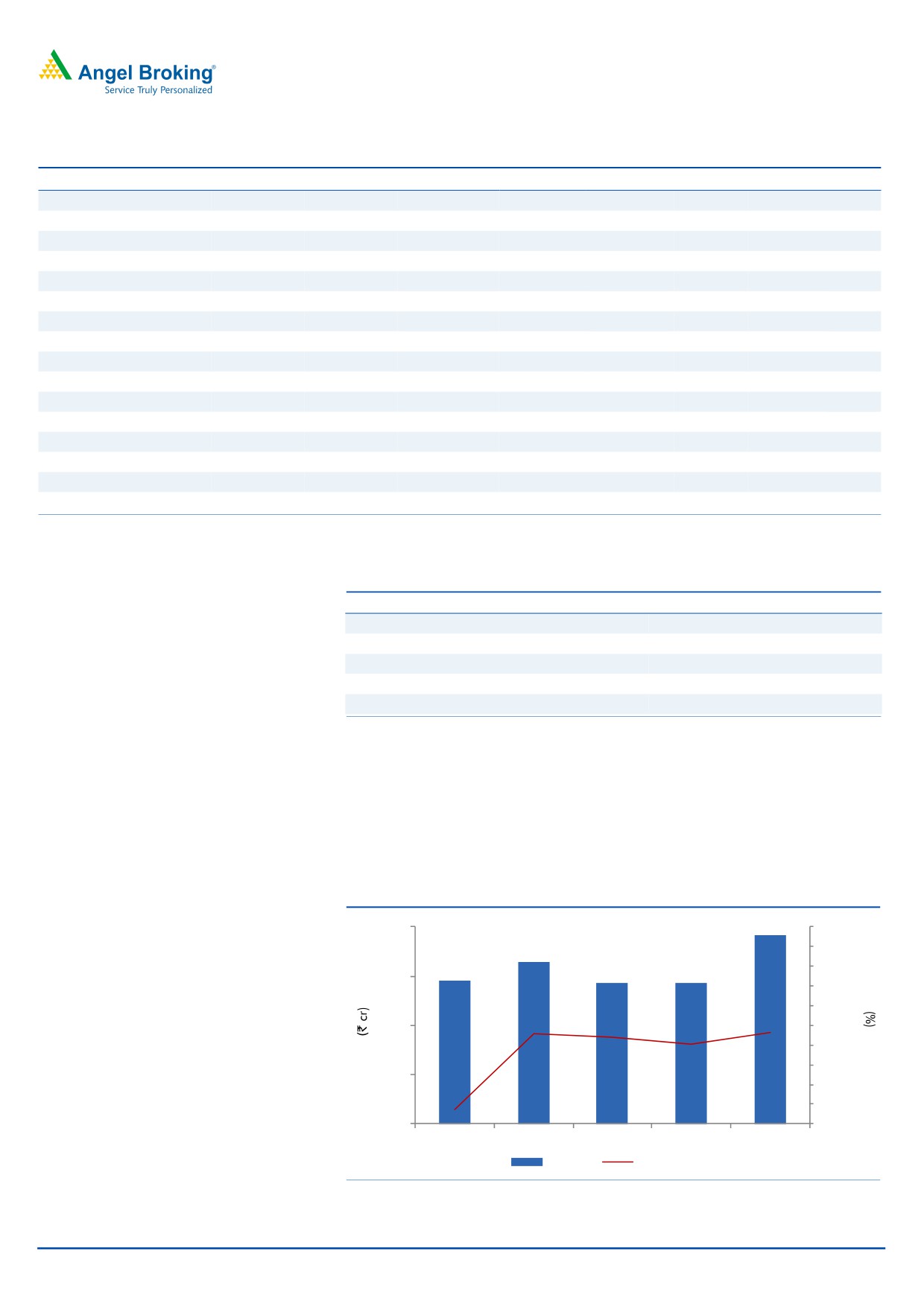

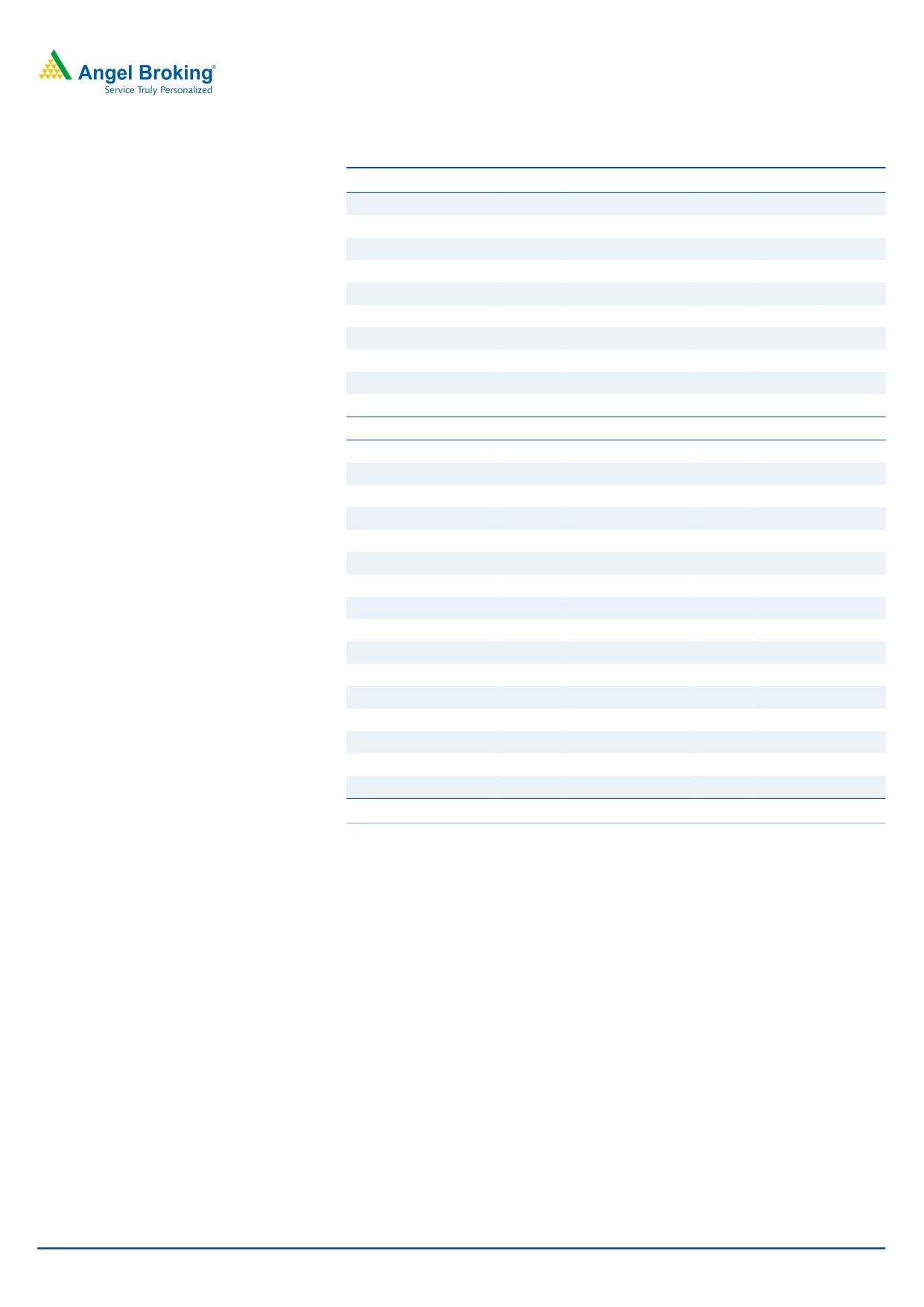

Revenue grew by 11.8%

Sales grew 11.8% yoy to `783cr (vs. `700cr expected). The growth was primarily

driven by 16% volume increase. The volume growth was partially moderated due

to the impact of NLEM related mandatory price cuts.

Exhibit 3: Sales trend

800

783

40.0

729

35.0

692

686

685

30.0

700

25.0

20.0

600

15.0

10.0

5.0

500

0.0

(5.0)

400

(10.0)

2QFY2016

3QFY2016

4QFY2016

1QFY2017

2QFY2017

Sales

Growth (YoY)

Source: Company, Angel Research

November 9, 2016

2

Glaxo Pharma | 2QFY2017 Result Update

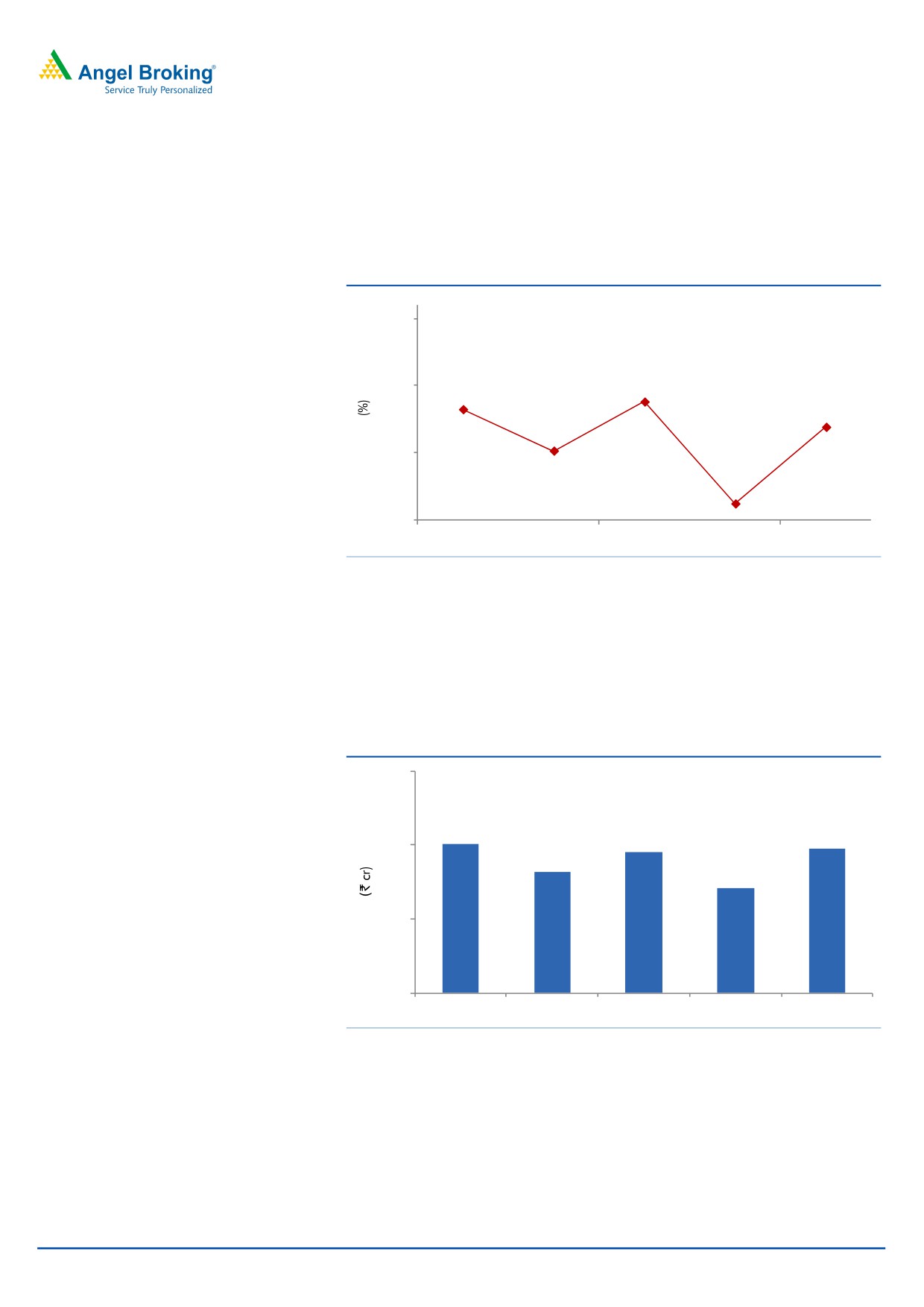

OPM comes in lower on a yoy basis at 15.9%

On the operating front, the gross margin came in at 53.8% vs. 55.7% in

2QFY2016. The OPM came in lower at 15.9% vs. 17.2% in 2QFY2016 and vs.

our expectation of 17.0%.

Exhibit 4: OPM trend

24.0

19.0

17.8

17.2

14.1

15.9

14.0

10.2

9.0

2QFY2016

3QFY2016

4QFY2016

1QFY2017

2QFY2017

Source: Company, Angel Research

Net profit lower than estimated

The reported net profit came in at `99cr vs. `96cr in 2QFY2017. The Adj. net

profit came in at `98cr vs. `101cr in 2QFY2017, a yoy de-growth of 2.9% and

lower than our expectation of `102cr.

Exhibit 5: Adjusted net profit trend

150

101

95

98

100

82

71

50

0

2QFY2016

3QFY2016

4QFY2016

1QFY2017

2QFY2017

Source: Company, Angel Research

November 9, 2016

3

Glaxo Pharma | 2QFY2017 Result Update

Recommendation rationale

Renewed focus on the Indian market: GSK is among the top ten players in the

Indian pharmaceutical market, having a market share of ~3.7%. Unlike other

MNCs, the company has been amongst the few which have taken initiatives to

grow their businesses in the Indian market with consistent launch of new products.

Over the last six years, the company has strategically decided to expand its

presence in the Specialty segment. The Specialty segment’s contribution to sales

has reached 23% (as of 2013). Another segment which is strong for the company

is the area of vaccine, where GSK Vaccines has become the leading company in

the private market for vaccines in India. The recently introduced vaccine for

pneumococcal conjugate disease, Synflorix, has become the biggest brand in the

vaccine portfolio of the company in the second year of its launch. The efforts of the

company in raising awareness about vaccines and preventable diseases continue

with increasing fervor. Also, in FY2015, GlaxoSmithKline Plc (Glaxo), London, UK,

entered into three inter-conditional agreements with Novartis AG (Novartis), Basel,

Switzerland. In one such agreement Glaxo agreed to acquire Novartis’ vaccines

business (excluding influenza vaccine) and its manufacturing capabilities and

facilities, and in the second agreement, Glaxo agreed to sell the rights of its

Marketed Oncology Portfolio, related R&D activities and AKT Inhibitors currently in

development to Novartis. Globally, these transactions with Novartis were

completed on March 2, 2015.

On the other hand, its other key segments like mass markets and mass specialty,

which contribute 60% of its sales, de-grew by 12% in CY2013. This was as a result

of a number of products of the company having come under the DPCO 2013

ruling, resulting in reduction in prices of its drugs, which impacted its sales in

CY2013. Along with this, the supply constraints, mainly from local supplies during

FY2015, have been impacting its performance. However, going forward, with

company’s own facilities coming on stream in FY2017, we expect the volatility in

sales to end. Overall, for FY2016-18E, we expect the domestic formulation

business of the company to grow at a CAGR of 10.0%.

Significant capex plans ahead indicate revival in growth: Global pharmaceutical

major Glaxo announced an `864cr investment in India to set up a medicine

manufacturing unit. The new facility will substantially increase the company’s

manufacturing base. The drug maker is proactively building capacity in the country

as it delivers its portfolio of products in areas such as gastroenterology and anti-

inflammatory medicines. When complete, the factory will make pharmaceutical

products for the Indian market at a rate of up to 8bn tablets and 1bn capsules a

year. The facility, expected to be operational by 2017, will include a warehouse,

site infrastructure, and utilities to support the manufacturing and packing of

medicines. It showcases GSK's latest commitment to its manufacturing network in

India where the company has invested `1,017cr over the last decade. The

development is positive and comes after a long lull in terms of investments.

November 9, 2016

4

Glaxo Pharma | 2QFY2017 Result Update

Outlook and valuation

GSK has a strong balance sheet with cash of ~`2,000cr, which could be used for

future acquisitions or higher dividend payouts. The company’s parent company

Glaxo increased stake in it through a voluntary open offer, after which Glaxo holds

75% stake in the Indian subsidiary. The buy-back of shares is a strong indicator

from the Management towards the performance of its listed Indian entity,

especially as it comes after the recent `864cr investment plan announced by the

company to further its growth prospects in the Indian pharmaceuticals market. The

said investments are expected to fructify by 2017.

On the operational front, we expect the company’s net sales to post a CAGR of

9.9% to

`3,312cr and EPS to register a CAGR of

17.3% to

`60.8 over

FY2016-18E. At current level, the stock is trading at 58.5x and 44.7x its FY2017E

and FY2018E earnings, respectively. We remain Neutral on the stock.

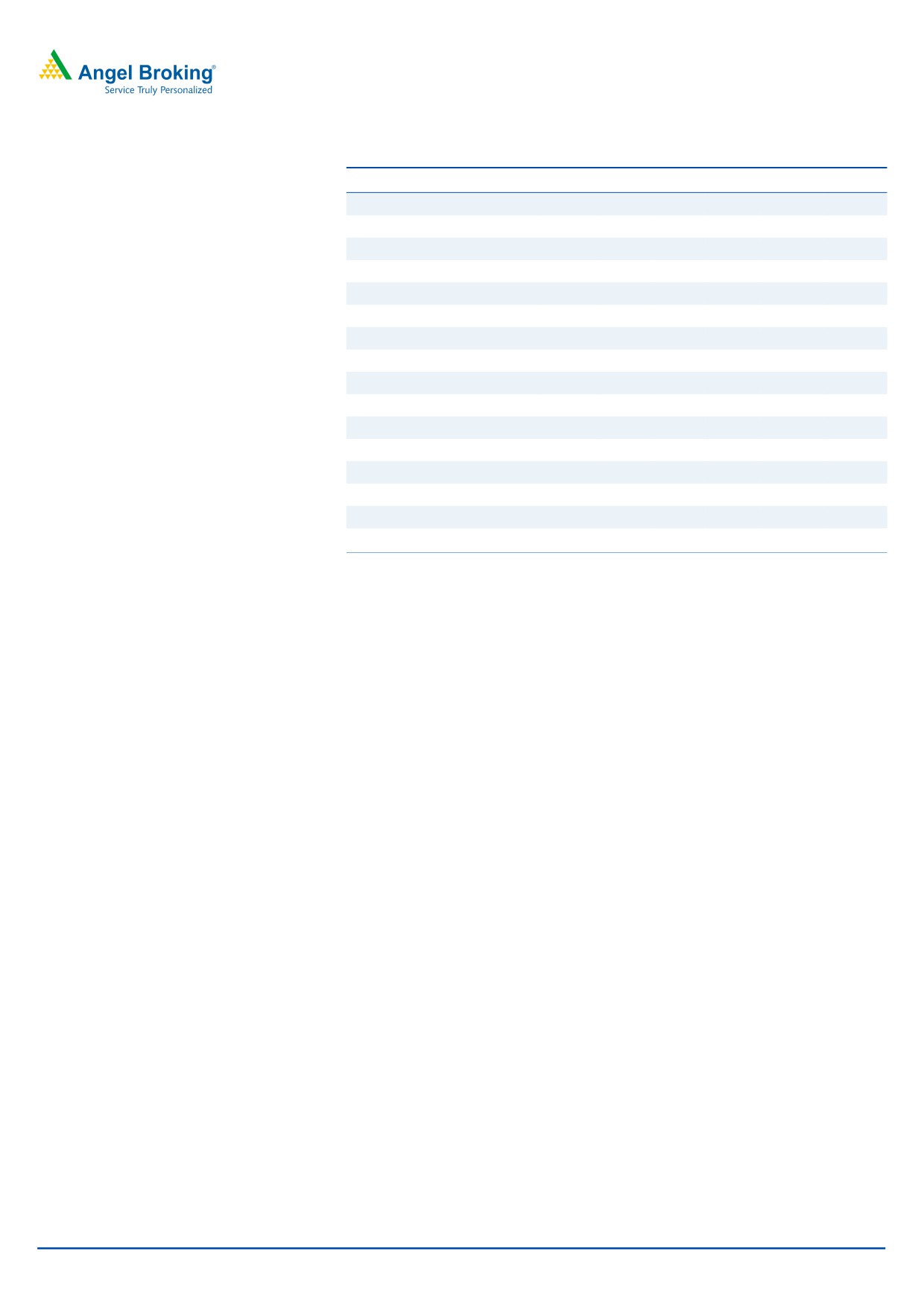

Exhibit 6: Key assumptions

FY2017E

FY2018E

Sales growth (%)

9.4

10.2

Growth in employee expenses (%)

16.2

10.0

Operating margin (%)

15.4

20.6

Capex (` cr)

200

200

Source: Company, Angel Research

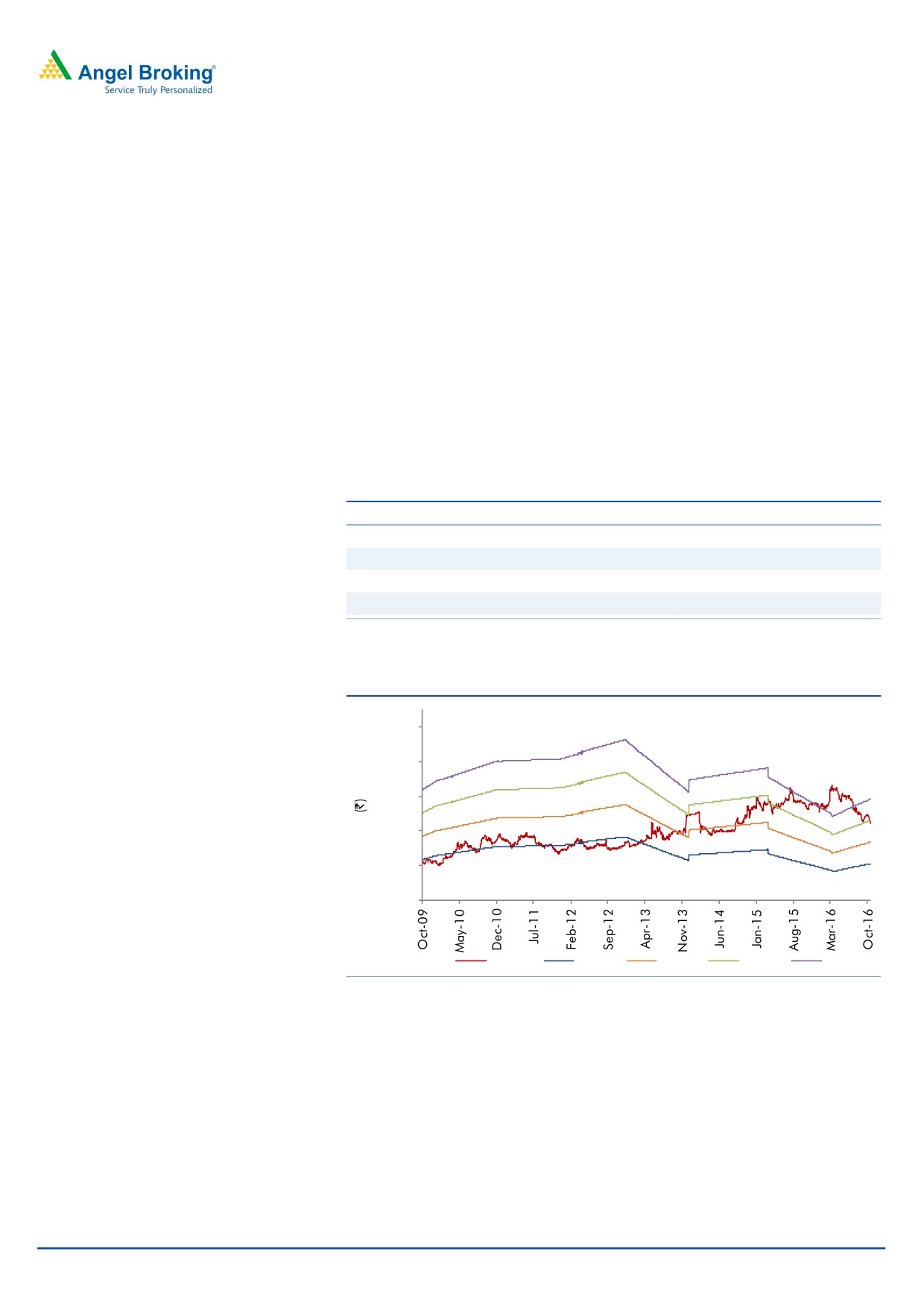

Exhibit 7: One-year forward PE

5,500

4,500

3,500

2,500

1,500

500

Price

18x

30x

42x

54x

Source: Company, Angel Research

November 9, 2016

5

Glaxo Pharma | 2QFY2017 Result Update

Exhibit 8: Recommendation summary

Company

Reco

CMP Tgt. price Upside

FY2018E

FY16-18E

FY2018E

(`)

(`)

% PE (x) EV/Sales (x) EV/EBITDA (x) CAGR in EPS (%) RoCE (%) RoE (%)

Alembic Pharma

Neutral

655

-

-

21.6

2.9

13.5

(10.8)

27.5

25.3

Aurobindo Pharma Buy

757

877

15.9

16.0

2.6

11.1

18.1

22.5

26.1

Cadila Healthcare

Buy

375

-

-

19.5

3.0

13.7

13.4

22.7

25.7

Cipla

Neutral

536

-

-

19.7

2.5

13.6

20.4

13.5

15.2

Dr Reddy's

Neutral

3,115

-

-

21.8

2.8

12.5

1.7

16.2

15.9

Dishman Pharma

Neutral

237

-

-

21.0

2.3

10.3

3.1

10.3

10.9

GSK Pharma*

Neutral

2,719

-

-

44.7

6.8

32.8

17.3

35.3

32.1

Indoco Remedies

Neutral

277

-

-

17.7

2.1

11.4

31.5

19.1

19.2

Ipca labs

Accumulate

572

613

7.2

29.0

2.0

13.1

36.5

8.8

9.4

Lupin

Buy

1,509

1,809

19.9

21.8

3.6

13.4

17.2

24.4

20.9

Sanofi India

Neutral

4,277

-

-

24.9

3.3

17.8

22.2

24.9

28.8

Sun Pharma

Buy

635

944

48.6

19.4

3.8

12.2

22.0

33.1

18.9

Source: Company, Angel Research; Note: * December year ending;

November 9, 2016

6

Glaxo Pharma | 2QFY2017 Result Update

Company Background

GlaxoSmithKline Pharmaceuticals (GSK) is the sixth largest pharmaceutical player

in the Indian market with a market share of ~3.7%. The company’s product

portfolio includes both, prescription medicines and vaccines. GSK sells prescription

medicines across therapeutic areas such as anti-infectives, dermatology,

gynaecology, diabetes, oncology, cardiovascular diseases and respiratory

diseases. A large portion of the company’s revenue comes from the acute

therapeutic portfolio. However, the company is now scouting for opportunities in

high-growth therapeutic areas such as CVS, CNS, diabetes and oncology. Further,

with a strong parentage, the company plans to increase its product portfolio

through patented launches and vaccines. To fructify the same, the company plans

to enhance its manufacturing assets with its parent company investing `864cr in it;

the capacity expansion is expected to fructify in 2017.

November 9, 2016

7

Glaxo Pharma | 2QFY2017 Result Update

Profit & loss statement

Y/E March (` cr)

CY2012

CY2013

FY2015

FY2016

FY2017E FY2018E

Gross sales

2,692

2,589

3,328

2,800

3,072

3,379

Less: Excise duty

71

51

56

59

72

68

Net sales

2,621

2,538

3,272

2,741

3,000

3,312

Other operating income

29

24

32

27

27

27

Total operating income

2,651

2,563

3,305

2,768

3,027

3,339

% chg

11.4

(3.3)

28.9

(16.2)

9.4

10.3

Total expenditure

1,862

2,034

2,690

2,289

2,537

2,629

Net raw materials

1,104

1,164

1,510

1,233

1,530

1,490

Other Mfg costs

94

89

115

99

107

115

Personnel

296

362

493

443

450

533

Other

369

420

572

514

450

491

EBITDA

759

504

582

452

463

682

% chg

2.1

(33.6)

15.5

(22.4)

2.5

47.3

(% of Net Sales)

29.0

19.9

17.8

16.5

15.4

20.6

Depreciation& amortization

18

20

25

25

37

45

EBIT

741

484

557

427

426

637

% chg

2.6

(34.7)

15.0

(23.3)

(0.2)

49.6

(% of Net Sales)

28.3

19.1

17.0

15.6

14.2

19.2

Interest & other charges

-

-

-

-

-

-

Other income

175

177

200

125

125

125

(% of PBT)

Share in profit of Associates

-

-

-

-

-

-

Recurring PBT

945

685

789

579

579

790

% chg

4.4

(27.5)

15.1

(26.5)

(0.1)

36.5

Extraordinary expense/(Inc.)

101

(26)

33

(3)

-

-

PBT (reported)

844

711

756

582

579

790

Tax

318

230

279

203

185

275

(% of PBT)

37.7

32.3

36.9

34.8

32.0

34.8

PAT (reported)

526

482

477

377

394

515

Add: Share of earnings

-

-

-

-

-

-

of asso.

Less: Minority interest (MI)

-

-

-

-

-

-

Prior period items

-

-

-

-

-

-

Exceptional items

PAT after MI (reported)

526

482

477

377

394

515

ADJ. PAT

657

464

509

374

394

515

% chg

12.0

(29.4)

9.8

(26.5)

5.2

30.9

(% of Net Sales)

25.1

18.3

15.6

13.7

13.1

15.6

Basic EPS (`)

78

55

60

44

46

61

Fully diluted EPS (`)

78

55

60

44

46

61

% chg

12.0

(29.4)

9.8

(26.5)

5.2

30.9

November 9, 2016

8

Glaxo Pharma | 2QFY2017 Result Update

Balance Sheet

Y/E March (` cr)

CY2012

CY2013

FY2015

FY2016

FY2017E

FY2018E

SOURCES OF FUNDS

Equity share capital

85

85

85

85

85

85

Preference Capital

-

-

-

-

-

-

Reserves& surplus

1,922

1,905

1,744

1,611

1,509

1,529

Shareholders funds

2,007

1,990

1,829

1,696

1,594

1,614

Minority Interest

Total loans

4

4

3

2

2

2

Other long-term liabilities

5

5

5

-

-

-

Long-term provisions

236

242

273

291

291

291

Deferred tax liability

(87)

(92)

(83)

(89)

(89)

(89)

Total liabilities

2,165

2,148

2,026

1,900

1,798

1,818

APPLICATION OF FUNDS

Gross block

274

323

467

725

925

1,125

Less: Acc. depreciation

227

247

272

297

334

379

Net block

47

76

195

428

591

746

Capital work-in-progress

44

44

44

44

44

44

Goodwill

42

42

-

-

-

-

Other non-current assets

17

14

-

-

-

-

Long-term loans and adv.

195

238

307

313

343

379

Investments

55

10

0

0

0

0

Current assets

2,602

2,614

2,587

2,172

1,960

1,907

Cash

2,067

2,042

1,911

1,348

1,060

914

Loans & advances

134

238

122

123

135

149

Other

401

335

554

701

765

844

Current liabilities

836

889

1,107

1,058

1,140

1,258

Net current assets

1,765

1,725

1,480

1,115

820

649

Mis. Exp. not written off

-

-

-

-

-

-

Total Assets

2,165

2,148

2,026

1,900

1,798

1,818

November 9, 2016

9

Glaxo Pharma | 2QFY2017 Result Update

Cash flow statement

Y/E March (` cr)

CY2012 CY2013 FY2015 FY2016 FY2017E FY2018E

Profit before tax and exceptional

844

711

756

582

579

790

Depreciation

18

20

25

25

37

45

(Inc)/Dec in working capital

(25)

15

114

(197)

7

25

Direct taxes paid

318

230

279

203

185

275

Cash Flow from Operations

519

517

616

207

438

585

(Inc.)/Dec.in fixed assets

(28)

(49)

(144)

(258)

(200)

(200)

(Inc.)/Dec. in investments

(57)

(45)

(10)

-

-

-

Cash Flow from Investing

(85)

(93)

(154)

(258)

(200)

(200)

Issue of equity

-

-

-

-

-

-

Inc./(Dec.) in loans

-

-

-

-

-

-

Dividend paid (Incl. Tax)

(491)

(495)

(624)

(495)

(495)

(495)

Others

110

47

32

(16)

(30)

(35)

Cash Flow from Financing

(381)

(448)

(593)

(512)

(525)

(531)

Inc./(Dec.) in cash

52

(25)

(131)

(563)

(288)

(146)

Opening cash balances

2,014

2,067

2,042

1,911

1,348

1,060

Closing cash balances

2,067

2,042

1,911

1,348

1,060

914

November 9, 2016

10

Glaxo Pharma | 2QFY2017 Result Update

Key ratio

Y/E March

CY2012

CY2013

FY2015

FY2016

FY2017E

FY2018E

Valuation Ratio (x)

P/E (on FDEPS)

35.0

49.6

45.2

61.5

58.5

44.7

P/CEPS

42.3

45.9

45.9

57.3

53.5

41.1

P/BV

11.5

11.6

12.6

13.6

14.4

14.3

Dividend yield (%)

1.8

1.8

1.8

1.8

1.8

1.8

EV/Sales

8.0

8.3

6.5

7.9

7.3

6.7

EV/EBITDA

27.6

41.7

36.3

48.0

47.4

32.4

EV / Total Assets

9.7

9.8

10.4

11.4

12.2

12.2

Per Share Data (`)

EPS (Basic)

77.6

54.8

60.1

44.2

46.5

60.8

EPS (fully diluted)

77.6

54.8

60.1

44.2

46.5

60.8

Cash EPS

64.2

59.2

59.3

47.4

50.8

66.1

DPS

50.0

50.0

50.0

50.0

50.0

50.0

Book Value

236.9

234.9

215.9

200.2

188.2

190.5

Returns (%)

RoCE (Pre-tax)

34.7

22.4

26.7

21.7

23.1

35.3

Angel ROIC (Pre-tax)

-

-

-

-

-

-

RoE

33.3

23.2

26.7

21.2

23.9

32.1

Turnover ratios (x)

Asset Turnover (Gross Block)

9.7

8.6

8.4

4.6

3.7

3.3

Inventory / Sales (days)

43

48

40

59

55

47

Receivables (days)

14

15

11

15

15

13

Payables (days)

58

54

55

77

74

78

WC cycle (ex-cash) (days)

74

79

69

99

104

103

Solvency ratios (x)

Net debt to equity

(1.0)

(1.0)

(1.0)

(0.8)

(0.7)

(0.6)

Net debt to EBITDA

(2.7)

(4.0)

(3.3)

(3.0)

(2.3)

(1.3)

Interest Coverage (EBIT / Int.)

-

-

-

-

-

-

November 9, 2016

11

Glaxo Pharma | 2QFY2017 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Glaxo Pharma

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

November 9, 2016

12