1QFY2018 Result Update | Pharmaceutical

August 07, 2017

Lupin

BUY

CMP

`993

Performance Highlights

Target Price

`1,467

Y/E March (`cr)

1QFY2018

4QFY2017

% chg qoq

1QFY2017

% chg yoy

Investment Period

12 months

Net sales

3,806

4,162

(8.6)

4,316

(11.8)

Other income

95

137

(30.7)

208

(54.6)

Stock Info

Operating

705

690

2.1

1,185

(40.5)

Pharmaceutical

profit

Sector

Interest

44

41

8.1

32

37.3

Market Cap (` cr)

44,944

Net profit

359

380

(5.4)

886

(59.4)

Net Debt (` cr)

8,165

Source: Company, Angel Research

Beta

0.7

52 Week High / Low

1,734 /986

Lupin, for 1QFY2018, posted poor set of numbers. Sales came in at `3,806cr

(`4,316cr expected) v/s. `4,316cr in 1QFY2017, a yoy de-growth of 11.8%. On

Avg. Daily Volume

1,15,245

operating front, the EBITDA margins came in at 18.5% (22.9% expected) v/s.

Face Value (`)

2

27.4% in 1QFY2017, mainly on the back of lower than expected sales during the

BSE Sensex

32,238

quarter and dip in the gross margins. Thus, the PAT came in at `359cr (`607cr

Nifty

10,014

expected) v/s. `886cr in 1QFY2017, a yoy de-growth of 59.4%. Tax rate during

Reuters Code

LUPN.BO

the quarter was 27.7% of PBT v/s. 23.6% of PBT in 1QFY2017. We maintain our

Bloomberg Code

LPC@IN

Buy rating on the stock.

Numbers lower than expectations: Sales came in at

`3,806cr

(`4,316cr

Shareholding Pattern (%)

expected) v/s. `4,316cr in 1QFY2017, a yoy de-growth of 11.8%. The dip was

Promoters

46.7

mainly on the back of formulation sales (`3,528cr), which declined by 12.8%,

MF / Banks / Indian Fls

10.9

mainly on the back of a 26.8% dip in the USA (`1,602cr; accounting for 42% of

FII / NRIs / OCBs

31.5

global sales). Lupin’s India formulation sales grew by 6.1% to `932.4cr during

Indian Public / Others

10.9

1QFY2018 as compared to 1QFY2017 and decreased by 1.8% compared to

4QFY2017, accounting for 25% of Lupin’s global sales. On operating front, the

EBITDA margins came in at 18.5% (22.9% expected) v/s. 27.4% in 1QFY2017,

Abs. (%)

3m 1yr 3yr

mainly on the back of lower than expected sales during the quarter and dip in

Sensex

7..8

16.4

25.3

the gross margins. Thus, the PAT came in at `358cr (`607cr expected) v/s.

Lupin

(30.6)

(40.8)

(15.6)

`882cr in 4QFY2017, a yoy de-growth of 59.4%.

3-year price chart

2,300

Outlook and valuation: We expect Lupin to post a net sales CAGR of 11.5% to

2,100

`21,289cr and earnings CAGR of 8.2% to `66.7/share over FY2017-19E.

1,900

Currently, the stock is trading at 14.9x its FY2019E earnings respectively. We

1,700

1,500

recommend a Buy rating on the stock.

1,300

1,100

Key financials (Consolidated)

900

Y/E March (` cr)

FY2016

FY2017

FY2018E

FY2019E

700

Net sales

13,702

17,120

18,657

21,289

500

% chg

8.7

24.9

9.0

14.1

Net profit

2,271

2,557

2,373

2,997

% chg

(5.5)

12.6

(7.2)

26.3

Source: Company, Angel Research

EPS (`)

50.5

56.9

52.8

66.7

EBITDA margin (%)

23.7

24.1

21.3

23.3

P/E (x)

19.7

17.5

18.8

14.9

RoE (%)

22.7

20.7

16.3

17.5

RoCE (%)

19.4

15.5

14.7

20.5

Sarabjit Kour Nangra

P/BV (x)

4.0

3.3

2.8

2.4

+91 22 3935 7600 Ext: 6806

EV/sales (x)

3.7

3.0

2.4

2.0

EV/EBITDA (x)

15.6

12.6

11.5

8.7

Source: Company, Angel Research; Note: CMP as of August 3, 2017

Please refer to important disclosures at the end of this report

1

Lupin | 1QFY2018 Result Update

Exhibit 1: 1QFY2018 - Consolidated performance

Y/E March (` cr)

1QFY2018

4QFY2017

% chg (qoq)

1QFY2017

% chg (yoy)

FY2017

FY2016

% chg (yoy)

Net sales

3,806

4,162

(8.6)

4,316

(11.8)

17,120

13,758

24.4

Other income

95

137

(30.7)

208

(54.6)

481

683

(29.6)

Total income

3,901

4,232

(7.8)

4,524

(13.8)

17,601

14,441

21.9

Gross profit

2,573

2,977

(13.6)

3,044

12,118

9,425

28.6

Gross margin

67.6

71.5

70.5

70.8

68.5

Operating profit

704.6

690.0

2.1

1,184.5

(40.5)

4,119

3,188

29.2

OPM (%)

18.5

16.6

27.4

24.1

23.2

Interest

44

41

8.1

32

37.3

153

59

156.5

Dep. & amortization

261

267

(2.6)

203

28.5

912

487

87.3

PBT

495

519

(4.6)

1,158

(57.3)

3,535

3,324

6.3

Provision for taxation

137

137

0.1

273

(49.9)

979

1,059

(7.6)

Reported net profit

358

382

(6.3)

885

(59.5)

2,556

2,265

12.9

Less : exceptional items

-

-

-

-

-

MI & share in associates

(1)

2

-

(1)

-

(1)

4

-

PAT after exceptional

359

380

(5.4)

886

(59.4)

2,557

2,271

12.6

items

EPS (`)

8.0

8.5

19.8

56.5

50.5

Source: Company, Angel Research

Exhibit 2: 1QFY2018 - Actual v/s. Angel estimates

` cr

Actual

Estimates

Variation

Net Sales

3,806

4,316

(11.8)

Other Income

95

137

(30.8)

Operating Profit

705

995

(29.1)

Deprecation

261

267

(2.6)

Tax

137

217

(37.0)

Net Profit

359

607

(40.8)

Source: Company, Angel Research

Revenue de-grows 11.8% yoy: Lupin, for 1QFY2018, posted poor set of numbers.

Sales came in at `3,806cr (`4,316cr expected) v/s. `4,316cr in 1QFY2017, a yoy

de-growth of 12.3%. The dip was mainly on the back of formulation sales

(`3,528cr), which declined by 12.8%, mainly on the back of a 26.8% dip in the

USA (`1,602cr; accounting for 42% of global sales). Lupin’s India formulation

sales grew by 6.1% to `932.4cr during 1QFY2018 as compared to 4QFY2017

and decreased by 1.8% compared to 1QFY2017; accounting for 25% of Lupin’s

global sales. Lupin’s APAC sales were at `599cr during 1QFY2018 compared to

sales of `6,12cr during 4QFY2017 and `5,42cr during 1QFY2017; accounting for

16% of Lupin’s global sales. API sales (`279.3cr) posted a dip of 5.8% yoy.

Lupin’s USA sales de-grew by 26.8% to `1602cr during 1QFY2018, contributing

42% of Lupin’s global sales. The Company launched 4 products in the US market

during the quarter. The Company now has 142 products in the US generics

market. Lupin is now the leader in 43 products marketed in the US generics

market and amongst the top 3 in 91 of its marketed products (market share by

prescriptions, IMS Health, June 2017).

August 07, 2017

2

Lupin | 1QFY2018 Result Update

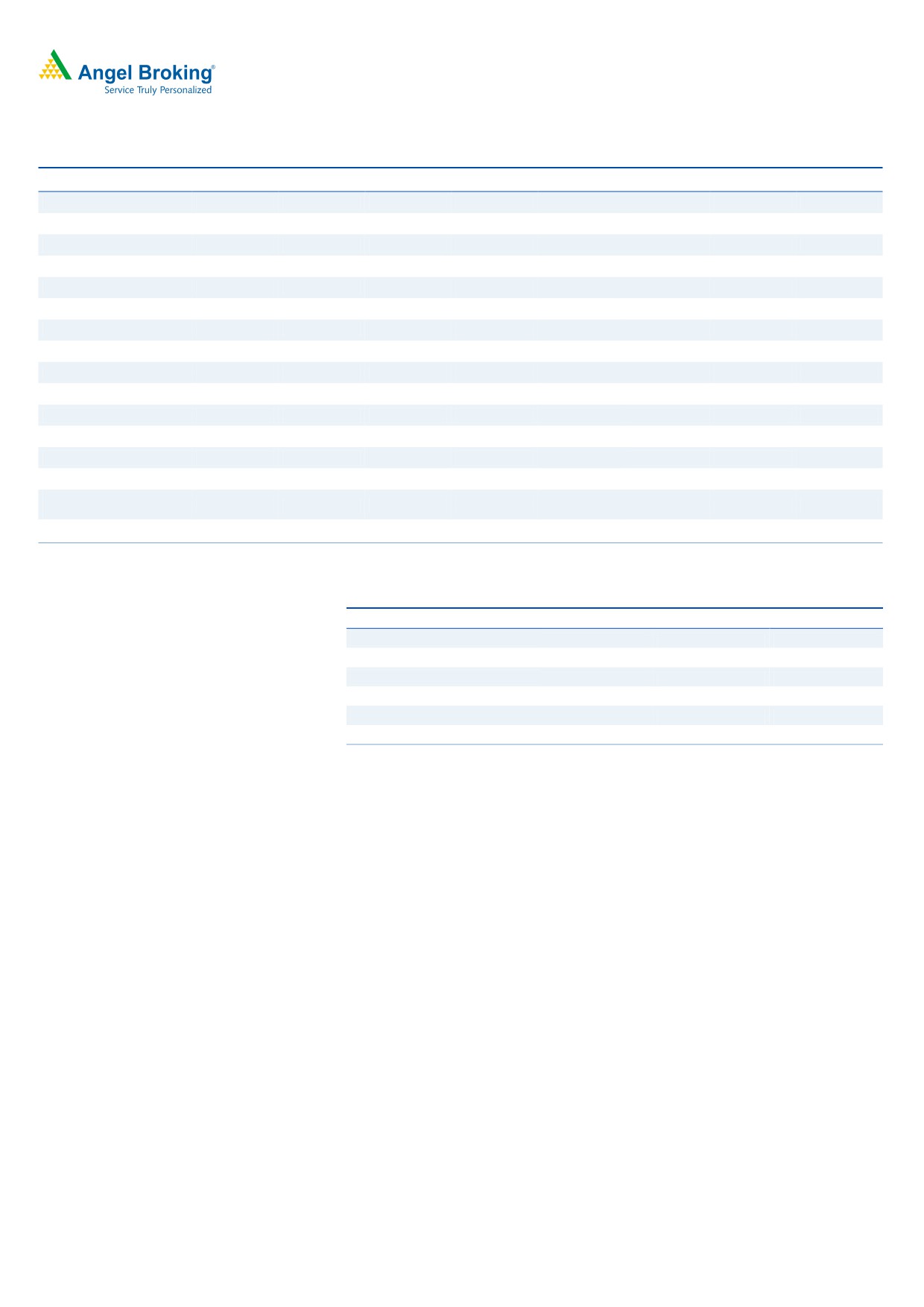

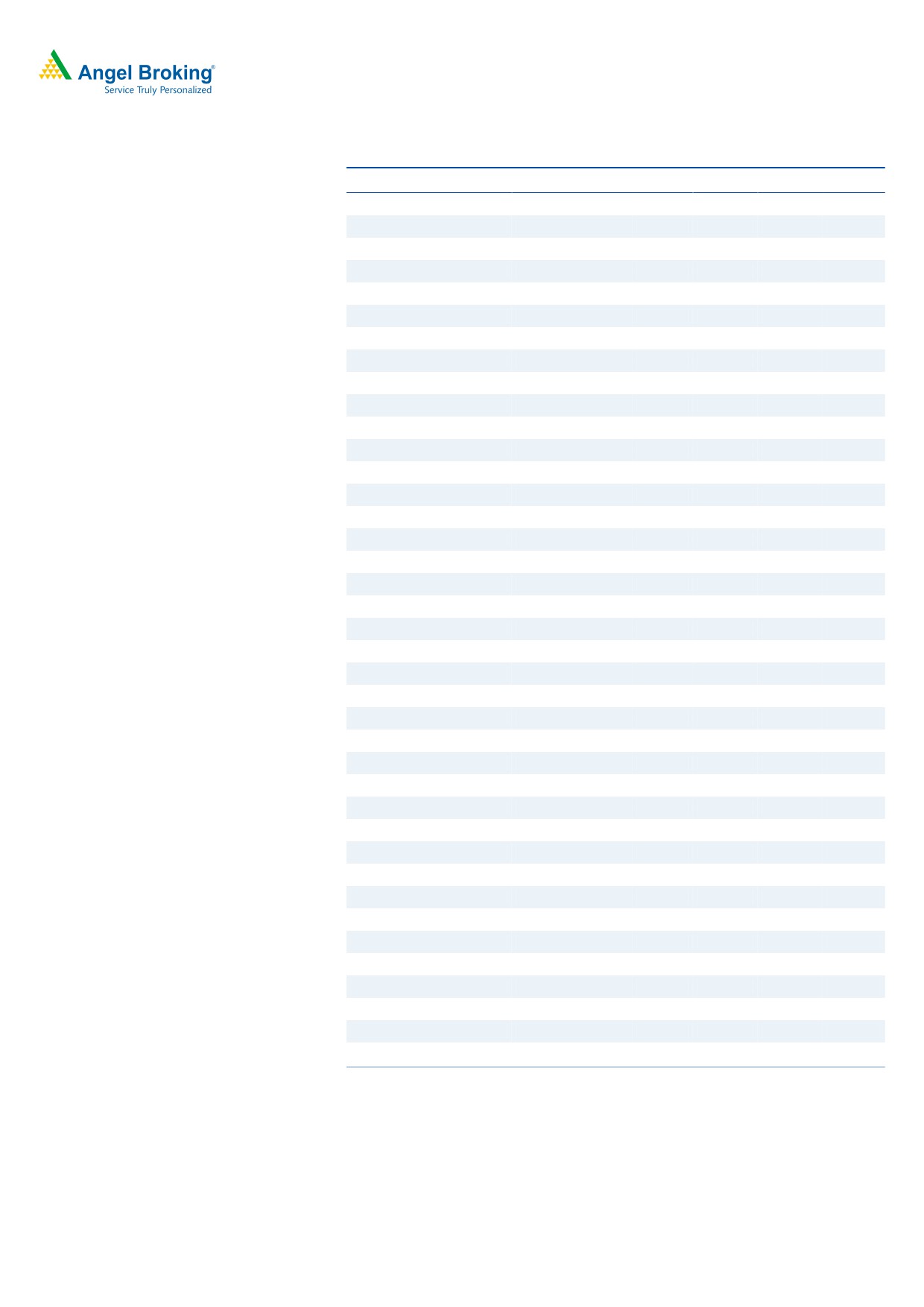

Exhibit 3: Advanced markets - Sales trend

3,000

2,233

2,408

2,431

2,500

2,329

2,000

1,828

1,500

1,000

500

0

1QFY2017

2QFY2017

3QFY2017

4QFY2017

1QFY2018

Source: Company, Angel Research

Exhibit 4: Domestic Formulation Market

1100

996

991

1000

932

950

900

879

800

1QFY2017

2QFY2017

3QFY2017

4QFY2017

1QFY2018

Source: Company

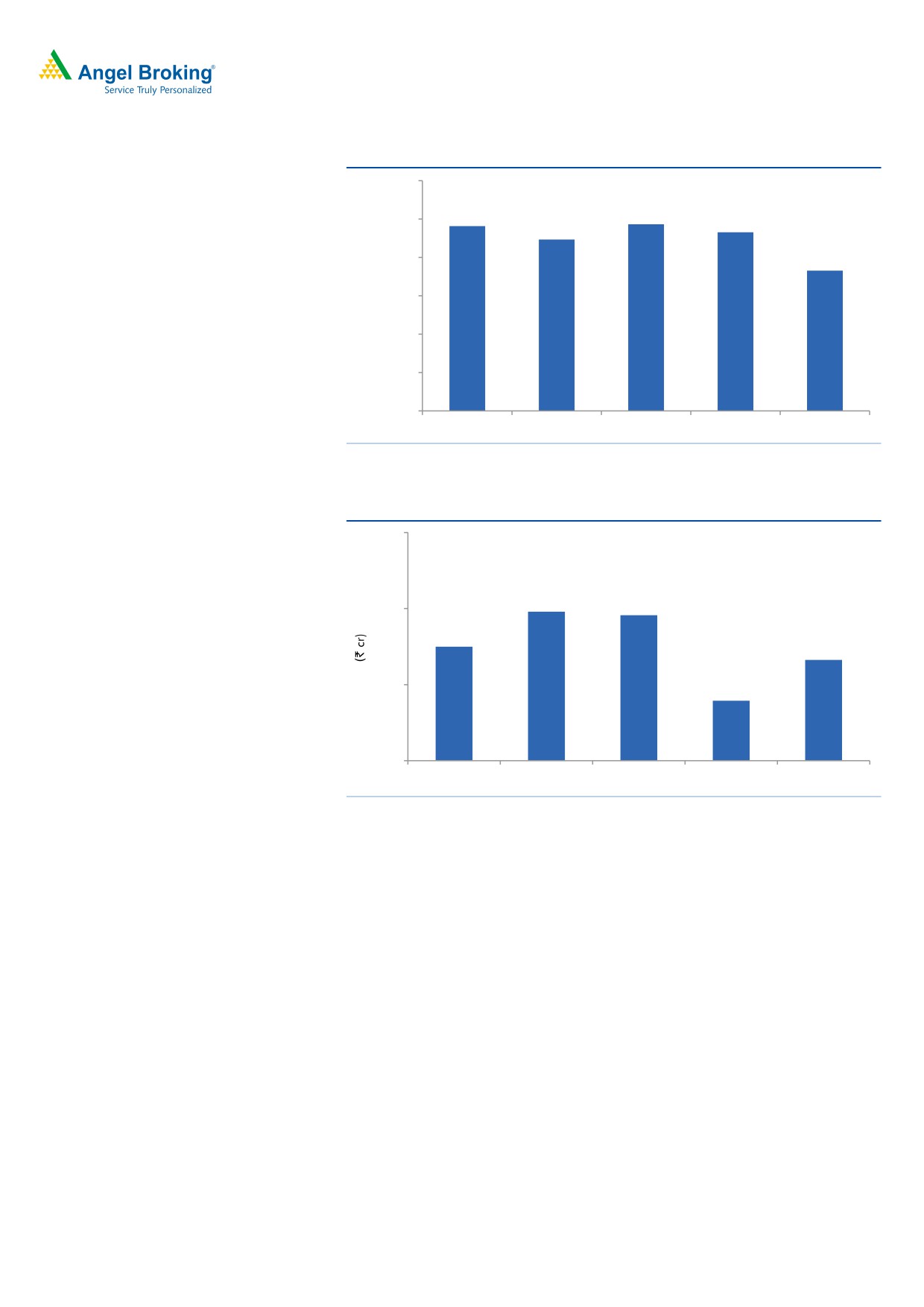

OPM at 18.5%, lower than expected: On the OPM front, the EBDITA margins

came in at 18.5% (v/s. 22.9% expected) v/s. 27.4% in 1QFY2017. While the Gross

margins came in at 67.6% v/s. 70.5% in 1QFY2017, a yoy rise of 1.7%, 0.1% and

(0.5)% in the employee, R&D and other expenses respectively restricted the higher

than expected contraction in the OPM. R&D expenses were 13.1% of sales in

1QFY2018 V/s. 11.6% of sales in 1QFY2017.

August 07, 2017

3

Lupin | 1QFY2018 Result Update

Exhibit 5: OPM trend

30.0

27.4

28.0

25.9

26.0

24.0

22.0

20.0

18.5

18.0

16.0

16.6

16.6

14.0

12.0

10.0

1QFY2017 2QFY2017 3QFY2017 4QFY2017 1QFY2018

Source: Company, Angel Research

Net profit growth lower than estimate: The PAT came in at `358cr (`607cr

expected) v/s. `882cr in 4QFY2017, a yoy de-growth of 59.4%. Tax rate during

the quarter was 27.7% of PBT v/s. 23.6% of PBT in 1QFY2017.

Exhibit 6: Net profit trends

950

882

850

750

662

633

650

550

450

380

358

350

250

150

50

1QFY2017 2QFY2017 3QFY2017 4QFY2017 1QFY2018

Source: Company, Angel Research

Conference call takeaways

Management has guided for 30-45 ANDA launches in FY2018.

R&D expense expected to be around ~`2,000cr in FY2018.

Company saw single-digit price erosion in its US business. It expects US

business to bottom out in 2QFY2018, although single-digit price erosion will

be seen in Glumetza and Fortamet.

With GST impact in India & US price erosion which is on account of channel

consolidation, EBITDA margin is expected to be in the range of 21-23% in

FY2018.

Company expects 14 FTFs in next five years.

August 07, 2017

4

Lupin | 1QFY2018 Result Update

With high number of approvals and launches going forward, US business is

expected to post strong growth FY2019 onward.

75% of APIs are consumed internally. Company is foraying into Oncology API

segment.

Recommendation rationale

US market - the key driver: The high-margin branded generic business has

been the key differentiator for Lupin in the Indian pharmaceuticals space. On

the generic front, Lupin is currently the fifth largest generic player in the US,

with 5.3% market share in prescription. Lupin is now the market leader in 43

products marketed in the US generics market and is amongst the top 3 by

market share in 91 products. Currently, the company’s cumulative filings stand

at 368, of which 217 have been approved, with 23 exclusive FTFs. Lupin plans

to launch 25-30 products in the US in FY2018. We expect the region to post a

CAGR of 9.9% over FY2017-19E on the back of new product launches.

Domestic formulations on a strong footing: Lupin continues to make strides in

the Indian market. Currently, Lupin ranks No 3, and is the fastest growing

company among the top five companies in the domestic formulation space,

registering a strong CAGR of 20% over the last few years. Six of Lupin's

products are among the top 300 brands in the country. Lupin has a strong

field force of ~6,000MRs (as of FY2016). We expect the domestic formulation

market to grow at a CAGR of 16.0% over FY2017-19E.

First-mover advantage in Japan: Lupin figures among the few Indian

companies with a formidable presence in Japan, the world’s second largest

pharmaceuticals market (Lupin was ranked as the 8th largest as per IMS MAT

March 2014). The Management believes that there will be patent expiries

(US$14-16bn) in the next two years in the Japanese market, which along with

increased generic penetration would drive growth in the market. The

Management expects improvement in growth in the next 3-4 years. On a

conservative basis, we expect the Japan market to post a CAGR of 20% over

FY2017-19E.

Valuation

We expect Lupin to post a net sales CAGR of 11.5% to `21,289cr and earnings

CAGR of 8.2% to `66.7/share over FY2017-19E. Currently, the stock is trading at

14.9x its FY2019E earnings, respectively. We recommend a Buy rating on the

stock.

August 07, 2017

5

Lupin | 1QFY2018 Result Update

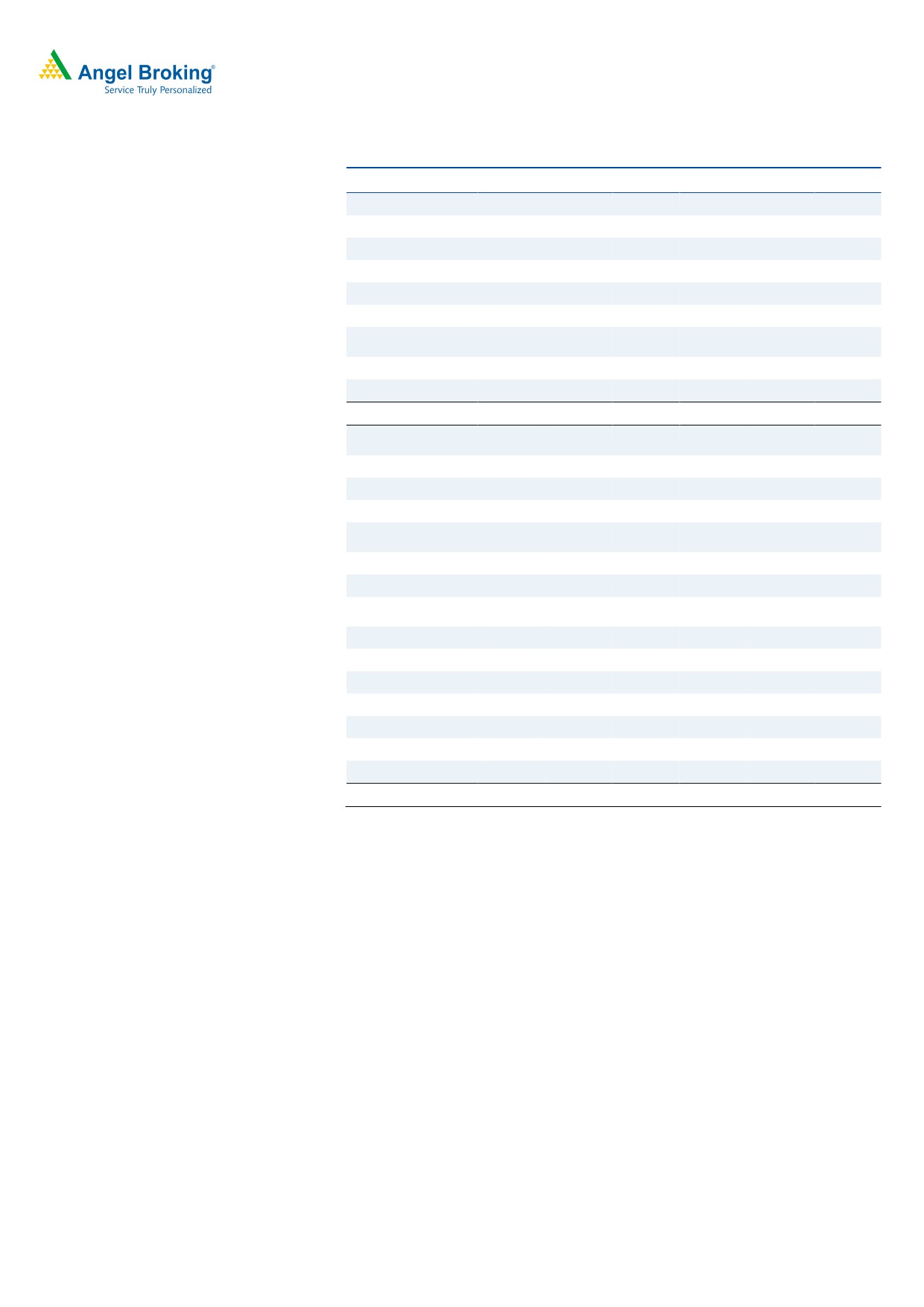

Exhibit 7: Key Assumptions

FY2018E

FY2019E

Sales growth (%)

9.0

14.1

Domestic growth (%)

16.0

16.0

Exports growth (%)

7.8

13.5

Operating margins (%)

22.3

24.1

R&D Exp ( % of sales)

12.0

12.0

Capex (` cr)

1000

1000

Source: Company, Angel Research

Exhibit 8: One-year forward PE

2,500

2,000

1,500

1,000

500

-

20x

25x

30x

35x

Source: Company, Angel Research

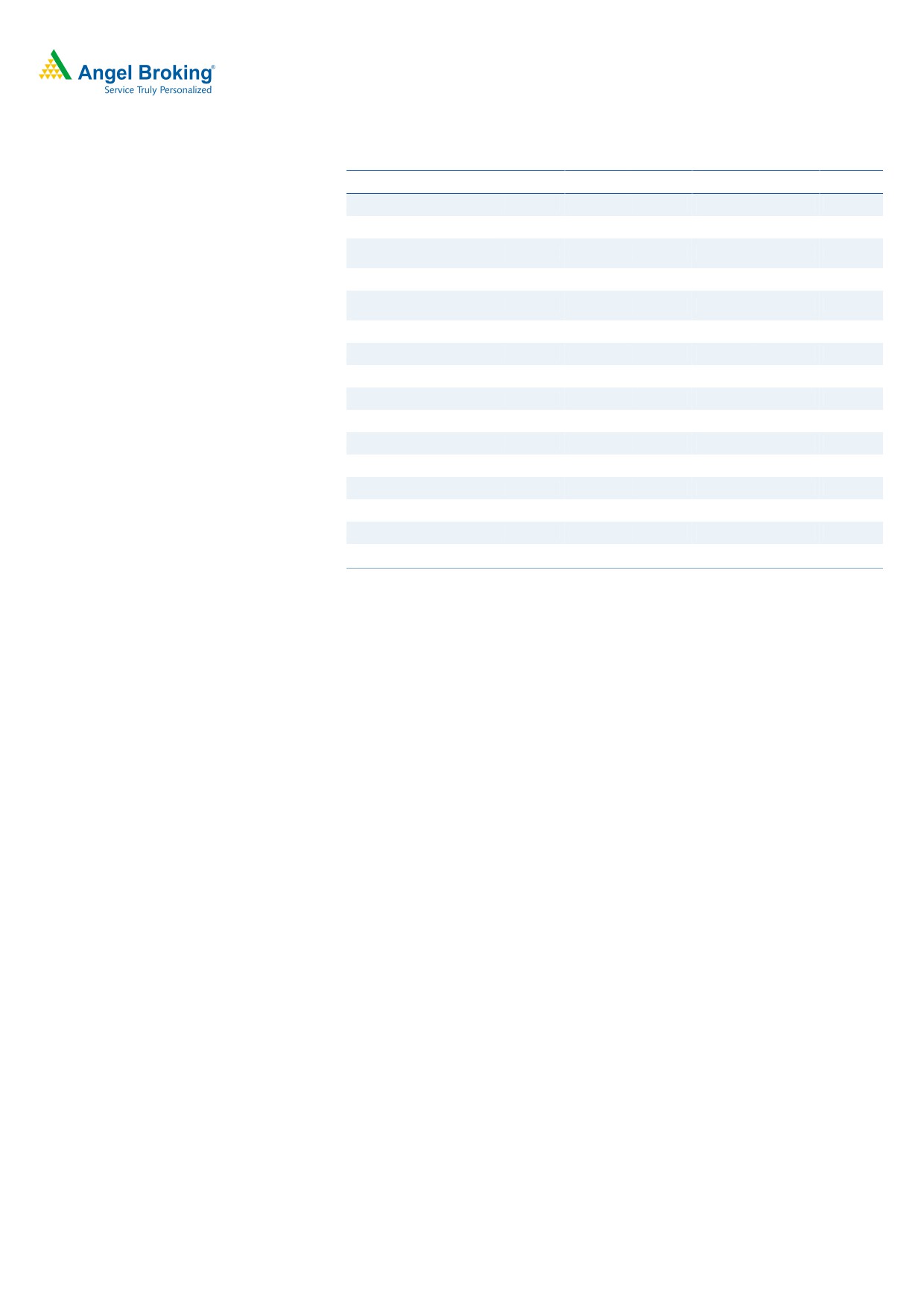

Exhibit 9: Recommendation summary

Company

Reco

CMP

Tgt. price

Upside

FY2019E

FY17-19E

FY2019E

EV/Sale

EV/EBITDA

CAGR in

(`)

(`)

(%)

PE (x)

RoCE (%) RoE (%)

(x)

(x)

EPS (%)

Alembic Pharma

Accumulate

531

600

13.1

19.5

2.2

11.4

12.8

24.3

20.6

Aurobindo Pharma

Accumulate

725

823

13.5

14.1

2.2

9.9

14.2

25.3

22.7

Cadila Healthcare

Sell

532

450

(15.3)

25.0

4.0

19.8

21.0

17.3

22.9

Cipla

Sell

567

461

(18.7)

23.4

2.4

15.1

39.2

11.0

13.2

Dr Reddy's

Neutral

2,244

-

-

20.2

2.3

12.5

23.6

11.2

13.0

Dishman Pharma

Under Review

301

-

-

18.9

1.3

10.1

(6.8)

2.9

2.5

GSK Pharma

Neutral

2,401

-

-

41.0

5.5

30.7

30.6

28.9

26.5

Indoco Remedies

Sell

199

153

(23.2)

15.6

1.5

10.2

23.0

11.2

15.0

Ipca labs

Buy

461

620

34.4

18.3

1.5

9.4

27.9

12.8

11.2

Lupin

Buy

993

1,467

47.8

14.9

2.0

8.7

8.2

20.5

17.5

Sanofi India*

Neutral

4,247

-

-

27.6

2.9

17.0

9.2

23.9

25.8

Sun Pharma

Buy

507

712

40.5

15.7

2.9

11.4

1.2

15.1

18.8

Source: Company, Angel Research; Note: * December year ending

August 07, 2017

6

Lupin | 1QFY2018 Result Update

Company Background

Lupin, established in 1968, is primarily engaged in the manufacture and global

distribution of active pharmaceutical ingredients (APIs) and finished dosages. Over

the years, the company forayed into the US markets through a differentiated export

strategy of tapping branded generics and consequently gaining a large share of

the US prescription market. Further, to expand its footprint in the global markets,

Lupin has prudently adopted the inorganic growth route. In-line with this, over the

last two years, the company made small acquisitions across geographies,

prominent among these being the acquisition of Kyowa in the growing Japanese

market. In the US, the company has acquired privately held Gavis Pharmaceuticals

LLC and Novel Laboratories Inc. The acquisitions have enhanced Lupin’s scale in

the US generic market and have also broadened its pipeline in dermatology,

controlled substance products and other high-value and niche generics.

August 07, 2017

7

Lupin | 1QFY2018 Result Update

Profit & Loss Statement (Consolidated)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017

FY2018E

FY2019E

Gross sales

11,167

12,684

13,797

17,224

18,770

21,417

Less: Excise duty

80

84

96

104

113

129

Net sales

11,087

12,600

13,702

17,120

18,657

21,289

Other operating income

200

170

507

375

375

375

Total operating income

11,287

12,770

14,208

17,494

19,032

21,663

% chg

17.1

13.1

11.3

23.1

8.8

13.8

Total expenditure

8,284

9,150

10,455

13,001

14,688

16,334

Net raw materials

3,817

4,157

4,309

5,001

5,970

6,387

Other mfg costs

847

963

1,047

1,308

1,426

1,627

Personnel

1,465

1,747

2,108

2,850

3,105

3,543

Other

2,155

2,283

2,580

3,842

4,187

4,778

EBITDA

2,803

3,449

3,247

4,119

3,969

4,954

% chg

34.1

23.1

(5.9)

26.9

(3.6)

24.8

(% of Net Sales)

25.3

27.4

23.7

24.1

21.3

23.3

Dep. & Amortization

261

435

464

912

1,002

1,122

EBIT

2,542

3,015

2,783

3,206

2,966

3,832

% chg

44.6

18.6

(7.7)

15.2

(7.5)

29.2

(% of Net Sales)

22.9

23.9

20.3

18.7

15.9

18.0

Interest & other charges

27

10

45

153

153

153

Other Income

116

240

188

107

107

107

(% of PBT)

4

7

5

3

3

3

Share in profit of asso.

Recurring PBT

2,832

3,415

3,433

3,535

3,295

4,160

% chg

47.1

20.6

0.5

3.0

(6.8)

26.3

Extraordinary exp./(Inc.)

-

-

-

-

-

-

PBT (reported)

2,832

3,415

3,433

3,535

3,295

4,160

Tax

962

970

1,154

979

923

1,165

(% of PBT)

34.0

28.4

33.6

27.7

28.0

28.0

PAT (reported)

1,870

2,444

2,279

2,556

2,372

2,996

Add: Share of earnings of asso.

-

-

-

-

-

-

Less: Minority interest (MI)

33

41

9

(1)

(1)

(1)

Prior period items

-

-

-

-

-

-

PAT after MI (reported)

1,836

2,403

2,271

2,557

2,373

2,997

ADJ. PAT

1,836

2,403

2,271

2,557

2,373

2,997

% chg

39.7

30.9

(5.5)

12.6

(7.2)

26.3

(% of Net Sales)

16.6

19.1

16.6

14.9

12.7

14.1

Basic EPS (`)

41.0

53.5

50.5

56.9

52.8

66.7

Fully Diluted EPS (`)

41.0

53.5

50.5

56.9

52.8

66.7

% chg

39.5

30.5

(5.5)

12.6

(7.2)

26.3

August 07, 2017

8

Lupin | 1QFY2018 Result Update

Balance Sheet (Consolidated)

Y/E March

FY2014

FY2015

FY2016

FY2017

FY2018E

FY2019E

SOURCES OF FUNDS

Equity share capital

90

90

90

90

90

90

Reserves & surplus

6,842

8,784

11,073

13,407

15,612

18,441

Shareholders funds

6,932

8,874

11,163

13,497

15,702

18,531

Minority interest

67

24

32

35

33

32

Total loans

553

471

7,119

7,952

1,500

-

Other Long-Term

46

74

75

76

77

78

Liabilities

Long-Term Provisions

132

132

592

836

836

836

Deferred tax liability

178

118

(9)

(113)

(113)

(113)

Total liabilities

7,908

9,693

18,973

22,283

18,036

19,364

APPLICATION OF

FUNDS

Gross block

4,564

5,355

6,853

7,853

8,853

9,853

Less: Acc. Depreciation

1,928

2,363

2,827

3,739

4,741

5,863

Net block

2,635

2,992

4,026

5,047

4,112

3,989

Capital work-in-

304

304

304

304

304

304

progress

Goodwill

720

1,648

7,089

7,815

7,815

7,815

Investments

178

1,658

16

2,136

2,136

2,136

Long-Term Loans and

373

275

968

957

1,318

1,504

Adv.

Current assets

5,924

6,176

9,885

9,840

7,327

9,293

Cash

798

1,306

822

699

115

1,064

Loans & advances

302

671

737

912

994

1,134

Other

4,825

4,199

8,326

8,229

6,218

7,095

Current liabilities

2,227

3,360

3,316

3,816

4,975

5,677

Net current assets

3,697

2,816

6,570

6,024

2,352

3,616

Mis. Exp. not written off

-

-

-

-

-

-

Total assets

7,908

9,693

18,973

22,283

18,036

19,364

August 07, 2017

9

Lupin | 1QFY2018 Result Update

Cash Flow Statement (Consolidated)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017

FY2018E

FY2019E

Profit before tax

2,832

3,415

3,433

3,535

3,295

4,160

Depreciation

261

435

464

912

1,002

1,122

(Inc)/Dec in working

(1,481)

1,487

(4,931)

434

2,727

(501)

capital

Direct taxes paid

(962)

(970)

(1,154)

(979)

(923)

(1,165)

Cash Flow from

649

4,367

(2,188)

3,903

6,102

3,617

Operations

(Inc.)/Dec.in Fixed Assets

(443)

(791)

(1,498)

(1,000)

(1,000)

(1,000)

(Inc.)/Dec. in Investments

-

-

-

-

-

-

Cash Flow from Investing

(443)

(791)

(1,498)

(1,000)

(1,000)

(1,000)

Issue of equity

-

-

-

-

-

-

Inc./(Dec.) in loans

(611)

(82)

6,648

833

(6,452)

(1,500)

Dividend Paid (Incl. Tax)

(157)

(168)

(168)

(168)

(168)

(168)

Others

926

(2,816)

(3,278)

(3,689)

934

-

Cash Flow from Financing

157

(3,067)

3,202

(3,024)

(5,686)

(1,668)

Inc./(Dec.) in Cash

363

509

(484)

(122)

(584)

948

Opening Cash balances

435

798

1,306

822

699

115

Closing Cash balances

798

1,306

822

699

115

1,064

August 07, 2017

10

Lupin | 1QFY2018 Result Update

Key Ratios

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017

FY2018E

FY2019E

Valuation Ratio (x)

P/E (on FDEPS)

24.3

18.6

19.7

17.5

18.8

14.9

P/CEPS

21.3

15.8

16.4

12.9

13.2

10.9

P/BV

6.4

5.0

4.0

3.3

2.8

2.4

Dividend yield (%)

0.6

0.8

0.8

0.8

0.8

0.8

EV/Sales

4.0

3.5

3.7

3.0

2.4

2.0

EV/EBITDA

15.8

12.7

15.6

12.6

11.5

8.7

EV / Total Assets

5.6

4.5

2.7

2.3

2.5

2.2

Per Share Data (`)

EPS (Basic)

41.0

53.5

50.5

56.9

52.8

66.7

EPS (fully diluted)

41.0

53.5

50.5

56.9

52.8

66.7

Cash EPS

46.8

63.1

60.8

77.2

75.1

91.6

DPS

6.0

8.0

8.0

8.0

8.0

8.0

Book Value

154.6

197.4

248.3

300.3

349.3

412.2

Dupont Analysis

EBIT margin

22.9

23.9

20.3

18.7

15.9

18.0

Tax retention ratio

66.0

71.6

66.4

72.3

72.0

72.0

Asset turnover (x)

1.7

1.6

1.1

0.9

1.0

1.2

ROIC (Post-tax)

25.4

28.2

14.4

11.9

11.0

15.5

Cost of Debt (Post Tax)

2.0

1.4

0.8

1.5

2.3

14.6

Leverage (x)

0.0

0.0

0.0

0.4

0.1

0.0

Operating ROE

25.4

28.2

14.4

16.4

12.0

15.5

Returns (%)

ROCE (Pre-tax)

34.7

34.3

19.4

15.5

14.7

20.5

Angel ROIC (Pre-tax)

44.1

48.2

32.4

26.5

25.5

38.4

ROE

30.3

30.4

22.7

20.7

16.3

17.5

Turnover ratios (x)

Asset Turnover (Gross

2.6

2.6

2.3

2.4

2.3

2.3

Block)

Inventory / Sales (days)

66

62

74

74

59

50

Receivables (days)

75

66

79

79

63

54

Payables (days)

84

78

82

70

77

84

WC cycle (ex-cash)

89

63

93

116

73

40

(days)

Solvency ratios (x)

Net debt to equity

(0.0)

(0.1)

0.6

0.5

0.1

(0.1)

Net debt to EBITDA

(0.1)

(0.2)

1.9

1.8

0.3

(0.2)

Interest Coverage

95.4

307.3

62.4

21.0

19.4

25.1

August 07, 2017

11

Lupin | 1QFY2018 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

August 07, 2017

12