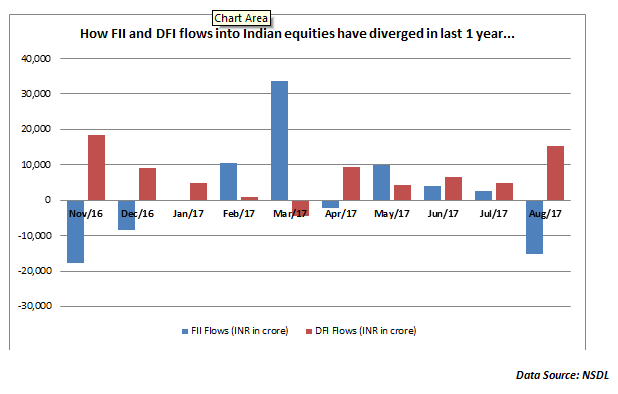

Foreign Institutional Investors (FIIs) have been aggressively selling across emerging markets and India has been no exception. In the 4 weeks of August, FIIs have pulled out over Rs.15,000 crore from Indian equity markets with the trend turning sharply negative due to a combination of geopolitical uncertainty and weak earnings season in the June quarter. In fact, the month of April has been one of the worst months in terms of FII flows into India in the last 8 months. On the other hand, domestic institutions (DFIs) have been aggressive buyers in Indian equities in August and have infused nearly Rs.15,400 crore in August, which is holding up the markets. Consider the chart below which captures the gist of the cumulative FII selling that has happened in Indian equities.

As the chart above depicts, while the FII flows have been tepid, except in March, the month of August saw the maximum FII selling since November last year. The question is what has driven this sudden spurt in FII selling and whether it is indicative of a larger shift in view?

For the June 2017 quarter, EU region showed a growth recovery to 0.6%, compared to just 0.3% in UK. In fact, the IMF has already projected that while the world economy will grow by 2.8% in 2018, the US will just grow at 1.7%. Europe will be the key driver of growth coming after years of sub-optimal performance and a substantially weaker Euro. This strength in Europe is already driving a lot of global funds to move money back into the safety of European assets. In fact, FIIs are of the view that valuations across Europe may be quite attractive.

Many FIIs have found the June quarter to be particularly disappointing in the Indian context. Profits have actually fallen by nearly 15% in the 1st quarter of this fiscal on a YOY basis. Even as there are wide variations among earnings estimates, even the most optimistic estimates are pegging the P/E of the Nifty at around 22-23 times. That really does not leave too much of room for a valuation boost unless the earnings see a shift towards a higher growth trajectory. In fact, FIIs have been worried that the much anticipated earnings momentum has been quite elusive.

In fact, global investors have typically stood by the government for its reforms focus but now there are some concerns that are being expressed along the way. Firstly, FIIs perceive that there could still be short term shocks from demonetization even as the long term benefits cannot be disputed. The impact on earnings and IIP is already visible. Secondly, the FIIs are also apprehensive that with higher outlays required in the next two years for loan write-offs and farm rescue packages, the government may find it difficult to stick to its 3% fiscal deficit targets. Lastly, the government has pushed through GST but there is an unfinished agenda in the form of land reforms and labour reforms. With central elections less than 20 months away, the FIIs are expecting the government to focus a lot more on populist measures rather than hard reform measures.

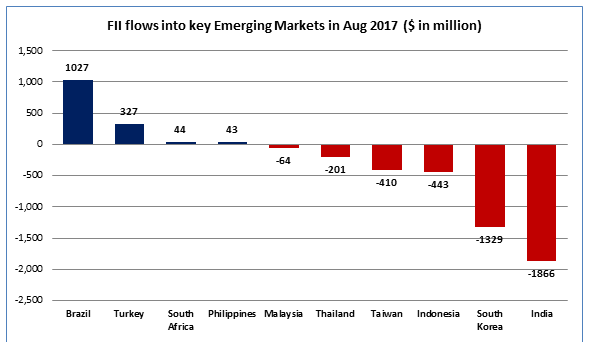

While there has been some risk-off that is visible in the last few months among Emerging Markets, this trend has got more pronounced in the month of August 2017. Global investors have been worried about high valuations in EMs and market fatigue is also setting in. If you look at the above graph, only Brazil and Turkey have been net recipients of FII flows for the month of August. Key Asian markets like Taiwan, Indonesia, South Korea and India have seen negative FII flows; with India alone seeing FII selling to the tune of $1.9 billion in August. Apart from valuation concerns in Asian EMs, they have also been hit by geopolitical concerns, especially considering their geographical proximity to North Korea and the South China Sea.

This is a slightly more complex equation when it comes to FII investments. When FIIs invest in India, they look at 2 potential variables viz. asset appreciation and rupee appreciation. FIIs will prefer a strong to stable rupee as it will ensure that their dollar gains are protected. On the other hand a weak rupee takes away part of your nominal returns when converted into dollars. Over the last 3 years, the rupee has been in the range of 62-68/$. This is the range that the RBI is also comfortable with. At the current level of 63-64/$, the chances of the rupee weakening are much higher than the chances of the rupee strengthening. The FIIs will, therefore, prefer to buy Indian equities when the currency exchange rate is higher at around 66-67/$ as it will ensure that their dollar gains are also protected in the process.

Going ahead, the lull in FII buying could continue considering that earnings traction may take some more time to pick up and the North Korean situation continues to worsen. According to equity strategists, “Foreign investments in India will largely hinge on global monetary policy and the colour of geopolitical risk emerging from North Korea.” Investors attention in the month of September will be focused on the ECB meeting on September 07th and the Fed meet concluding on September 20th. That could be the next big monetary cues for the FII activity!

Enjoy Zero Brokerage on Equity Delivery

Join our 2 Cr+ happy customers

Enjoy Zero Brokerage on

Equity Delivery